The U.S. dollar got its shine back this week, leveling up off of fresh U.S. inflation data pointing inflation rates picking up the pace in February.

Overall, FX outcomes did show a slight risk-off lean, but the usual correlations weren’t as strong with a lack of major catalysts and central bank speak, signaling individual narratives like BOJ’s potential rate hike and oil strength were driving factors as well.

USD Pairs

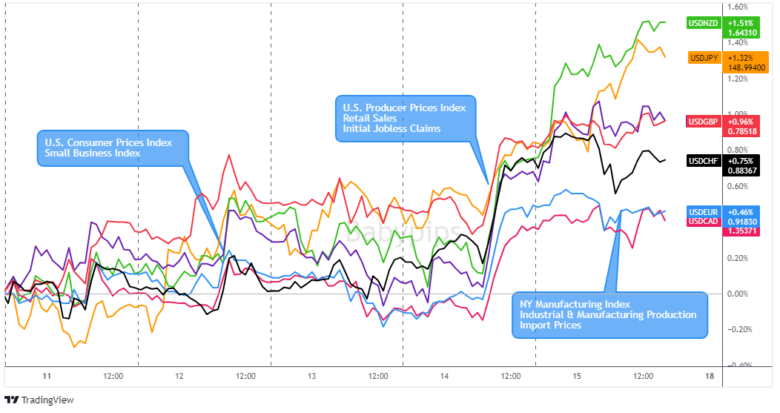

Overlay of USD vs. Major Currencies Chart by TradingView

The U.S. dollar enjoyed a strong week overall, ending on a positive note. This performance was primarily driven by hotter-than-expected inflation reports (CPI and PPI), which reinforced the view that inflation remains stubbornly high. These data releases sparked a sharp rally in bond yields, further fueling the dollar’s gains.

The dollar’s strength signaled that markets are reassessing their expectations for Federal Reserve policy. The odds of rate cuts for June fell to 50% according to the CME FedWatch Tool, pushing the dollar higher. Despite some softer economic data on retail sales and manufacturing, the focus remained squarely on inflation and its potential to keep the Fed hawkish for longer.

Bullish Headline Arguments

- U.S. Consumer Price Index for February: 0.4% m/m (0.3% m/m forecast; previous); Monthly Core read came in at 0.4% m/m vs. 0.3% m/m forecast

- U.S. Producer Prices Index for February 2024: 0.6% m/m (0.3% m/m forecast/previous)

- U.S. Retail Sales for February: 0.6% m/m (0.5% m/m forecast; -1.1% m/m previous): Core Retail Sales at 0.3% m/m (0.4% m/m forecast; -0.8% m/m previous)

Bearish Headline Arguments

EUR Pairs

This was a surprisingly resilient week for the euro, a bit like that underdog boxer who just won’t stay down. Despite a string of lackluster economic news and even some dovish remarks from European Central Bank members hinting at potential rate cuts (not exactly a fighter’s rally cry), the euro kept bobbing and weaving.

Underneath it all, a couple of hotter-than-expected inflation reports from Germany and France might have given the euro a much-needed adrenaline shot. Plus, with inflation fears running rampant across the global markets, a touch of risk aversion might have sent some investors seeking the euro as a slightly safer alternative.

Bullish Headline Arguments

- ECB Kazimir says the European Central Bank shouldn’t cut interest rates before June

- Germany’s February CPI confirmed at 0.4% m/m as expected vs. 0.2% m/m previous; 2.5% y/y as forecasted vs. 2.9% y/y

- French final CPI reading upgraded from initially reported 0.8% month-over-month increase in January to 0.9%

Bearish Headline Arguments

GBP Pairs

Overlay of GBP vs. Major Currencies Chart by TradingView

The British pound had a week full of ups and downs, like a particularly bumpy ride on a double-decker bus. It started with a jolt lower thanks to a worrisome jobs report that had traders selling the pound faster than afternoon tea disappears. Luckily, a net positive GDP update helped the pound stabilize mid-week.

For the rest of the week, the pound seems to have traded mostly as a counter currency. And as risk aversion crept back into the markets, the pound likely felt the pressure as it often trades as a “risk-on” currency.

Bullish Headline Arguments

Bearish Headline Arguments

CHF Pairs

Overlay of CHF vs. Major Currencies Chart by TradingView

The Swiss franc started the week off strong, climbing steadily like a determined mountain goat. Even some disappointing consumer climate data couldn’t shake its confidence – the franc just shrugged it off with the stoicism of a Swiss banker.

However, things took a turn on Thursday. Despite surprisingly positive producer price data, sellers swooped in on the franc, making it stumble a bit. It was like watching someone trip just as they were about to reach the summit. Yet, by Friday, a touch of risk aversion crept into the markets, arguably giving the Swiss franc a boost. The safe-haven appeal was back against most of the majors, and the franc finished the week with a respectable net gain, reminding everyone why it’s as reliable as a Swiss watch.

Bullish Headline Arguments

Bearish Headline Arguments

CAD Pairs

Overlay of CAD vs. Major Currencies Chart by TradingView

The Canadian dollar put on its hockey helmet and had a solid week, skating circles around most of its major currency rivals. Boosted by net positive economic data (much like a power boost from a plate of poutine), it seems like the markets agree – that Bank of Canada is right to take a breather from all the rate-cutting madness.

Additionally, Canada’s favorite export, oil, had a winning streak of its own. News of rising oil demand and shrinking U.S. inventories were like a dose of maple syrup for the Loonie, giving it an extra energy boost.

Overall, the Canadian dollar finished the week feeling strong and proud, second only the U.S. dollar’s big bounce this week.

Bullish Headline Arguments

AUD Pairs

The Australian dollar experienced a mixed week, lacking significant domestic catalysts to drive its direction. Its movement largely mirrored broader market sentiment, indicating that it traded primarily as a counter currency.

Towards the end of the week, the Aussie joined other risk-sensitive currencies in weakening against the U.S. dollar as a renewed focus on inflation data triggered a shift towards safe-haven assets.

Bearish Headline Arguments

NZD Pairs

Overlay of NZD vs. Major Currencies Chart by TradingView

The New Zealand dollar had a week it would probably like to forget, taking a tumble like a kiwi bird trying out a new pair of roller skates. A combination of global inflation jitters and some less-than-stellar economic news from home sent the Kiwi on a downward slide.

Thursday’s double-whammy of sticky U.S. inflation numbers and a disappointing Business Manufacturing PMI reading seemed to really knock the wind out of its sails.

Bullish Headline Arguments

Bearish Headline Arguments

JPY Pairs

Overlay of JPY vs. Major Currencies Chart by TradingView

The Japanese yen started the week like a rising star, buoyed by expectations of wage hikes and their potential to support the end of the Bank of Japan’s negative interest rate policy. Monday’s rally seemed to confirm the optimism, possibly fueled by those late Friday reports about the Bank of Japan considering policy changes.

However, the tide turned quickly on Tuesday, correlating with comments by BOJ Governor Ueda highlighting some economic weaknesses within the recovery likely sent the yen tumbling. A brief bounce arrived mid-week with some hotter-than-expected PPI data from Japan, but it was short-lived.

Economic data continued to come in net negative, likely contributing to yen’s weakness, along with speculation that the BOJ wouldn’t ditch negative rates until April.

Bullish Headline Arguments

Bearish Headline Arguments

Looking for your own spot to record your market observations & trading statistics? If so, then check out TRADEZELLA! It’s an easy-to-use journaling tool that can lead to valuable performance & strategy insights! You can easily add your thoughts, charts & track your psychology with each and every trade. Click here to see if it’s right for you!

Disclaimer: Babypips.com earns a commission from any signups through our affiliate link. When you subscribe to a service using our affiliate links, this helps us to maintain and improve our content, a lot of which is free and accessible to everyone–including the School of Pipsology! We appreciate your support and hope that you find our content and services helpful. Thank you!