Geopolitical news came to the forefront of traders’ focus, sparking big financial market moves to start the week.

From there, traders had to balance geopolitical drivers with a heavy dose of central bank speak from around the globe, and another round of top tier economic updates.

With so many different major narratives to follow, the correlations between major assets and the usual broad risk sentiment behaviors were weak, leading to a very mixed and unusual performance outcome by the end of the week.

Notable News & Economic Updates:

🟢 Broad Market Risk-on Arguments

On Monday, ECB Vice-President Luis de Guindos said that he expects inflation (both core and headline) to continue their downtrends, although he remains cautious due to oil prices

China considers new stimulus, potentially ¥1T ($137B) of sovereign debt according to unnamed sources – Bloomberg

On Wednesday, ECB Governing Council member Knot said that inflation shocks are waning but the council remains ready to take action if needed

FOMC Meeting Minutes: will “proceed carefully” and sees risks with both over tightening or under tightening

China sovereign wealth fund raised stake in ‘Big Four’ banks for the first time since 2015 and encouraged speculations that the government will step in to stem stock market losses

🔴 Broad Market Risk-off Arguments

Hamas militants launched a surprise attack, firing rockets and sending ground forces into Israel on Saturday. Israel declared war on Hamas on Sunday, launching their own air strikes and preparing a ground invasion of Gaza. Tragically, thousands of civilian casualties on both sides have been recorded in just the first week of conflict, with hundreds of thousands more civilians displaced from their homes.

On Monday, Bank of England policy committee member Catherine Mann commented that as long as inflation remains above target, central bankers will need to stay aggressive in reacting to it

According to sources, the BOJ may raise their inflation outlook for the current business year to 3% from 2.5%, likely due to rising oil prices and depreciating yen.

Israel ordered the evacuation of 1.1M people from northern part of Gaza, the UN said on Thursday

On Thursday, the IEA cut its oil demand forecast for 2024 from 1M bpd to 880K bpd

U.S. CPI for September: 0.4% m/m (0.4% m/m forecast; 0.6% m/m previous); Core CPI 0.3% m/m (0.3% m/m forecast/previous)

During an IMF panel, ECB President Lagarde reiterates that the central bank will raise interest rates again if necessary, but will monitor the effects of prior moves

China New Loans for September: ¥2.1T ($564B), below ¥2.5T forecast; M2 money supply growth rate fell to 10.3% y/y vs. 10.6% y/y forecast/previous

Bank of England Governor Andrew Bailey commented on Friday that uninsured deposits are a risk being watched; upcoming monetary policy decision will be “tight” despite seeing improvement in inflation conditions

Preliminary U.S. consumer sentiment read for October falls drastically to 63.0 (68.0 forecast; 68.1 previous); Expectations index falls from 66.0 to 60.7; Inflation expectations rise from 3.2% to 3.8%

Global Market Weekly Recap

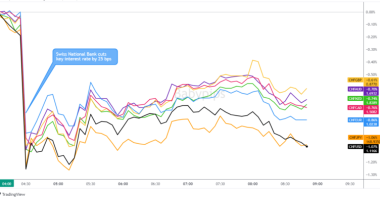

Dollar, Gold, S&P 500, Oil, U.S. 10-yr Yield, Treasury Futures, Bitcoin Overlay Chart by TradingView

With several markets on holiday on Monday, the week was supposed to start quietly ahead of a busy economic calendar. Unfortunately, that was far from the case as the traders quickly reacted to news from the weekend that Hamas attacked Israel on Saturday, followed Israel declaring war on Hamas on Sunday.

This prompted traders to price in higher oil prices (historically the usual behavior around conflict in the Middle East) and broad risk aversion behavior, characterized by a rise in prices of bonds, gold, and the Greenback vs. a fall in equities, crypto and bond yields.

After the initial weekly opening moves, market prices stabilized pretty quickly, holding in tight ranges through Tuesday and early Wednesday. This may have been due to several factors, including some speculating that the Israel-Hamas war would not likely spread into a wider regional conflict, and/or traders sitting on their hands as they awaited both for further developments in the Israel-Hamas war and on top tier economic updates starting on Wednesday.

On Wednesday, we did start to see volatility pick up again, starting with a drop in oil prices, correlating with the IEA’s lower growth demand forecast for oil for 2024. This was followed by a broad market rise in volatility around the latest FOMC meeting minutes released during the U.S. trading session.

The main takeaway from the minutes seems to have been that the committee generally sees that policy is restrictive enough and that they can proceed carefully. This sentiment was largely re-iterated all week from not only Federal Reserve members, but also from comments seen from European Central Bank and Bank of England speeches as well. The markets took this as a cue to further price in higher odds of a peak in the rate hike cycle, which meant risk-on assets saw gains vs. a fall in USD and bond yields.

Markets mostly quieted down through the Thursday Asia and London sessions as news flow was light, and probably on traders waiting on the sidelines ahead of the highly anticipated U.S. consumer prices index update.

And the CPI data didn’t disappoint as the September read signaled sticky inflation conditions once again, prompting traders to price in higher odds of “higher for longer” interest rate scenario and back into pro-USD mode. Bond yields jumped (U.S. 10-year Treasury yield went from 4.55% to a high of 4.72%) and the U.S Dollar Index went from 105.70 to 106.60 (+0.86% gain) in just a few hours.

On Friday, the markets returned focus back to the conflict in Israel, this time reacting to news that Israel warned 1.1 million civilians in northern Gaza to evacuate their homes. This was a signal that Israel was about to intensify their operations in Gaza city, likely raising the odds of more civilian casualties as this is seen as an impossible task by the United Nations.

This drove a broad risk-off reaction from the financial markets (characterized by a rise in gold, bond prices) as well as another rally in oil prices, which was weighed down on Thursday by rising inventory data. The broad risk-off vibes continued into the Friday close, likely with the help of one more top tier update from the U.S.: the preliminary U.S. consumer sentiment read from the University of Michigan.

The UoM preliminary index came in well below forecast at 63.0 vs. 68.1 previous, with the future Expectations index falling from 66.0 to 60.7. This seems to have sparked one last round of elevated volatility, this time in favor equity and crypto bears and gold bulls going into the weekend close.

This post first appeared on babypips.com