The Bank of Canada (BOC) is up in a few days!

Word around the block is that the central bank will likely keep its interest rate steady in September.

What’s up with that and how may CAD traders react?

Here are points you need to know if you’re planning on trading the central bank event:

Event in Focus:

Bank of Canada (BOC) Monetary Policy Statement

When Will it Be Released:

September 6, 2023 (Wednesday): 2:00 pm GMT

Use our Forex Market Hours tool to convert GMT to your local time zone.

Expectations:

- BOC to maintain its main policy interest rate at 5.00%

- Policymakers to reiterate that they’re still willing to hike if data calls for it

Relevant Canadian Data Since the Last BOC Statement:

🟢 Arguments for Hawkish Monetary Policy / Bullish CAD

S&P Global Canada Manufacturing PMI for July: 49.6 vs. 48.8 June

Raw materials prices index for July: 3.5% m/m (0.2% m/m forecast; -2.0% m/m previous); Industrial product price index was 0.4% m/m (0.0% m/m forecast; -0.6% m/m previous)

CPI for July: 0.6% m/m (0.4% m/m forecast; 0.1% m/m previous); core CPI was 0.5% m/m (0.5% m/m forecast; -0.1% m/m previous)

Ivey PMI Prices Index for July was at 65.1 vs. 60.6 previous

S&P Global Canada PMI survey: average input costs rose and the rate of inflation accelerated to a four month high.

Building Permits for June: 6.1% m/m (-1.3% m/m forecast; 12.6% m/m previous)

Retail Sales for June: +0.1% m/m to C$65.9B (-0.1% forecast; 0.1% m/m previous)

🔴 Arguments for Dovish Monetary Policy / Bearish CAD

Employment Change for July: -6.4k (20.0k forecast; 59.9k previous); unemployment rate: 5.5% vs. 5.4% forecast/previous

Ivey Manufacturing PMI for July: 48.6 vs. 50.2 previous; Employment Index at 54.2 vs. 57.6 previous;

Housing Starts for July fell -10% y/y to 255.0k (243.0k forecast; 283.5k previous)

New Housing Price Index for July: -0.1% m/m (0.0% m/m forecast; 0.1% m/m previous)

June monthly GDP declined 0.2% from May; Q2 GDP unexpectedly contracted by 0.2% (vs. 1.2% expected)

S&P Canada Manufacturing PMI for August: 48.0 vs. 49.6 in July

Previous Releases and Risk Environment Influence on CAD

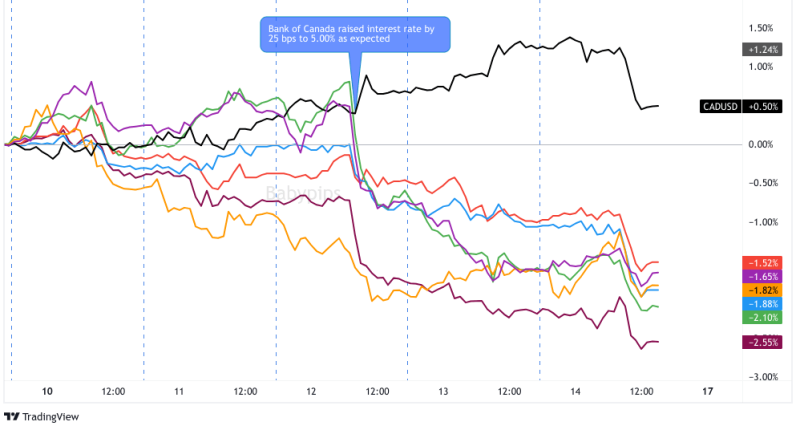

July 12, 2023

Overlay of CAD vs. Major Currencies Chart by TV Chart by TV

Action/results: As expected, the BOC raised its interest rates by another 25bps to 5.00%. BOC Gov. Tiff Macklem also shared that “inflationary pressures are proving more persistent than we expected” but that he and his team will be taking each future rate announcement “one at a time.”

The prospect of becoming data-dependent in their future policy decisions did not sit well with those who expected more rate hikes. This is probably why CAD dropped across the board at the news and started intraweek downtrends that didn’t let up until the week ended.

Risk environment and Intermarket behaviors: Consolidation was the name of the game that week. However, downbeat U.S. CPI figures made for an anti-USD trading environment while weak Chinese trade data raised speculations for a PBOC stimulus.

This is probably why “risk” assets like commodity-related currencies (except CAD) gained ground while safe-haven alternatives like CHF and JPY saw intraweek gains.

June 7, 2023

Action/results: After keeping its interest rates steady in the March and April meetings, the BOC surprised markets with its first rate hike since January. The central bank raised its main interest rates by 25 basis points to 4.75% instead of pausing at 4.50% as markets had expected.

In its statement, BOC members noted their concerns that high inflation “could get stuck materially above the 2% target” as well as their belief that their previous policies weren’t “sufficiently restrictive” just yet.

The surprise (and hawkish!) rate hike, which came a day after the RBA executed its own rate hike, boosted the Canadian dollar sharply during the U.S. session and ended the day not far from its intraday highs.

Risk environment and Intermarket behaviors: The release of weaker-than-expected ISM services PMI in the U.S. and disappointing trade data from China made it tricky to sustain risk rallies throughout the week.

“Risky” bets like crude oil, AUD, and CAD popped higher on specific headlines like stronger oil demand data and the RBA and BOC’s hawkish rate hikes. Even then, the assets soon lost ground and fell in line with the overall risk-averse trading environment.

Price action probabilities

Risk sentiment probabilities: Data from the U.S. and other major economies are coming in only slightly weaker to expectations, possibly encouraging investors around the world to view decreased risks of further interest rate hikes by major central banks and raising the odds of a “soft landing.”

At the moment, there doesn’t seem to be a strong risk bias given the holiday in North America and a relatively light calendar ahead, so unless take the second and third tier economic updates this week as arguments to focus more on global growth concerns rather than “peak interest rate” speculations, we may see continued risk-taking in the markets.

Also, keep in mind that Wall Street is coming back from the Summer season, so volatility and directional strength may pick up relative to the past few months as the week progresses.

Canadian Dollar scenarios

Base case: Canada’s inflation remains elevated at 3.3% y/y in July. However, markers such as housing and labor market suggest weaknesses that may be welcome to the BOC.

This is why the BOC will likely keep its interest rates at 5.0% this week. In fact, many analysts expect no changes from the central bank at least until early 2024. And like the other major central banks, Governor Macklem and his team will also want to keep further rate hikes on the table to keep traders from pricing in interest rate cuts prematurely.

Rate hike pauses in March and in April were expected, but that didn’t stop CAD bears from attacking back then. So, CAD may still get hit with some selling even if a rate hike pause materializes.

In case of a rate hike pause and without hawkish rhetoric from the BOC, CAD may see losses against safe havens like CHF and JPY as well as fellow commodity currencies like AUD and NZD.

Alternative Scenario: If the BOC surprises with another interest rate hike (a possibility given the upside inflation surprises in both hard and soft data), that surprise element will most likely bump the Loonie higher across the board.

In this scenario, look for CAD to potentially see short-term gains against JPY and CHF, especially if risk-on sentiment. And, if the markets continues its shift slightly towards anti-USD sentiment, USD/CAD may see further losses at the decision.

This post first appeared on babypips.com