I’ve rounded up FOUR mechanical forex strategies right here to see how they performed recently. Take a look!

I’ve got a neat systems snapshot table for their latest performance down below, but keep in mind that the time periods and some trading assumptions vary among my fellow FX-Men.

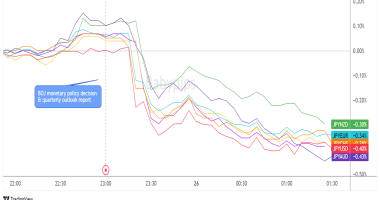

HLHB Trend-Catcher System

The “Huck Loves Her Bucks” mechanical system uses a simple EMA cross method, combined with the RSI and ADX indicators, to catch short-term trends on the 1-hour charts of EUR/USD, GBP/USD, and USD/JPY.

In this week’s update, Huck’s winning streak took a breather after one big losing trade dragged the trend-catcher’s totals 93 pips (-0.31%) in the red. Can you guess the pair that yielded the loss? Read more.

SMA Crossover Pullback

Robopip’s newbie-friendly SMA Crossover Pullback trading system is as simple as its name suggests.

This strategy features an SMA crossover method to gauge the trend and a Stochastic pullback entry signal on the 1-hour charts of EUR/USD, GBP/USD, and EUR/JPY.

This week saw another set of early exits, but fortunately one of these managed to lock in a decent win.

EUR/USD hit its trailing stop while Cable and EUR/JPY snagged small losses new crossovers. With that, the system wound up with a 93-pip or 0.62% dent for the week. Read more.

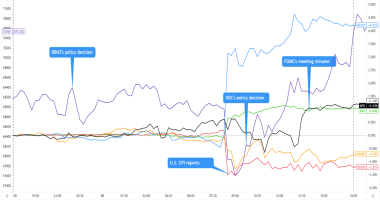

Inside Bar Momentum Strategy 2.0

Another tried-and-tested system is Robopip’s Inside Bar Momentum Strategy 2.0 which monitors purely candlestick price action, free of any technical indicators, on the 4-hour charts of GBP/JPY and USD/JPY.

This mech system extended its winning streak for yet another week! It scored a couple of wins on both pairs, making up for a small losing position on GBP/JPY and ending up with a 58-pip gain. Read more.

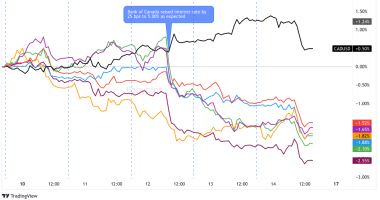

Short-Term Bollinger Reversion Strategy 2.0

This Short-Term Bollinger Reversion Strategy 2.0 is one of Robopip’s newest creations and is currently being tested on range-bound pairs like CAD/CHF and USD/CAD.

This strategy finally chalked up a winning week after consecutive losses!

USD/CAD had another signal-free run while CAD/CHF was able to bag a 15.5 or 0.31% win. I know it ain’t much, but I’m pretty happy that it’s not another loss. Read more.

Forex Systems Summary

| Mechanical Trading System | Time Period | P/L in pips | P/L in % |

|---|---|---|---|

| HLHB Trend-Catcher System | Feb. 15 – 19 | -93 | -0.31 |

| SMA Crossover Pullback System | Feb. 9 – 16 | -93 | -0.62 |

| Inside Bar Momentum Strategy 2.0 | Feb. 11 – 18 | +58 | – |

| Short-Term Bollinger Reversion Strategy 2.0 | Feb. 11 – 18 | +15.5 | +0.31 |

Check out how these trading systems fared in 2020: This post first appeared on babypips.com