There are not a lot of top-tier economic reports scheduled for printing this week, but we will see a bunch of CPI releases while major central bankers share their two cents in a central bank forum.

But before talking inflation and interest rates, ICYMI, I’ve written a quick recap of the market themes that pushed currency pairs around last week. Check it!

And now for the closely-watched potential market movers this week:

Major Economic Events:

ECB central bank forum (June 29, 1:30 pm GMT) – The European Central Bank (ECB) will be hosting a central bank forum in Portugal throughout the week!

The event’s highlight will be on Wednesday when Bank of England (BOE) Gov. Bailey, Fed Chairman Powell, and ECB President Lagarde will participate in a panel discussion to talk monetary policies.

Hints on the aggressiveness and timeline for future tightening and the overall direction of the major banks’ policies can influence the major currencies, so y’all better be glued to the tube during the event!

U.S. core PCE price index (June 30, 12:30 pm GMT) – On Thursday, the U.S. core personal consumption expenditures (PCE) – the Fed’s preferred inflation measure – is expected to maintain its 0.3% growth in May while its annualized reading slows down from 4.9% to 4.8%.

We’ll likely see upside surprises since the survey was taken on the same month that CPI clocked in at 8.6%, the highest since 1981. Meanwhile, other consumer-related reports like personal income and spending scheduled on the same day are expected to reflect lower readings compared to the previous month.

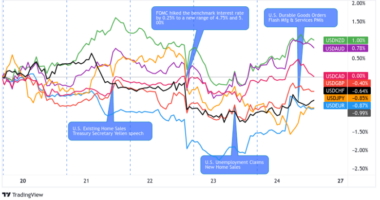

Keep in mind that last Friday’s downgrade in the UoM consumer inflation expectations led traders to price in a less aggressive tightening path from the Fed. If this week’s consumer reports point to more Fed rate hikes, then we could see another round of risk aversion and USD strength in the markets.

Eurozone CPI (July 1, 9:00 am GMT) – Consumer price growth could hit notable highs this week as the region continues to deal with higher oil and gas prices.

For now, the first readings of Germany and Spain’s June CPIs on June 29 and France’s CPI release on June 30 are expected to print lower monthly readings compared to May’s increases.

The Eurozone CPI on Friday is expected to print at 0.5% (from 0.8%) while the annual inflation speeds up from 8.1% to 8.3%.

Forex Setup of the Week: EUR/USD

EUR/USD is trading in what looks like a Double Bottom pattern on the daily chart after finding support from the 1.0400 levels.

The “neckline” at 1.0775 lines up with a key support from March and April and is not far from the 100 SMA on the daily time frame.

Will EUR/USD get enough push to test the Double Bottom neckline? Or will the (down)trend be forex traders’ friend this week?

CPI reports and central banker speeches from both the U.S. and the Eurozone should shake things up for the pair this week.

Inflation is expected to slow down from May to June in the major Eurozone economies while the Fed’s preferred inflation gauge could take cues from the 41-year high CPI release.

Meanwhile, talks of interest rate hikes from the ECB and the Fed could factor in EUR/USD’s longer-term trend.

Keep an eye on how EUR/USD reacts to a possible test of the 1.0800 levels!