Heads up, Aussie traders!

The RBA will be making its interest rate decision tomorrow (July 7, 4:30 am GMT) and might cause a ruckus among AUD pairs.

How did their previous decision turn out? And what’s expected this time? Read on to find out!

What happened last time?

- RBA hiked rates by 0.50% versus expectations of 0.25% increase

- Cash rate raised from 0.35% to 0.85% in June

- Policymakers acknowledged significant increase in inflation

- RBA emphasized economic resilience and labor market strength

The Australian central bank surprised the markets with a larger than expected 0.50% hike in June versus estimates of a 0.25% hike from 0.35% to 0.60%.

According to their official statement, this aggressive tightening move is projected to bring inflation back towards their 2-3% target over time. They outlined a number of factors contributing to higher price pressures, including the war in Ukraine, higher oil prices, and supply chain disruptions.

Policymakers also noted that the Australian economy has been resilient, propped up mostly by business investment and construction work, as well as strong employment.

However, the RBA also expressed some concerns about the impact of higher inflation and higher borrowing costs on household spending.

The hawkish announcement took most Aussie traders by surprise, spurring a sharp pop higher for AUD across the board. The currency quickly returned most of its gains, though, as traders weighed the possibility of seeing another big hike from the RBA.

What’s expected this time?

- RBA to raise rates by another 0.50% to 1.35%

- Some analysts expect a more cautious 0.25% hike

The RBA is still widely expected to put the pedal to the metal when it comes to tightening, as many expect the central bank to announce another 0.50% increase in borrowing costs.

After all, inflation has remained elevated over the past month, as crude oil kicked higher and likely spilled over to consumer prices once more. According to the Melbourne Institute, June inflation expectations got a boost from 5.0% to 6.7%.

Jobs data has also been pretty robust, with the economy adding 60.6K positions versus the projected 25K gain in the latest report. Consumer sentiment, however, remains shaky as Westpac reported another sharp decline for June.

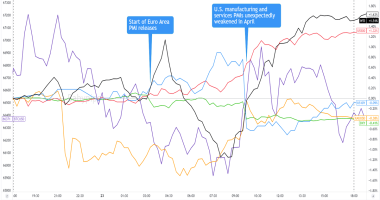

Meanwhile, the flash PMI readings turned out mixed, with the manufacturing component ticking higher from 55.7 to 55.8 and the services sector printing a dip from 53.2 to 52.6.

With that, RBA officials might feel confident enough to frontload their rate hikes in order to make room for a slower pace of tightening (or even rate cuts?) later in the year.