A lack of non-U.S. top-tier economic releases sure didn’t stop traders from moving the major currencies around this week!

After all, they had growth concerns on their minds in the first half of the week and then had to price in a hawkish Fed in the last few days.

Not sure what I’m talking about? I can explain, but lemme show you the biggest headlines first:

Notable News & Economic Updates:

? Broad Market Risk-on Arguments

BOJ’s Tankan manufacturing index jumps from 1 to 5, non-manufacturing index was also higher from 20 to 23 in Q2 as raw material costs peaked and the removal of pandemic curbs lifted factory output and consumption

U.S. jobs data (private payrolls and job cuts) for June signaled a very tight labor market, adding more fuel to the idea the Fed will stay hawkish with monetary policy

Germany Factory Orders for May: +6.4% m/m (+1.5% m/m forecast; +0.2% m/m previous)

Australia’s retail sales up by another 0.7% in May (vs. 0.7% expected and previous) as consumers take advantage of promotions and sales events

ISM Services PMI for June: 53.9 vs. 50.3 in May; Prices Index: -2.1 to 54.1; Employment Index was up +3.9 to 53.1; New Orders Index was up +2.6 to 55.5

S&P Global U.S. Services PMI for June: 54.4 vs. 54.9 in May; “Companies noted that strong client demand and a sustained uptick in new business supported the latest expansion.”

? Broad Market Risk-off Arguments

Russia and Saudi Arabia extended oil supply cuts, prompting a spike higher in oil prices on Monday

China’s Caixin manufacturing PMI slowed down from 50.9 to 50.5 in June (vs. 50.0 expected) as firms grew increasingly concerned about sluggish market conditions

U.K. Manufacturing PMI for June: 46.5 (46.2 forecast; 47.1 previous); “manufacturers face lackluster demand in both domestic and overseas markets”; “Employment fell for the ninth month in a row, with the rate of reduction the sharpest since March”

Consents for new residential buildings continue to plunge in New Zealand, down 2.6% m/m in May (from -2.6%m/m in April)

China hits back in the chip war, imposing export controls on Gallium and Germanium used in computer chips and solar panels starting August 1 “to protect national security and interests.”

FOMC meeting minutes showed on Wednesday that a slower pace of hiking is likely ahead; 12 out of 18 members expect at least two more hikes this year.

ECB Governing Council member Joachim Nagel said that the interest rate hiking cycle isn’t finished as upside risks to the price outlook dominate

HCOB Eurozone Construction PMI for June: 44.2 vs. 44.6; “marked deterioration in activity in Germany that was the steepest seen since February 2021”

S&P Global Canada Manufacturing PMI for June: 48.8 vs. 49.0 in May; market demand subdued due to clients postponing spending decisions (likely due to high interest rates and macroeconomic uncertainty); modest rise in input costs; “firms on average chose to cut their employment levels”

China’s Caixin services PMI expanded at a slower pace (from 57.1 to 53.9) in May amidst steeper deflation, high youth unemployment, and sluggish foreign demand

The UK sold 4 billion GBP of gilts at the highest yield in 16 years on Wednesday, underscoring the elevated returns governments must offer to lure investors after more than a year of interest-rate hikes

Euro Area Retail Sales for May: 0.0% m/m (0.3% m/m forecast; 0.0% m/m previous); -2.9% y/y (-3.2% y/y forecast; -2.9% y/y previous)

France’s HCOB services PMI drops from 52.5 to 48.0, the strongest pace of decline since February 2021, as demand falters

U.S. Non-Farm Payrolls for June: 209K (250K forecast; 306K previous); unemployment rate dips to 3.6% vs. 3.7% forecast/previous; Average Hourly Earnings: 0.4% m/m (0.3% m/m forecast; 0.4% m/m previous)

Global Market Weekly Recap

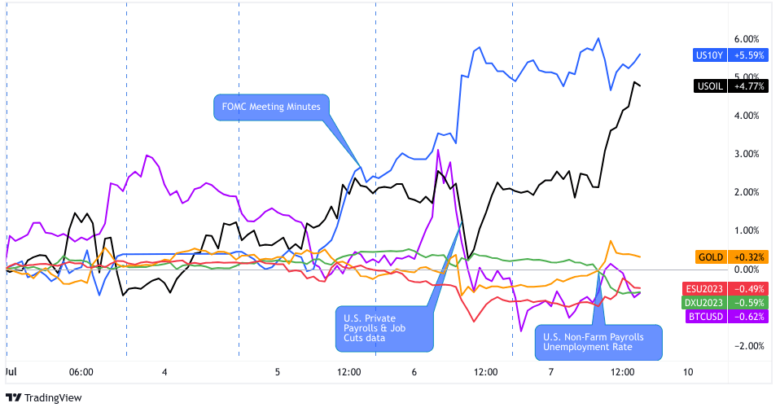

Dollar, Gold, S&P 500, Oil, U.S. 10-yr Yield, Bitcoin Overlay Chart by TV

Traders were happy to continue pricing in a weak U.S. core PCE index and dollar-buying on Monday when Saudi Arabia and Russia shook the markets ahead of their OPEC+ meeting.

Saudi Arabia announced that it would keep cutting its output by 1 million barrels a day for an additional month into August. Meanwhile, Russia decided to drop its oil exports by another 500,000 barrels a day in August. These are on top of the supply cuts that OPEC+ gang had already agreed on!

Crude oil prices spiked higher at the news, but it did make new intraday lows during the U.S. session.

The prospect of global oil demand weakening enough to warrant supply cuts did NOT sit well with markets that are already worried about high interest rates dragging economic growth.

Of course, it didn’t help that both China and the U.S. – the world’s two largest economies – printed weaker manufacturing PMI numbers that day.

Safe havens like gold, USD, and CHF traded higher while BTC/USD revisited the previous week’s highs.

All the fireworks were confined to the U.S. skies and Asian markets on Tuesday with only the RBA and Japanese officials making things interesting for the markets.

The RBA kept its interest rates at 4.10% and disappointed those who saw another rate hike. It’s not done with its hawkish plans though! While its members recognized that inflation has “passed its peak,” they also believe that “some further tightening” may still be required down the road.

The Australian dollar spiked lower at the “surprise” rate hike pause, but soon recovered its losses and made new intraweek highs against its major counterparts (except NZD).

In Japan, Finance Minister Shunichi Suzuki and top financial diplomat Masato Kanda did a bit of verbal intervention by flexing that they are in close contact with U.S. Treasury Secretary Yellen and other overseas officials “almost every day” over currencies and broader financial markets.

Threats of Japanese and global financial authorities being besties didn’t do JPY much favor, as it capped the day lower against the comdolls and GBP.

Intraweek trends got clearer when our U.S. trader friends returned on Wednesday. Unfortunately for market bulls, the mood was clearly bearish.

China helped set the tone with a much weaker than expected Caixin services PMI while Asian and European equities traders stayed on the sidelines ahead of the FOMC meeting minutes release.

All the cautiousness translated to risk aversion when the Fed’s minutes showed that 12 out of 18 members expect at least two more rate hikes this year. This shook traders who were already betting on at least one rate cut in 2023.

The repricing of Fed expectations led to U.S. Treasury yields starting an uptrend and the dollar gaining against major counterparts like bitcoin, gold, AUD, NZD, and CAD during the Wednesday U.S. session.

U.S. crude oil was an exception, hitting new highs above $72.00 as some traders who just started their trading week caught up to Saudi Arabia and Russia’s output cuts.

The release of jobs-related reports in the U.S. provided traders with more reasons to extend the dollar rally on Thursday and sell risk assets.

Closely watched data releases like the Challenger job cuts, ISM services PMI, and the ADP report came in better-than-expected and supported the Fed’s hawkish biases.

The U.S. 10-year yields hit highs near 4.08%, gold dropped, and commodity-related currencies lost even more pips. U.S. crude oil, which hit new weekly highs at $72.30, also dropped sharply before an inventory report attracted some bulls.

Markets calmed down heading into the Friday Asia session, the usual tendency as traders awaited the highly anticipated U.S. Non-Farm Payrolls report. And to no one’s surprise, volatility picked up quickly once again after its release, but it was a bit more muted than the reaction to Thursday’s data as traders arguably saw Friday’s as mixed data.

The net employment change number came in below both forecast and the May read at 209K, but the unemployment rate ticked lower to 3.6% and the average hourly earnings rate rose faster than expected. Overall, this signaled a really tight labor market but the Greenback sold off following the report and wasn’t able to recover at the Friday close.

As for the rest of the financial markets, it looks like it was mostly an anti-dollar kinda day as oil, gold, equities all trended higher for the next few hours, potentially signaling that traders are still seeing the Fed closer to the end of the rate hike cycle than the beginning after this event.