Surprisingly strong inflation numbers from the U.S. and weakening economic indicators from around the globe were likely the drivers for traders to push the U.S. dollar and Japanese yen into the top spots this week.

Notable News & Economic Updates:

President Zelensky says Ukraine retook 6K sqm from Russian control this month

U.S. Consumer prices rose in August and the annual growth rate slowed less than expected

U.K. headline consumer inflation slowed in August to 9.9% y/y but still remains way hot; core CPI ticked higher to 6.3% y/y

ZEW economic sentiment in Europe weakened to -60.7 vs. -54.9 previous

Australia’s unemployment rate ticked higher to 3.5% and net jobs gain came in below expectations as 33.5K

EIA crude oil inventories rose by 2.4M barrels

The German government took temporary control of two subsidiaries of the Russian energy giant Rosneft on Friday

FedEx Corp. sees business conditions deteriorating, and possibly will get worse, fueling global recession bets further ahead of the weekend.

Russian President Vladimir Putin pledged to up attacks on Ukraine’s civilian infrastructure, and pledging to continue military operation despite recent setbacks.

Intermarket Weekly Recap

After an open week bounce in risk taking, sentiment quickly shifted on Tuesday with the main economic event of the week: U.S. CPI data.

This was hotter than expected and had markets back in betting mode that the Federal Reserve will stay relatively aggressively with monetary policy tightening. This of course fueled further bets that high interest rates will likely induce a global recession as early as this year, calls made by both Fitch and the World Bank.

These warnings on Thursday, plus a week of net weak economic updates from around the globe, were likely the catalysts for that additional quick dip in risk assets we can see in the chart above, which carried into the weekend.

In the crypto space, we finally saw the Ethereum network moved to proof-of-stake consensus on Thursday, after the highly anticipated Merge event. Unfortunately, that didn’t seem to be enough to prevent Ether from falling roughly 6%, likely more influenced by “buy-the-rumor, sell-the-news” type behavior and the negative market sentiment we’re seeing these days.

In the forex space, King Dollar takes the crown this week, locking in gains after the highly anticipated U.S. CPI number on Tuesday. This performance was closely followed by the Japanese yen, another “safe haven” move, which signals the world is more focused on the ever increasing recessionary outlook.

USD Pairs

Overlay of USD Pairs: 1-Hour Forex Chart

In August, the U.S. consumer price index rose by 0.1% m/m . The inflation gauge increased 0.6% when food and energy were excluded, which is higher than anticipated.

U.S. budget deficit widens to $220B in August, up by 29% from the same month last year

Homebuyers’ demand for U.S. mortgages declined 29% since last year as interest rates rise above 6%.

While better than anticipated, but primarily due to a sharp increase in motor vehicle and parts dealer receipts, U.S. retail sales increased 0.3% m/m in August vs. -0.4% m/m in July

U.S. initial jobless claims dipped to 213K vs. 225K forecast and 218K previous

Declines in new orders and shipments dragged the U.S. Philly fed index to a surprising negative reading (-9.9) in September

U.S. industrial production contracts by 0.2% (vs. 0.2% uptick expected) on lower utilities output

GBP Pairs

Overlay of GBP Pairs: 1-Hour Forex Chart

UK July GDP up by 0.2% vs. 0.3% expected, -0.6% in June

UK’s industrial production dips by 0.3% vs. 0.4% expected, -0.9% in June

UK manufacturing production improves by 0.1% vs. 0.3% expected, -1.6% previous

GDP grew in July by +0.2% q/q but the outlook remains one of recession – NIESR

U.K. average earnings index accelerated from 5.2% to 5.5% vs. 5.4% forecast

U.K. claimant count increased by 6.3K vs. estimated 13.2K decline; the jobless rate dipped from 3.8% to 3.6% on lower participation rate

U.K. headline CPI slowed from 10.1% to 9.9% in August vs. 10.2% expected; core CPI rose by 6.3% y/y vs. 6.2% previous

BOE Survey: UK public inflation expectations at record high of 10.1% in July

U.K. retail sales clocked in at -1.6% in August, the biggest decline so far this year

EUR Pairs

Overlay of EUR Pairs: 1-Hour Forex Chart

The seasonally adjusted Italian industrial production index rose 0.4% m/m in July 2022. The recent three months’ average dropped 1.6% from the prior three.

According to Bundesbank President Joachim Nagel, the European Central Bank would have to keep raising interest rates if the current trend in consumer prices continues.

ZEW’s economic sentiment index for Germany declined to -61.9 from -55.3 in August. Reuters economists predicted -60.0 for September.

Industrial production down by 2.3% m/m in the Euro

area & by 1.6% m/m in the EU; down by 2.4% and 0.8% respectively when compared with July 2021

The ECB’s chief economist Philip Lane predicts lower increases following last week’s 75 bps hike

ECB policymaker Constantinos Herodotou said on Wednesday that the ECB will stay open with how high interest rates may go

German wholesale price index chalked up 0.1% uptick vs. expected 0.5% gain

ECB Chief Economist Lane says rate increases will be larger

CHF Pairs

Overlay of CHF Pairs: 1-Hour Forex Chart

Swiss producer prices dip by another 0.1% vs. estimated 0.1% uptick

CAD Pairs

Overlay of CAD Pairs: 1-Hour Forex Chart

Canadian manufacturing sales declined 0.9% to $71.6B in July, mainly driven by the primary metal, petroleum and coal, and furniture and associated products industries.

Canada Housing Starts for August: -3% m/m to 267,443 units

Canadian Wholesale sales declined in July by -0.6% m/m to $80.2B

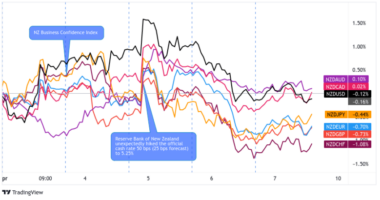

NZD Pairs

Overlay of NZD Pairs: 1-Hour Forex Chart

New Zealand data: August Food Price Index +1.1% m/m (prior +2.1%)

NZ current account deficit narrows from 6.5B NZD to 5.22B NZD in Q2 2022

New Zealand economy grew 1.7% in Q2 2022 vs. 1.0% consensus

AUD Pairs

Overlay of AUD Pairs: 1-Hour Forex Chart

Australian Westpac consumer sentiment index rebounded by 3.9% m/m vs. -3% m/m previous

Australian NAB business confidence index up from 8 to 10 in Aug

AU new home sales down by another 1.6% in August after 13.1% slide in July

Australia’s MI inflation expectations slowed from 5.9% to 5.4%

Australia added 33.5K jobs in August vs. estimated 35.5K gain

Australian jobless rate ticked higher from 3.4% to 3.5%

JPY Pairs

Overlay of Inverted JPY Pairs: 1-Hour Forex Chart

Japanese BSI manufacturing index recovered from -9.9 to +1.7

Japan’s producer prices up by 9.0% y/y vs. projected dip to 8.9%

Japan’s core machinery orders surprisingly gain by 5.3% vs. 0.6% decline expected in July

Japan September factory mood retreats from seven-month highs on cost pressure: Reuters Tankan

Japan’s industrial output revised lower from 1.0% to 0.8% in July

Japan’s finance minister says FX intervention among options to combat yen falls

Japanese official Katayama: FX intervention not likely to prop JPY up in long run

Japanese trade deficit widened from 2.16T JPY to 2.37T JPY

Japanese tertiary industry activity sank 0.6% vs. estimated 0.1% dip