Ready to get your pips in?

I’m seeing a handful of big market movers coming our way this week, including the U.S. advanced GDP and BOJ decision.

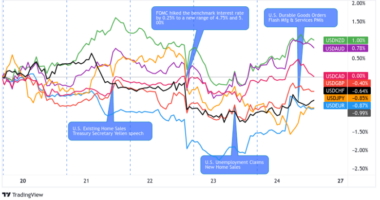

ICYMI, I’ve written a quick recap of the market themes that pushed currency pairs around last week. Check it!

Here’s are the top economic events lined up and what’s expected.

Major Economic Events:

Australia’s quarterly CPI (Apr. 27, 1:30 am GMT) – The Land Down Under will be printing its quarterly inflation figures for Q1 2022, likely reporting the jump in price pressures during the latter part of the period.

Recall that the conflict between Russia and Ukraine drove fuel and commodity prices higher worldwide starting in late February. Because of that, Australia’s headline CPI reading likely advanced from 1.3% to 1.7% last quarter while the trimmed mean CPI probably ticked higher from 1.0% to 1.2%.

Higher than expected readings might boost RBA tightening hopes, as analysts are already pricing in a hike in June.

BOJ monetary policy decision (Apr. 28) – The Japanese central bank is scheduled to announce its rate decision, following weeks of verbal and actual intervention.

Don’t forget that officials have been watching the yen’s movements in the forex market extra closely lately, reiterating that a weak currency would benefit the Japanese economy.

More jawboning is expected from the central bank this week and possibly some adjustments that could drag the yen lower against its peers.

U.S. advanced GDP (Apr. 28, 12:30 pm GMT) – After chalking up an impressive 6.9% growth figure in the previous quarter, Uncle Sam’s expansion is expected to have slowed to a meager 1.0% pace in Q1.

Along with this, the advanced GDP price index is also up for release and might print an uptick from 7.1% to 7.3%.

Stronger than expected results could continue to fuel Fed tightening hopes, leading to increased calls for a 0.50% hike in their next meeting.

U.S. core PCE price index (Apr. 29, 12:30m pm GMT) – Rounding up the U.S. data dump for the most part of the week is the Fed’s preferred measure of inflation.

Analysts predict that the figure for March would dip from 0.4% to 0.3% but this might not be enough to dampen Fed rate hike bets.

Forex Setup of the Week: USD/JPY

I’m keeping close tabs on this short-term consolidation pattern on USD/JPY, especially with the BOJ decision coming up!

Intervention has been the name of the game for the central bank lately, as officials have been jawboning the currency for a while now. Any actual moves during their rate statement could spur losses for the yen and another sharp rally for this pair.

Technical indicators are looking mixed, though. While the 100 SMA is above the 200 SMA to suggest that the uptrend is more likely to gain traction than to reverse, Stochastic is pointing down to show that selling pressure is in play.

Price could keep testing support around the rising trend line visible on its short-term time frame until sellers are tired, but a break below the 128.50 area could signal that a reversal is looming.

Other catalysts to watch out for include the release of the U.S. advanced GDP figure for Q1 and the core PCE price index for March. Slower U.S. growth data is eyed, so this might keep a lid on dollar gains in the near-term.