It’s gonna be another busy trading week since we’ve got rate statements coming from the BOC, BOJ, and ECB!

Also, Uncle Sam will be printing its advanced Q3 GDP and the Fed’s preferred inflation measure.

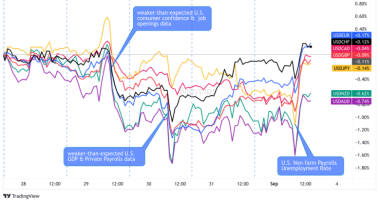

Don’t forget to review which factors drove forex market price action last week, too!

Major Economic Events:

Australian quarterly CPI (Oct. 27, 12:30 am GMT) – Another 0.8% increase in the headline figure and 0.5% gain in the trimmed mean CPI is expected for Q3.

Stronger than expected results could spur more gains for the Australian currency, given how the economy is starting to regain its footing after the pandemic lockdowns.

After all, this might push the RBA into action, possibly considering hiking interest rates to keep price pressures in check.

BOC monetary policy statement (Oct. 27, 2:00 pm GMT) – No actual changes to the 0.25% interest rate are eyed, but the Canadian central bank might have some adjustments to asset purchases.

Recall that employment and inflation figures have surpassed expectations in the past months, so the BOC could stay on track towards ending their easing program by December. This would mean a reduction from 2 billion CAD to 1 billion CAD in weekly asset purchases.

Any confirmation that the BOC might start hiking rates by mid-2022 could also mean upside for the Loonie.

BOJ monetary policy statement (Oct. 28) – Japanese central bankers are widely expected to sit on their hands for now, keeping interest rates and bond purchases unchanged.

Many expect this event to be a snoozer since the BOJ isn’t exactly joining the tightening bandwagon just yet. Still, any dovish remarks might be worth keeping tabs on.

ECB monetary policy statement (Oct. 28, 11:45 am GMT) – No actual changes to interest rates or bond purchases are expected from the ECB as well.

In fact, policymakers might dash hopes of an interest rate hike for next year since stagflation remains a strong threat in the region. To top it off, the energy crunch and supply chain issues are also weighing on growth prospects.

U.S. Q3 advance GDP (Oct. 28, 12:30 pm GMT) – After printing an impressive 6.7% growth figure previously, Uncle Sam might show a slower 2.6% expansion this time.

Weaker jobs growth and rising price levels likely kept consumer spending in check, even as businesses slowly resumed normal operations. Government spending and construction activity likely picked up, though.

Note that the Atlanta Fed GDP model is pointing to a meager 0.5% growth figure, so a downside surprise might be in the cards.

U.S. core PCE price index (Oct. 29, 12:30 pm GMT) – This is the Fed’s preferred inflation measure, so market watchers would likely pick up tightening clues from this one.

However, slightly slower price pressures are eyed, since the reading could dip from 0.3% to 0.2% in September.

Forex Setup of the Week: CHF/JPY

This pair is testing the top of its rising channel on the daily time frame, setting up for a potential countertrade opportunity.

If sellers defend this resistance area, CHF/JPY could retreat to nearby support levels such as the channel bottom at 120.00 or the mid-channel area of interest around 122.00.

Stochastic is already reflecting exhaustion among buyers, so turning lower would confirm that bearish pressure is returning.

However, the 100 SMA is still above the 200 SMA to suggest that the longer-term uptrend is more likely to resume than to reverse.

I’d stay on the lookout for any hawkish surprises during the BOJ announcement or some profit-taking activity after the event when trading this one.