It was another busy week in the financial markets with a calendar full of central bank speak, inflation updates and more signs of cracks in global economic growth.

Overall, we saw a general risk-off vibe across most markets, and in FX, that meant another strong week for the U.S. dollar.

But the top performer was the British pound as the bulls continue to drive it higher thanks to a slew of headlines from the U.K.

Notable News & Economic Updates:

China Caixin services PMI fell to 49.3 in September from 55.0 in August.

Russia unleashed its most broad air assaults since the start of the Ukraine war on Monday, showering cruise missiles on cities during rush hour to avenge a blown-up bridge.

The IMF estimated that global GDP will drop to 2.7% next year, 0.2% lower than its July forecast, and that 2023 will feel like a recession for millions.

On Tuesday, G7 leaders began an emergency meeting to examine the latest round of missile attacks that Russian forces conducted against Ukraine.

Bank of England expanded its emergency purchase to include inflation-linked debt in an effort to stop a rapid sell-off in the 2.3 trillion pound market for British government bonds.

The Bank Of Korea has raised its key base interest rate 50 bps to 3.00% as expected

API reports surprise 7.05M build in oil stockpiles

EIA: U.S. crude supply up by 9.9 million barrels for the week ended Oct 7, the most since March 2021

The Central Bank of Chile hike its interest rate by 50 bps to 11.25% on Friday, but suggested that they may hold off on rate moves at their next meeting.

The Monetary Authority of Singapore tightened policy once again by re-centering its policy band

Intermarket Weekly Recap

Based on the price action above, we can see that inflation expectations and speculation of recession ahead continued to be the dominant themes this week.

This is evidenced by the net gains in bond yields and the U.S. dollar, while risk assets and even gold steadily lost ground throughout the week, consistent with market behavior through most of 2022.

Those themes were supported by another round of hot inflation updates from pretty much everywhere, most notably from the U.S. which reported a hotter-than-expected 8.2% y/y CPI read on Thursday, which was the likely the catalyst for the whipsaw moves in the broad markets on the chart above.

This of course was likely the reason we saw bond yields move higher as traders sold off bonds on the lowered the probability of central banks easing on tightening moves any time soon.

Speaking of bond sales, the U.K. was drawing all the attention this week due to an incredibly busy news cycle. That included a near collapse of the U.K. government bond market, forcing the Bank of England to step in with a short-term bond buying program, along with drama on the political front as British PM Liz Truss rolled back and promised to cut her predecessor’s tax increases.

With the u-turn on the proposed tax plan and the BOE’s intervention in the bond market, it’s no wonder that Sterling was able to recover quickly, and actually taking the top spot away from the Greenback this week (which likely benefited from the hot inflation reads and safe haven flows).

Aside from the U.K. drama, traders were also likely trying to keep up with a busy week on the central bank front, due to the IMF meetings that produced commentary from all of the major central bank heads and top level officials.

And along with the hawkish rhetoric to fight inflation, we got actual monetary policy tightening action from several central banks this week, mainly in Asia, including the Bank of Korea, and the monetary authorities of Hong Kong and Singapore.

USD Pairs

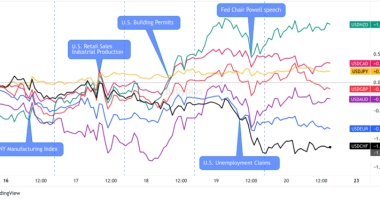

Overlay of USD Pairs: 1-Hour Forex Chart

According to Chicago Federal Reserve President Charles Evans, as supply chain pressures ease, there are some indications that inflation is slowing down.

According to Fed Vice Chair Lael Brainard on Monday, the U.S. Federal Reserve is clear that restrictive monetary policy is necessary to reduce inflation, but the direction and rate of rate increases will remain “data-dependent.”

The National Federation of Independent Business (NFIB) reported that its Small Business Optimism Index improved to 92.1 this month, marking the second consecutive month of gains.

Fed’s Mester says there’s been no progress on inflation, so interest rates need to move higher

U.S. Producer Price Index for September: +0.4% m/m vs. -0.1% m/m previous; core PPI was +0.4% m/m vs. +0.2% m/m previous

Neel Kashkari, president of the Minneapolis Fed, said that given the continued strength of underlying inflation, the hurdle for the Federal Reserve to veer away from tightening monetary policy is “quite high.”

U.S. mortgage interest rates rise to an average of 6.81%, the highest level since 2006; mortgage loan appliction volume fell -2.0% w/w and down -69% y/y

U.S. monthly headline CPI up by 0.4% in Sept vs. 0.2 expected, core CPI also higher at 0.6% vs. 0.5% estimates; Annualized U.S. inflation slows to 8.2% –the lowest in seven months – but still higher than 8.1% estimates

The Federal Reserve Open Market Committee (FOMC) meeting minutes from the most recent meeting showed that the FOMC members are surprised that inflation has been persistent and pulling back at a slower-than-expected pace.

The University of Michigan consumer sentiment index: 59.8 in October from 58.6 in September and 59.0 forecast.; Inflation expectations rose to 5.1% from 4.7% previous

Federal Reserve Bank of San Francisco President Mary Daly stated on Friday that rates between 4.5% and 5.0% is the most likely outcome.

GBP Pairs

Overlay of GBP Pairs: 1-Hour Forex Chart

In response to the recent market volatility, the Bank of England announced on Monday that it would temporarily enlarge its collateral repo facility to assist banks in reducing the liquidity constraints on their client funds.

The Bank of England announced an expansion of its emergency bond-buying operation on Tuesday. widening its buying of index-linked gilts from Oct. 11-14.

U.K. claimant counts increased in September at 25.5k vs. 4.2k forecast and 6.3k in August; the jobless rate ticked down from 3.6% to 3.5%; average earnings index popped higher from 5.5% to 6.0% vs. 5.9% forecast

U.K. GDP in August: -0.3% m/m vs. +0.2% m/m previous; manufacturing production fell -1.6% m/m

UK trade deficit widened to 7.1B GBP in August from a downwardly revised 5.4B GBP in July

In August, the total imports of goods, excluding precious metals, increased by £3.1 billion (5.7%); the total exports of goods, excluding precious metals, increased by £0.4 billion (1.2%)

On Friday, British PM Truss abandoned her campaign promise to roll back her predecessor Boris Johnson’s increase in company tax from 19% to 25%. This move was expected to net the U.K. Treasury some £18 billion ($20.1 billion) by 2026.

EUR Pairs

Overlay of EUR Pairs: 1-Hour Forex Chart

Eurozone Sentix investor confidence worsens from -31.8 to -38.8 in Oct

The European Central Bank’s chief economist, Philip Lane, suggested on Tuesday that hiking interest rates may have a greater impact on the markets than reducing its enormous inventory of bonds.

Eurozone industrial production increased by 1.5% m/m in August vs. -2.3% m/m drop in July

German final CPI unchanged at 1.9% m/m or 10% on year-over-year basis

August saw the euro zone’s goods trade deficit with the rest of the world rise to about 51 billion euros ($49.7 billion), the largest deficit the group has experienced since Lithuania joined in January 2015 as its 19th member.

Germany Wholesale prices jumped in September by 19.9% y/y and 1.6% m/m (vs. 0.1% m/m previous)

ECB President Lagarde warns we are seeing early signs of credit risk and risk of financial stability to the euro area at the IMF meeting

ECB officials Vasle and Kazimir stated on Friday that a 75 bps hike in October may be appropriate

CHF Pairs

Overlay of CHF Pairs: 1-Hour Forex Chart

In order to fight rising inflation, central banks must defy political pressure to slow the tightening of monetary policy, according to Thomas Jordan, chairman of the Swiss National Bank.

Swiss Producer and Import Price Index rose by 0.2% m/m in September and +5.4% y/y; The rise was mostly a result of higher prices for steel, raw milk and dairy products, as well as vegetables and potatoes. Products made of aluminum and petroleum, on the other hand, became less expensive.

CAD Pairs

Overlay of CAD Pairs: 1-Hour Forex Chart

Canada manufacturing sales for August fell -2.0% m/m to $70.4B vs. -0.6% m/m previous

Canada Wholesale sales for August: +1.4% m/m to $81.3B vs. -0.6% m/m previous

Tiff Macklem, governor of the Bank of Canada, highlighted that despite growing concerns about a potential recession next year, he has not changed his position on interest rate hikes. In an interview with reporters, Macklem reiterated the central bank’s present goal of restoring price stability and reducing inflation down to its two percent target and said that now is not the time to be flexible on interest rates.”

NZD Pairs

Overlay of NZD Pairs: 1-Hour Forex Chart

BusinessNZ: New Zealand’s manufacturing sector loses steam, drops from 54.8 to 52.0 in September

New Zealand Food Price Index for September: +0.4% m/m vs. 1.1% m/m

Grant Robertson, the finance minister of New Zealand, stated on Friday that governments must reduce spending in order to assist their central banks in battling inflation.

AUD Pairs

Overlay of AUD Pairs: 1-Hour Forex Chart

Australia AiG September services index 48.0 vs 53.3 in Aug.

Australia’s Westpac consumer sentiment retreated by 0.9% after earlier 3.9% gain

Australian NAB business confidence index slipped from 10 to 5 in Sept.

Australia Household Spending Index fell 0.5% m/m in September, Commonwealth Bank of Australia announced Tuesday.

The Household Spending Intentions Index fell 0.5% in September from a month earlier, Commonwealth Bank of Australia announced Tuesday.

Australia’s MI inflation expectations unchanged at 5.4%

JPY Pairs

Japanese current account deficit narrowed from 0.63T JPY to 0.53T JPY

Japan’s Economy Watchers Sentiment index improved from 45.5 to 48.4

Japanese PM Kishida: BOJ needs to maintain policy until wages rise

Japanese FM Suzuki: Ready to take steps against excess FX volatility

Japan’s core machinery orders post -5.8% m/m decline, the biggest fall in 6 months. Core orders came in at +9.7% y/y vs. an expectation of +12.6% y/y

Japan Reuters Tankan index hits 5-month low of 5 in Oct

Japanese producer prices jumped from 9.4% to 9.7% y/y in Sept.

Japanese Finance Minister Suzuki: Excess FX volatility can hurt economy

Japanese cabinet secretary Masuno says they’re closely watching yen movements

As the dollar increased to a new 24-year high versus the yen on Wednesday and barriers to direct intervention remained strong, Japan’s policymakers continued to caution investors against selling the yen.