Traders balanced a really heavy economic calendar, with global inflation figures and central bank rhetoric taking focus in the front half of the week, while U.S. updates sparked quick bouts of heavy volatility throughout.

Central bank rhetoric was arguably at the top of topics of focus, including talk of FX intervention, as the People’s Bank of China made surprise announcements while jawboning kept yen declines in check.

Later on, hawkish remarks from a handful of central bank leaders highlighted divergences between policy plans while also bringing some risk-off flows in the mix.

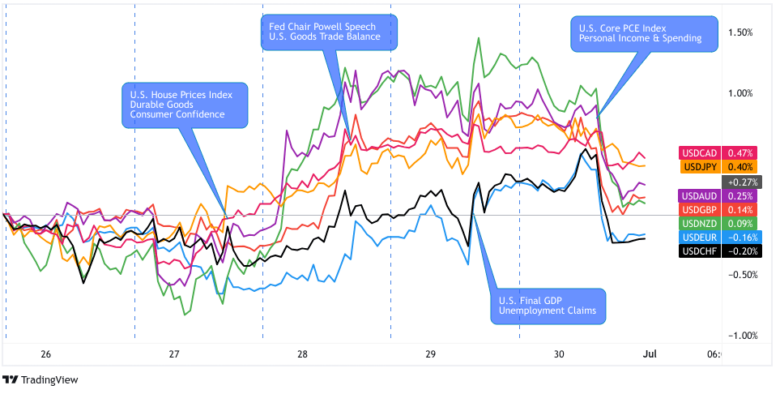

USD Pairs

Dollar pairs were off to a lazy rangebound start, and bearish lean before the U.S. currency soon took advantage of risk aversion and renewed Fed tightening hopes.

Fed head Powell dropped hints about future interest rate hikes once again, explaining that the strength of the labor market suggests that monetary policy might not be restrictive enough. These hawkish remarks, along with mostly upbeat mid-tier data, lifted the Greenback’s spirits midweek.

The U.S. currency popped higher again after the initial jobless claims report beat estimates but later on return a good chunk of gains after core PCE price index report showed further slowing in inflation rates.

? Bullish Headline Arguments

May core durable goods orders rebounded 0.6% month-over-month after an earlier 0.3% decline, with headline reading up 1.7% vs. estimated 0.8% drop

New home sales jumped from 680K to 763K, beating the consensus at 677K

Richmond manufacturing index improved from -15 to -7 in June vs. the estimated -12 figure

CB consumer confidence index jumped from 102.5 to 109.7 in June vs. the projected 103.9 reading, the highest level since early 2022

Fed Chairperson Powell mentioned during the ECB forum that monetary policy might not be restrictive enough, with a strong labor market lifting the odds of more hikes this year

Initial jobless claims came in at 239K vs. 264K forecast and 265K previous, easing fears of a U.S. labor market slowdown

Final Q1 GDP revised higher to 2% year-over-year growth from 1.2% previously reported

? Bearish Headline Arguments

U.S. Core PCE in May: 3.8% y/y (3.9% y/y forecast; 4.3% y/y previous); personal income grew by +0.4% m/m (+0.3% m/m forecast/previous); personal spending growth slowed to +0.1% m/m (+0.4% m/m forecast; +0.6% m/m previous)

U.S. Pending Home Sales in May: -2.7% m/m (-0.6 m/m forecast; -0.4% m/m previous)

EUR Pairs

After a shaky start to the week, the shared currency staged a pretty steady rally against its rivals, particularly against the commodity currencies.

However, the euro was unable to hold on to some of its gains, returning a good amount of its winnings to the dollar and the franc towards the latter part of the week while maintaining a strong lead versus the yen and Kiwi.

? Bullish Headline Arguments

German central bank expects that the technical recession will end in Q2

During the ECB forum, Chairperson Lagarde noted the impact of tight labor markets on wage increases, which are further stoking inflationary pressures

Preliminary Germany CPI for June: +6.4% y/y vs. +6.1% y/y in May

Euro area unemployment rate for May 2023 at 6.5% as forecasted

Flash Euro area CPI for June: 5.5% y/y(5.6% y/y forecast; 6.1% y/y

? Bearish Headline Arguments

German GfK consumer climate index fell from a downgraded -24.4 reading in May to -25.4 in June vs. the projected -22.9 figure

Euro Area Private Loans in May: 2.1% y/y vs. 2.5% y/y previous; Broad monetary aggregate M3: 1.4% y/y vs. 1.9% y/y previous

Eurozone Economic Sentiment Index for June: 95.3 vs. 96.4 in May

Germany Retail Sales for May: +0.4% m/m (+0.4% m/m forecast; +0.7% previous)

Germany Unemployment rate ticked higher to 5.7% vs. 5.6% forecast/previous

GBP Pairs

Sterling had a tough Monday, chalking up steep losses to the dollar and franc early on. The rest of the week was a mixed bag as GBP pulled up against the commodity currencies and the yen, while giving up even more ground against the rest of its peers.

There were hardly any reports released from the U.K. economy in the past few days, which probably explains why the pound simply moved as a counter currency instead of finding its own direction.

? Bullish Headline Arguments

During the ECB forum, BOE head Bailey pointed to noticeable signs of sustained inflation in the U.K. economy and that they would take all steps necessary to bring it back to target

U.K. Nationwide House Prices in June: +0.1% m/m (-0.3% m/m forecast; -0.1% m/m previous)

? Bearish Headline Arguments

U.K. BRC price shop index fell from 9.0% year-on-year to 8.4% in June to reflect weaker inflation among retailers

U.K mortgage approvals for May: 50.5K vs. 49K previous; net consumer credit by individuals: £1.1B vs. £1.5B

U.K. Final GDP read for Q1 2023: 0.1% q/q as forecasted/previous

CHF Pairs

The franc hit the ground running, as it still seemed to be drawing support from risk-off flows in the previous week.

It also helped that SNB head Jordan dropped strongly hawkish remarks over the weekend, suggesting that the central bank could carry on with tightening.

After a slight dip on Tuesday, CHF rallies resumed in the next couple of days, particularly against the Aussie and Kiwi.

? Bullish Headline Arguments

Over the weekend, SNB head Jordan mentioned in an interview that the latest hike was “very likely not quite” enough to calm inflation

Swiss Retail Sales (real seasonally adjusted) in May: +2.1% m/m (1.2% m/m forecast; -2.2% m/m previous)

? Bearish Headline Arguments

KOF Swiss Leading Indicators: 90.8 (90.9 forecast, 91.4 previous)

AUD Pairs

The Aussie is poised to closed the week net red as risk aversion and weaker expectations for PBOC stimulus dragged the commodity currency south.

Although the Australian currency was able to benefit from the Chinese central bank’s efforts to slow the yuan’s decline, downbeat Australian CPI added more weight for the Aussie’s slump as it dampened RBA tightening expectations.

? Bullish Headline Arguments

PBOC set USD/CNY reference rate lower than expected during their announcements on Tuesday and Thursday to slow down the pace of the yuan’s declines

Chinese Premier Li Qiang talked about the country still being on course to achieve its 5% economic growth target in 2023

Australian retail sales posted a 0.7% month-over-month uptick in consumer spending for May, following an earlier flat reading

? Bearish Headline Arguments

S&P cut the Chinese GDP forecast from 5.5% to 5.2% for the year, citing that an uneven pace of growth can be expected

Australian May CPI slumped from 6.8% to 5.6% year-over-year vs. an estimated dip to 6.1%

CAD Pairs

Overlay of CAD vs. Major Currencies Chart by TV

The Loonie also had a rough start, as risk-off flows from the earlier week carried over to Monday’s trading. It managed to draw some support from improving crude oil demand conditions but wound up returning some gains when the Canadian CPI fell short.

Midweek trading was a hot mess, as CAD advanced against its comdoll rivals while caving against the euro, dollar, and franc. Broad direction returned Friday, once again to the downside for Loonie as traders correctly anticipated a weak monthly GDP read.

? Bullish Headline Arguments

Crude oil opened slightly higher after a failed coup attempt in Moscow, as Wagner mutiny convoys returned to bases and charges against Prigozhin dropped

U.S. EIA crude oil inventories showed a draw of 9.6 million barrels vs. the estimated reduction of 1.4 million barrels and earlier draw of 3.8 million barrels

Bank of Canada Business Outlook Survey—Second Quarter of 2023: While far from normal, the BOC says that both consumers and businesses foresee improvements in inflation conditions and demand for goods and services.

? Bearish Headline Arguments

Canadian headline May CPI came in line with consensus at 3.4% year-over-year from the previous 4.4% reading, the lowest since June 2021

Canada GDP for April 2023: 0.0% m/m (0.2% m/m forecast, 0.1% m/m previous)

NZD Pairs

Overlay of NZD vs. Major Currencies Chart by TV

The Kiwi actually had a positive start to the week before all hell broke loose on Wednesday.

Other than risk aversion stemming from expectations of higher global borrowing costs, there was no clear catalyst for the sharp selloff.

After stabilizing Wednesday and Thursday, possibly with the help of improving NZ business confidence survey data and a slight shift positive in risk sentiment, the Kiwi was able to claw back some of its losses, managing to see green by the Friday close against a few of the major currencies.

? Bullish Headline Arguments

New Zealand ANZ business confidence index improved from -31.1 to -18.0 in June, reflecting weaker pessimism

JPY Pairs

The yen seemed to be pulled in opposite directions by risk-off flows and yen-tervention threats.

Early in the week, the BOJ Summary of Opinions revealed that a policymaker called for an early revision of their YCC. The report also showed that committee members acknowledged the chance that inflation could moderate soon.

However, rumors that the BOJ could step in to intervene in the FX market once USD/JPY hits the 145-150 range kept yen traders on edge for the rest of the week.

? Bullish Headline Arguments

BOJ core CPI climbed from 3.0% year-over-year to 3.1% as expected, marking fourth consecutive monthly gain

Japanese Ministry of Finance’s vice minister Kanda says they are closely monitoring FX moves with a high sense of urgency

Japan Housing Starts for May: +3.5% y/y (-2.0% y/y forecast; -11.9% y/y previous)

? Bearish Headline Arguments

During the ECB forum, BOJ Governor Ueda reiterated their plans to keep monetary policy unchanged while policymakers monitor the impact of higher rates on economic activity