Another week of pressure for the Greenback despite some positive movement towards a new U.S. administration and better-than-expected economic / sentiment updates from the U.S. and vaccine news.

Positive risk sentiment and continued massive stimulus measure continues to be the main driver for the Greenback’s weekly move lower.

United States Headlines and Economic data

Monday:

U.S. Recovery gains further momentum with hiring at all-time high

Trump administration gives go signal to Biden transition

President-elect Biden to tap former Fed head Yellen for Treasury

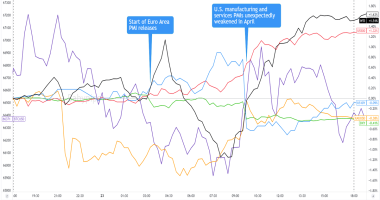

The Dollar had been trading lower to start the week on positive global risk sentiment, once again sparked by more positive covid vaccine / therapy news (Oxford-AstraZeneca Covid vaccine shows an average 70% effectiveness in preventing the virus, FDA authorizes Regeneron’s Covid treatment for emergency use).

But better-than-expected U.S. flash manufacturing PMI (up from 53.4 to 56.7 vs. 52.5 forecast) and U.S. flash services PMI (up from 56.9 to 57.7 vs. 55.8 forecast) were the catalysts for that broad spike higher in the Greenback during the U.S. trading session.

Fed’s Barkin: Next few months could be challenging until vaccine available

The Chicago Fed National Activity Index (CFNAI) was +0.83 in October, up from +0.32 in September. The three-month moving average fell to +0.75 in October from +1.37 in September.

Fed’s Evans sees no rate hikes until late 2023, maybe 2024 – “inflation in his view is unlikely to reach 2% until late 2022 or even 2023”

Tuesday:

Richmond Fed Manufacturing Index fell from 29 in October to 15 in November

S&P Corelogic Case-Shiller Index Shows Annual Home Price Gains Soared To 7% In September

U.S. House Prices Rise 3.1 Percent in Third Quarter; Up 7.8 Percent over the Last Year

U.S. consumer confidence fell to a reading of 96.1 in November as rising coronavirus cases pushed American optimism down to the lowest level since August

Yellen would need Congress to approve use of clawed-back Fed loan funds, Treasury says – the Trump administration recently took back $455 billion meant for pandemic support.

Key lines from the unveiling of Biden’s top national security and foreign policy team

Wednesday:

U.S. Goods-Trade Gap Widens as Imports Rise to Highest in a Year – “The shortfall grew to $80.3 billion from $79.4 billion in September, according to Commerce Department data released Wednesday. The median estimate by economists in a Bloomberg survey was for a negative balance of $80.4 billion. Imports rose by 2.2% to $206.3 billion, the highest since September 2019, while exports increased 2.8% to $126 billion.”

U.S. Durable Goods Orders Expand Faster Than Expected in October – “Bookings for durable goods — items meant to last at least three years — increased 1.3% from the prior month, according to a Commerce Department report Wednesday that exceeded estimates in a Bloomberg survey that had called for a 0.8% rise. The September reading was revised up to a 2.1% increase.”

U.S. Personal income -0.7% in Oct. Core PCE Price Index was 0.0% in Sept.

Fed weighed adjusting bond purchases to provide more help to economy ‘fairly soon,’ minutes show

FOMC minutes: Officials discussed possible adjustments to bond purchases

FOMC minutes: “Many participants judged that the Committee might want to enhance its guidance for asset purchases fairly soon.”

Thursday:

The U.S. was on holiday for the session, so no major news or economic events of note, and volatility was relatively low in the Greenback.

Friday:

President Donald Trump says he will leave White House if Electoral College votes for Joe Biden – “Biden won the election with 306 Electoral College votes — many more than the 270 required — to Trump’s 232, and the electors are scheduled to meet on Dec. 14 to formalize the outcome.”