It’s another busy economic schedule this week since we’ve got FIVE central bank decisions and a handful of top-tier reports.

What are analysts expecting from these catalysts?

Major Economic Events:

Chinese data dump (Dec. 15, 2:00 am GMT) – A bunch of major economic reports will be released from China midweek, and these might be able to sway risk sentiment.

Retail sales in November are expected to have slowed from 4.9% to 4.8% year-over-year while industrial production likely advanced from 3.5% to 3.8%. Fixed asset investment probably tumbled from 6.1% to 5.4%.

U.S. retail sales (Dec. 15, 1:30 pm GMT) – Slower consumer spending is eyed for November, with the headline figure estimated to have fallen from 1.7% to 0.8%. The core version of the report likely slipped from 1.7% to 0.9%.

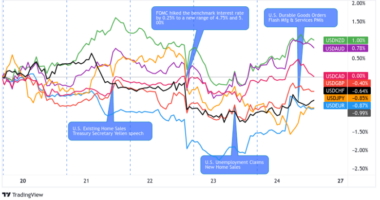

FOMC statement, projections & presser (Dec. 15, 7:00 pm GMT) – The U.S. central bank is widely expected to keep rates on hold at <0.25% but might print updates on their economic projections.

Dollar traders are keen to find out if the Fed will shift back to a cautious stance due to the Omicron variant or carry on with their pace of tapering. Note that price pressures remain very elevated, so policymakers might consider accelerating their timeline to withdraw stimulus.

Any major changes in the Fed’s growth and inflation forecasts could give some clues on their tightening plans, along with adjustments to their dot plot forecasts of interest rates.

New Zealand quarterly GDP (Dec. 15, 9:45 pm GMT) – After an impressive 2.8% growth figure in Q2, New Zealand might report a sharp 4.5% contraction for the previous quarter.

An even larger reduction to growth could dash hopes of seeing another interest rate hike from the RBNZ anytime soon, which might be bearish for the Kiwi.

Australian jobs report (Dec. 16, 12:30 am GMT) – The Land Down Under could post a strong 200K rebound in hiring for November, following the earlier 46.3K drop in employment.

This should be enough to bring the unemployment rate down from 5.2% to 5.0%, but weaker than expected figures could mean more downside for the Aussie.

SNB monetary policy decision (Dec. 16, 8:30 am GMT) – No actual interest rate changes are expected from the Swiss central bank, so traders are just likely to stay on the lookout for jawboning remarks.

BOE monetary policy statement (Dec. 16, 12:00 pm GMT) – The BOE is also expected to sit on its hands and keep interest rates on hold for the time being.

No changes to asset purchases are expected as well, with policymakers likely taking a step back due to the emergence of Omicron and the possibility of lockdowns.

Also keep in mind that hawkish members like Saunders have toned down their optimistic comments recently, so a more somber BOE statement might be in the cards.

ECB monetary policy statement (Dec. 16, 1:30 pm GMT) – No actual changes to interest rates or bond purchases are expected from the ECB this time.

Policymakers have been emphasizing how inflationary pressures are just temporary, particularly with supply chain disruptions still in play.

Still, market watchers will likely keep their ears peeled for clues on what the central bank will do after the PEPP expires in March.

BOJ monetary policy decision (Dec. 17) – The Japanese central bank will also stand pat, keeping interest rates and its QE program unchanged. Many expect this announcement to be a non-event because the Japanese economy is still struggling to recover from the pandemic.

Some expect the BOJ to extend their emergency facilities, possibly at reduced levels, considering how it already downgraded economic forecasts in their October meeting.

Forex Setup of the Week: USD/CAD

This pair recently fell through an ascending trend line, suggesting that a reversal from the uptrend is in the cards.

Price has yet to retest the broken support, which might hold as resistance moving forward. This is near an area of interest at the 61.8% Fib level and the 1.2750 minor psychological mark.

Technical indicators are still looking mixed, though. The 100 SMA is above the 200 SMA to suggest that there’s a chance the rally could resume, but Stochastic is already indicating exhaustion among buyers.

The FOMC decision could determine where this dollar pair is headed next, as dovish adjustments to their dot plot forecasts might mean a selloff for the U.S. currency.