Traders were leaning risk-on in a relatively quiet week, prompting risk currencies to outperform against the safe havens.

The Kiwi took the top spot with the help of easing covid restrictions in New Zealand, while the Swiss franc was all red, likely on global risk sentiment and negative economic updates from Switzerland.

Notable News & Economic Updates:

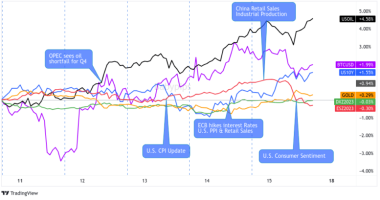

Intermarket Weekly Recap

We saw a steady stream of economic updates this week, but there were no major catalysts to spark an oversized move of note, not even from the monthly U.S. employment update. Overall, global economic data was mixed, but arguably, we’re seeing signs of a potential peak in the global economic recovery. Business sentiment data seems to be pulling back from record positive levels, and lagging data like GDP and employment updates were disappointing as well.

Oddly enough, this didn’t seem to deter risk-on sentiment as we saw risk assets outperform the safe havens for most of the week. This is likely a continuation of speculation that we won’t be seeing central banks taper supportive monetary policy as worries of an approaching global economic slowdown grows. Weak USD sentiment may have also been a factor as well, sparked by Fed Chair Powell’s tapering comments from his Jackson Hole speech last Friday.

Oil price action was relatively muted despite traders having to navigate oil production developments from the Gulf of Mexico after Hurricane Ida, as well as commentary from OPEC on future supply and demand outlooks.

Crypto, as usual, was the one areas of tradable volatility, albeit at lower levels. The bulls were likely happy campers this week as we saw broad gains, mainly lead by Ether (up +21% this week) and the altcoins space. The rapid growth of the NFT and Defi markets were likely drivers, along with the broad risk-on vibes and U.S. dollar weakness environment.

In the forex space, the safe haven currencies were, as expected in risk-on environments, the biggest losers of the week with the Swiss franc taking very last place. We had a rare week where Switzerland posted multiple economic updates, which were all disappointing versus both previous reads and expectations.

The Kiwi took the top spot at the Friday close, despite much weaker-than-expected business confidence and housing data from New Zealand. It’s likely that Kiwi bulls not only rode the broad risk-on sentiment higher, but also longed on news that COVID-19 lockdowns eased in most regions this week.

USD Pairs

GBP Pairs

EUR Pairs

CHF Pairs

CAD Pairs

NZD Pairs

AUD Pairs

JPY Pairs