Looking for more central bank events to trade?

The Reserve Bank of New Zealand (RBNZ) is dropping its May monetary policy decision next week!

Here are points to note if you’re planning on trading NZD during the release:

Events in Focus:

Reserve Bank of New Zealand Monetary Policy Statement

Quarterly RBNZ Monetary Policy Assessment

Quarterly RBNZ Press Conference

When Will it Be Released:

May 24, Wednesday: 2:00 am GMT, presser to follow an hour later.

Use our Forex Market Hours tool to convert GMT to your local time zone.

Expectations:

- RBNZ to raise its OCR by 25 basis points from 5.25% to 5.50%

- RBNZ’s new forecasts may reflect lower inflation, tighter labor market, and higher growth compared to February’s estimates

Relevant New Zealand Data Since the Last RBNZ Statement:

? Arguments for Tighter Monetary Policy / Bullish NZD

BusinessNZ manufacturing survey inched up from 48.1 to 49.1 in April but was still lower than the 53.0 long-term average; while still signaling contractionary conditions, the turn higher may be signaling a bottoming in those conditions

New Zealand’s quarterly employment change up by 0.8% in Q1 vs. 0.5% expected and previous, unemployment rate steady at 3.4% vs. 3.5% expected

Business managers in New Zealand predicted annual inflation to average 4.28% in the coming year, down from 5.11% in the first quarter’s RBNZ survey.

RBNZ’s Financial Stability Report noted that “New Zealand’s financial system is well placed to handle the increasing interest rate environment and international financial market disruptions”

New Zealand visitor arrivals tick 0.6% m/m higher in February after plummeting by 26.3% in January

? Arguments for Looser Monetary Policy / Bearish NZD

BusinessNZ Performance of Services Index declined by 4 points from a month earlier to 49.8 in April 2023, falling into contraction for the first time since February 2022.

New Zealand ANZ commodity prices slipped 1.7% month-over-month in April vs. previous 1.3% gain, as exporter freight prices continue to soften

Q2 CPI slumped from 1.4% to 1.2% q/q versus projected increase to 1.5%, dampening RBNZ tightening hopes as energy prices tumbled

New Zealand’s food price index chalked up 0.8% month-over-month gain in March, following earlier 1.5% increase to suggest slowing consumer price pressures

BusinessNZ services index down from 55.8 to 54.4 to reflect slower pace of growth in March, as the economy cooled down and general uncertainty set in

BusinessNZ manufacturing index fell into contraction, printing at 48.1 in March after a 51.7 February reading.

Previous Releases and Risk Environment Influence on NZD

Apr. 5, 2023

Action/results: RBNZ surprised markets with a 50 bps official cash rate (OCR) from 4.75% to 5.25% when traders only priced in a 25bps increase. What’s more, the central bank maintained its hawkish stance, saying that “inflation is still too high and persistent, and employment is beyond its maximum sustainable level” and that the economy’s financial system can “manage” through a period of slower activity.

The surprisingly hawkish decision took NZD to new intraday (and intraweek) highs against its major counterparts. But a lack of further catalysts also limited NZD’s bullish momentum. The currency gave up most of its gains and capped the day only slightly higher than its daily open prices.

Risk Environment and Intermarket Behaviors: Thin volume trading ahead of the Easter holidays as well as fresh PMI data supporting recession concerns for the U.S. and other major economies limited the demand for “risky” bets like NZD.

Feb. 22, 2023

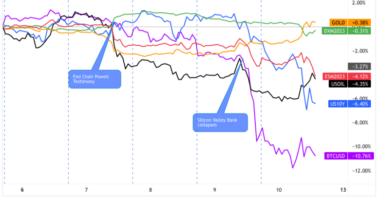

Overaly of NZD vs. Major FX Chart by TV

Action/Results: As expected, the RBNZ took its OCR 50 basis points higher from 4.25% to 4.75%, the highest since January 2009.

The central bank also flagged further rate hikes and said that the RBNZ crew needed “OCR needed to reach a level where the Committee could be confident it would reduce actual inflation” to its target range.

NZD shot up at the RBNZ’s hawkish news but quickly found resistance around the previous U.S. session’s inflection points. It eventually extended its intraday uptrends against AUD, EUR, CHF, and GBP, however, despite traders staying on the sidelines ahead of the FOMC meeting minutes.

Risk Environment and Intermarket Behaviors: Sticky inflation reads and green shoots in global PMI reports got traders pricing in more rate hikes from the major central banks. This limited risk-taking and NZD’s intraweek gains ahead of Friday’s U.S. core PCE report.

Price action probabilities

Risk sentiment probabilities: RBNZ will print its decision in the middle of the week, after PMI reports from the Euro Area, U.K., and the U.S. but before the FOMC meeting minutes and the second reading of the U.S. Q1 2023 GDP. The U.S. debt ceiling crisis is also having a noticeable impact on broad risk sentiment in recent weeks, so developments there are one to watch when gauging risk-on/risk-off expectations.

This means that the markets’ reaction to RBNZ’s event could play to already existing dominant market themes and extend NZD’s intraweek trends, or it could provide short-term pullbacks for major NZD pairs if the environment is behavior counter to normal NZD risk tendencies (e.g., broad risk-off environment may mean NZD pullback despite bullish NZD catalysts/themes).

New Zealand Dollar scenarios

Base case: Lower inflation expectations, higher labor supply brought about by migration, and the government’s inflationary spending plans are supporting a hawkish hike scenario for RBNZ.

That is, the central bank could raise its rates by 25 bps to 5.50% as expected and hint at least one more rate hike in the foreseeable future.

But NZD’s reaction could be short-lived as traders prepare for the FOMC meeting minutes and U.S. GDP. If NZD gives up most of its post-report highs/lows like it did in the last two releases, then it’s probably better to trade NZD against counterparts like USD, AUD, and CHF.

Alternative Scenario 1: If the RBNZ surprises markets with a 50bps rate hike, then we could see sharper NZD rallies and maybe sustained rallies against some pairs.

Like in the Base Case scenario, strong NZD moves are more prominent against safe havens like USD and CHF and against AUD, especially if the broad market environment is leaning risk-on.

Alternative Scenario 2: In the low probability scenario that the RBNZ holds off on any rate change, we may see traders unload NZD, especially if it makes another push higher against the majors leading up to the event.

NZD has had a broad, solid run higher in May, likely due to expectations of a rate hike, so it makes sense that some traders will take profits on the event.

If the environment is risk-off during the release, NZD/JPY may see the bigger dip, especially since the yen was one of the weaker currencies against the Kiwi in May, as well as the euro.

If the environment is risk-on in the scenario, then NZD may lose more ground against the Loonie and Aussie on the release.