The financial markets traded with mixed results as the major assets reacted to individual catalysts.

How did your favorite assets trade on Tuesday?

We have the breakdown:

Headlines:

- HCOB Flash France Manufacturing PMI for April: 44.9 vs. 46.2; Services PMI rose to 50.5 vs. 48.3 previous

- HCOB Flash Germany Manufacturing PMI for April: 42.2 vs. 51.9 previous; Services PMI rose to 53.3 vs. 50.1

- HCOB Flash Eurozone Manufacturing PMI for April: 45.6 vs. 46.1; Services PMI rose to 52.9 vs. 51.5 previous

- S&P Global Flash U.K. Manufacturing PMI for April: 48.7 vs. 50.3; Services PMI at 54.9 vs. 53.1

- In a speech on Tuesday, BOE member Jonathan Haskel says “Where we are going depends strongly on V/U [the vacancies to unemployment ratio],” and that inflation expectations “have remained remarkably anchored“

- BOE Chief Economist Huw Pill favors a cautious approach to cutting rates, saying “There are greater risks associated with easing too early should inflation persist rather than easing too late should inflation abate.“

- ECB Vice President Luis de Guindos said in a newspaper interview that a June rate cut is a “fait accompli” and that he’s “very cautious” about what may happen afterward

- In a speech on Tuesday, ECB Governing Council member Joachim Nagel shared that “If the favorable inflation outlook from March is confirmed in the June forecast and the incoming data supports this forecast, we can consider lowering interest rates.”

- S&P Global U.S. Flash Manufacturing PMI for April: 49.9 vs. 51.9 previous; Flash Services Index came in at 50.9 vs. 51.7

- U.S. New Home Sales for March: 8.8% m/m (2.7% m/m forecast; -5.1% m/m previous); Services Index for April: -13 (-5 forecast; -7 previous)

- New Zealand’s trade improved from a 315M NZD deficit to a 588M NZD surplus in March as exports rose by 3.8% m/m but imports fell by a whopping 25% m/m

Broad Market Price Action:

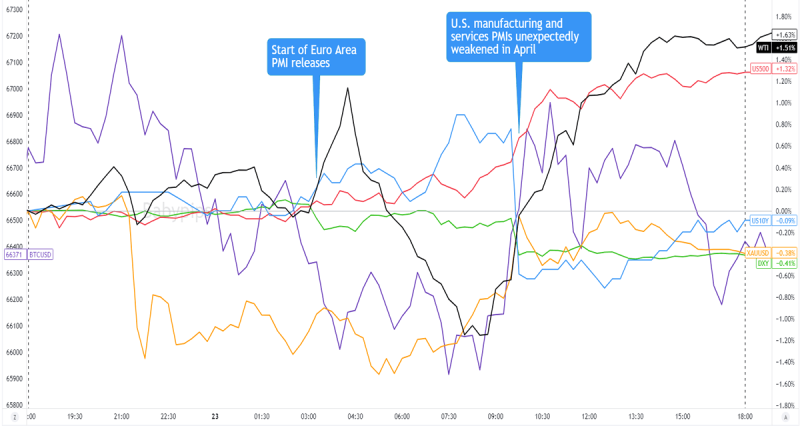

Major financial assets traded mixed, with spot gold extending its losses in the Asian session as traders priced in easing Middle East concerns and increased USD demand. Bitcoin (BTC/USD) reversed some of its gains from the previous day, likely on a bit of profit-taking after the “Bitcoin halving” event over the weekend.

Price action heated up in the European session thanks to PMI releases from the Euro Area and the U.K. that inspired a bit of risk-taking. Then, unexpectedly weak U.S. PMI reports during the U.S. session revived calls for a Fed interest rate cut in June and the markets reacted accordingly.

Crude oil recouped its intraday losses, spot gold almost capped the day in the green, and U.S. bond yields plummeted from 4.65% to the 4.57% area before leveling off at 4.60%. U.S. equity benchmarks like the S&P 500 also rode the “Fed rate cut” train AND was boosted by optimism over this week’s earnings report releases.

FX Market Behavior: U.S. Dollar vs. Majors

Overlay of USD vs. Major Currencies Chart by TradingView

The U.S. dollar was trading in tight ranges for most of the day before surprisingly weak manufacturing and services PMI reports during the U.S. session revived interest rate cut bets for the Fed.

It didn’t help the safe haven that PMI reports from Australia and the Euro Area surprised to the upside while the British pound was supported by BOE Chief Economist Huw Pill supporting a cautious approach to cutting rates.

The Greenback capped the day lower across the board, with its biggest losses seen against GBP, AUD, and EUR while only losing marginally to fellow safe havens like JPY and CHF.

Upcoming Potential Catalysts on the Economic Calendar:

- Germany’s Bundesbank President Joachim Nagel to give a speech at 7:00 am GMT

- Switzerland’s Credit Suisse economic expectations at 8:00 am GMT

- Germany’s IfO business climate at 8:00 am GMT

- U.K. CBI industrial order expectations at 10:00 am GMT

- Canada’s retail sales at 12:30 pm GMT

- U.S. core durable goods orders at 12:30 pm GMT

- EIA crude oil inventories at 2:30 pm GMT

With more traders looking for clues for a potential Fed rate cut, you can bet that they’ll be looking at the U.S. core durable goods reports. EIA’s crude oil inventories data may also spur volatility for crude oil benchmarks, so make sure you’re glued to the tube during the releases!

Looking for your own spot to record your market observations & trading statistics? If so, then check out TRADEZELLA! It’s an easy-to-use

journaling tool that can lead to valuable performance & strategy insights! You can easily add your thoughts, charts & track your psychology with each and every trade. Click here to see if it’s right for you!Disclaimer: Babypips.com earns a commission from any signups through our affiliate link. When you subscribe to a service using our affiliate links, this helps us to maintain and improve our content, a lot of which is free and accessible to everyone–including the School of Pipsology! We appreciate your support and hope that you find our content and services helpful. Thank you!