The central bank of the world’s largest economy is about to drop its May monetary policy decision!

What are traders expecting from the event and how can it affect USD’s price action?

Here’s what you need to know if you’re planning on trading this central bank announcement:

Event in Focus:

Federal Open Market Committee (FOMC) Monetary Policy Statement

When Will it Be Released:

May 3, Wednesday: 6:00 pm GMT, 7:00 pm London, 2:00 pm New York, 3:00 am Tokyo (May 4)

Check our Economic Calendar to see what time the reports come out in your time zone!

Expectations:

- Fed to raise its interest rates by 25 basis points to the 5.0% – 5.25% range

- Chairman Powell will likely signal a pause in rate hikes but do his best to discourage rate cut speculations for 2023

Since the March decision, the Fed’s closely-watched indicators continue to show that inflation remains sticky at elevated levels and that the labor market activity remains un-recession-y.

But last week’s much weaker-than-expected advance GDP reading hammered the risks of tightening monetary policies as much as the Fed has done in the last few months.

The Fed is also particularly cautious of banking sector worries as it recognized that “historical recessions related to financial market problems tend to be more severe and persistent than average recessions” back in March.

So, while the Fed will likely push through with another rate hike to take another jab at inflation, it’s speculated they will announce a pause for June to reassess the impact of its tightening moves.

But a June rate hike pause is already widely expected (the CME Fed Watch Tool is currently pricing 63.6% probability of Fed Funds at 500-525 bps range). What markets will want to know right now is the Fed’s plans for the rest of 2023 and early 2024, and any surprises there will likely spike volatility short-term

Relevant U.S. Data Since Last FOMC Statement:

? Arguments for Tighter Monetary Policy / Bullish USD

U.S. Mortgage Applications in the week ended April 21 rose by 4.6% w/w despite a rise in the 30-year fixed mortgage by 12 bps to 6.55% (a one-month high)

Core PCE Prices came in hot at 4.9% q/q (+4.1% q/q forecast) vs. 4.4% q/q previous

U.S. Consumer Price Index for March: +0.1% m/m (+0.3% m/m forecast) vs. +0.4% m/m previous: +5.0% y/y (+5.3% y/y forecast); Core CPI ticked higher to +5.6% y/y vs. +5.5% y/y forecast/previous

US employment costs accelerated from 1.0% to 1.2% in Q1, marking the first acceleration in a year and the seventh consecutive quarter or above 1.0% growth.

S&P Global U.S. Manufacturing PMI for April: 50.4 vs. 49.2 previous; Services Business Activity Index at 53.7 vs. 52.6 previous

? Arguments for Looser Monetary Policy / Bearish USD

Dallas Fed Manufacturing Activity for April: -23.4 (-11.0 forecast) vs. -15.7 in March; Employment index fell 2.4 points to 8.0; wages and benefits index climbed to 37.6, above the average rate of 21.0

U.S. Advance GDP read for Q1 2023: +1.1% q/q vs. +2.6% q/q previous

The four-week average of jobless claims climbed 10,250 to 1,836,500 in the April 27 release, the highest level since December 2021

U.S. Personal Income for March came in at 0.3% m/m as expected & inline with the February read; Personal spending was flat at 0.0% m/m in March (-0.2% m/m forecast) vs. +0.1% m/m previous

U.S. headline producer prices fell by 0.5% m/m in March while core PPI dipped by 0.1%. Annual prices fell 2.7% y/y, its smallest gain in two years, and supported the price deceleration seen in this week’s CPI data.

Philly Fed Manufacturing Index – an index the Fed once cited in its decision – for April: -31.3 (-18.0 forecast) vs. -23.2 in March

U.S. Consumer confidence index fell to 101.3 in April (106.0 forecast) vs. 104.0 previous

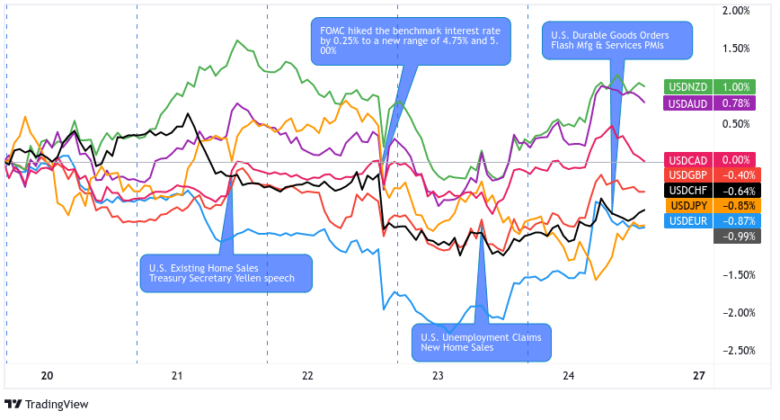

Previous Releases and Risk Environment Influence on USD

Mar. 22, 2023

Action/results: As expected, the Fed raised its interest rates by 25 basis points to the 4.75% – 5.00% target range, citing tighter bank lending conditions as one of the reasons for not taking its rates even higher.

FOMC members didn’t change their dot plot forecasts, but new projections showed that they’re expecting higher inflation and lower GDP and unemployment rate in 2023 compared to their December forecasts.

The Fed raising its interest rates by “only” 25 basis points and shifting its tightening bias from “ongoing rate increases will be appropriate” to “some additional policy firming may be appropriate” translated to “dovish rate hike” during the U.S. session.

Risk Environment and Intermarket Behaviors: Markets were coming off from their bank jitters and coordinated central bank action on Monday. This made it easier to sell USD and buy “riskier” bets when markets took “dovish hike” from the Fed event.

USD dropped sharply across the board at the statement’s release but only retained its weakness against its fellow safe havens before the end of the day.

Feb. 1, 2023

Action/results: As expected, the Fed raised the target interest rate range by 25 bps to 4.50% to 4.75%. Chairman Powell also unexpectedly didn’t go full hawk on the markets. He noted a “most welcome” recent ease in inflation rates and shared that it hasn’t weighed the labor market…yet.

Risk Environment and Intermarket Behaviors: The less hawkish rhetoric, which traders had started pricing in a day before the decision, dragged the U.S. dollar lower across the board. The USD-selling likely pushing gold, crypto, and U.S. equities higher.

Price action probabilities

Risk sentiment probabilities: Concerns over the banking sector and slower global growth are making it easy for market players to “sell in May and go away” this week.

Unless we see start-of-month risk-taking, or this week’s PMIs show improving business activities, then safe-haven demand could limit USD’s losses amidst dovish Fed expectations.

U.S. Dollar scenarios

Base case: As with the last two FOMC decisions, the Fed could do what the markets are expecting and raise its rates by 25 basis points to the 5.00% – 5.25% range.

In his presser, Powell will likely recognize the tightening impact of stricter bank lending conditions and the recessionary risks they and the higher interest rates bring.

But Powell will also point to persistently high inflation and a still-okay labor market to justify keeping interest rates high for a long period of time. He will probably reinforce the Fed’s dot plot projections of not raising rates until 2024 and maybe hint at further rate hikes should economic data allow it.

The confirmation of a less hawkish stance will drag USD against its counterparts but if we’re in a broad risk aversion on Wednesday, that may limit any USD’s losses if they occur. In case of a dovish FOMC event and broad risk-off lean, look for sell setups in USD against safe havens like JPY, CHF, and even EUR.

Alternative Scenario: The Fed’s rate hike is already priced in, so USD’s volatility will likely depend on what markets take away from Powell’s presser.

If the interst rate announcement and following press conference turns out to be a non-event, then other market themes (ex: debt ceiling, bank sector woes, geopolitical concerns) and/or counter currency stories could take the front seat to drive USD’s intraweek prices.

USD could act more like a safe haven if risk-off vibes persist, and making potential long setups against “riskier” bets like AUD, NZD, CAD, and GBP something look at this week.

This post first appeared on babypips.com