The U.K. is about to release its latest labor market numbers!

Based on the last two releases, British pound traders may only look at ONE data point for direction.

Can you guess which report may get more attention?

Event in Focus:

U.K.’s August Employment Data: Claimant Count Change, Unemployment Rate, Average Weekly Earnings

When Will it Be Released:

September 12, 2023 (Tuesday) 6:00 am GMT

Use our Forex Market Hours tool to convert GMT to your local time zone.

Expectations:

- A net of -80K jobs lost in August (vs. 66K job losses in July)

- The unemployment rate may steady at 4.2%

- The 3-month moving average of earnings is seen slowing down from 8.2% to 8.0%

- The jobless claimants are expected to decrease from 29K to 17K

Relevant Data Since Last Event/Data Release:

- S&P Global Manufacturing PMI dropped from 45.3 to 43.0 in August; “Manufacturing staffing levels were cut for the eleventh successive month in August. Companies linked lower employment to reduced intakes of new work, falling output volumes, and cost control efforts.“

- S&P Global Services PMI fell from 51.5 to 49.5 in August; “Subdued business conditions put a brake on staff hiring across the service economy, with the latest rise in employment the slowest since March“

- S&P Global Construction PMI weakened from 51.7 to 50.8 in August; “Employment numbers increased for the seventh month running, but the rate of growth weakened since July and was only modest.“

- CBI’s retail report: “Retail employment in the year to August fell for the fourth quarterly survey running, but at a slower pace than last quarter (-20% from -48% in May).“

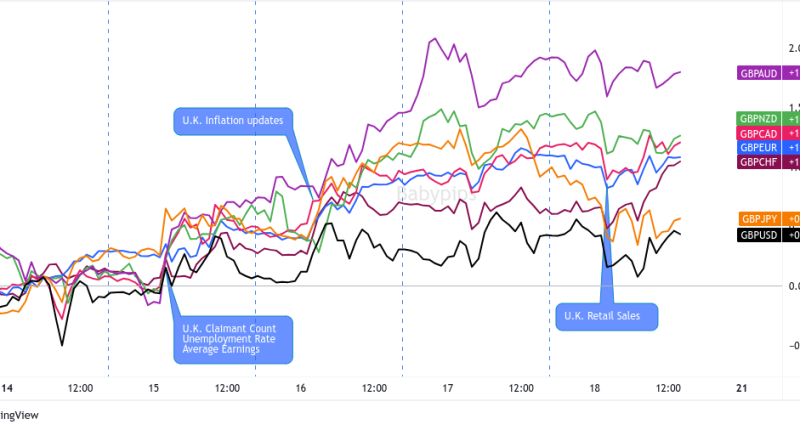

Previous Releases and Risk Environment Influence on the British Pound

August 15, 2023

Event Results / Price Action:

Jobless claimants edged higher in July, coming in at 29K when the markets only saw a 19.6K decrease after a 16.2K addition in June. The unemployment rate also rose higher from 4.0% to 4.2%. That’s the highest since late 2021!

But all eyes were on the three-month average wage increase, which accelerated from 7.2% to a whopping 8.2% in the three months to June.

The high wage growth all but sealed the deal for another BOE rate hike and pushed GBP higher across the board. Like in the July release, though, there seemed to be profit-taking less than two hours after the release before GBP eventually extended its intraday gains.

Risk Environment and Intermarket Behaviors:

Expectations of interest rate hikes from the Fed and the BOE kept USD and GBP in demand for most of the week.

The intraweek trends between the major currencies diverged further as China and Australia printed weak reports while data from the U.K. and the U.S. supported further rate hikes.

July 11, 2023

Event Results / Price Action:

There were 25.7K jobless claimants in June, more than the 20.5K figure that the markets had expected, and almost canceled out the 22.5K decrease in May. The jobless rate also edged higher from 3.8% to 4.0% but what really caught the market headlines was three-month average earnings accelerating from 6.7% to 6.9% in May.

The stubbornly high wage inflation supported calls for a “peak rate” of 6.0% to 6.50% from the BOE. This is probably why GBP spiked higher at the news.

The British pound saw pullbacks in the same hour of the release, but the hawkish numbers helped GBP cap the day higher against most of its major counterparts.

Risk Environment and Intermarket Behaviors:

Weak Chinese data, higher oil prices, and expectations of a dovish U.S. CPI helped encourage risk-taking ahead of the U.S. inflation release.

A bit of profit-taking may have also accelerated USD’s losses early in the week.

Price action probabilities:

Risk sentiment probabilities: Thanks to higher oil prices and data misses from major economies like China, the concept of higher interest rates isn’t very welcome in the markets right now. This is in contrast to the August U.K. jobs release when hawkish expectations for the Fed and BOE supported USD and GBP.

For now, bond yields are up, global equities are trading lower, and the safe haven USD is trading higher. In the next few days, we have lower-tier economic releases and a couple of Fed speak. Hawkish remarks may accelerate global growth concerns and weigh on the demand for “risk” assets like commodity-related currencies.

British Pound scenarios:

Potential Base Scenario:

Based on the weaknesses in the manufacturing and services industries in August, it’s possible to see weaker labour numbers in August. The unemployment rate could remain at 4.2% but we could see 80K net job cuts and 17K additional jobless claimants.

Like in the July and August releases, though, all eyes (including the BOE’s) will likely be on the average wage growth. The three-month average is currently expected to slow down a smidge from 8.2% to 8.0% in July. But take note that the data point has surprised to the upside in four out of the last five releases.

If July’s wage growth exceeds market expectations again, then rate hike speculators may cause bullish spikes for GBP especially against counterparts like USD, AUD, NZD, CAD, and JPY.

Before you buy GBP against other major currencies, though, you should remember that GBP’s initial reactions in the last two releases were followed by partial or full pullbacks before the British pound extended its intraday trends. Consider entering on a pullback if you missed the initial move.

Potential Alternative Scenario:

If the labour market weaknesses extend to average earnings and we see subdued wage growth, then the BOE will have fewer reasons to raise its interest rates further.

In a presser in Parliament earlier this week, Bailey shared that “There was a period where…it was clear that rates needed to rise… but we’re not I think in that phase anymore,” adding that “I think we are much nearer to [the top of the cycle] on interest rates on the basis of current evidence.”

A not-so-hawkish wage growth update would support BOE gang’s less urgent approach to high inflation. GBP may attract sellers against counterparts like safe havens USD and JPY or currencies with a bit more hawkish central banks like AUD and NZD.

This post first appeared on babypips.com