Following the bank’s disclosure that its financial reporting procedures for 2022 and 2021 contained “significant deficiencies,” shares of Credit Suisse dropped sharply early on Tuesday, setting a new record low for the troubled bank.

This also seems to have been the catalyst for fresh risk aversion behavior in the financial markets, especially after Credit Suisse’s largest investor, Saudi National Bank, said it won’t provide further financial help for the bank.

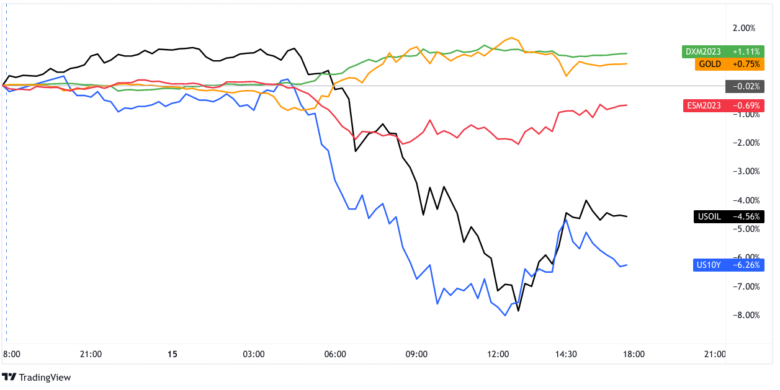

Traders seem to have rushed to safe haven assets like the Greenback and gold on the session, an understandable market reaction given the heightened fears that a global banking system crisis is brewing, sparked over the last week by the sudden closure of large regional banks in the U.S. (Silicon Valley Bank and Signature Bank).

And given how banking system stress can affect the entire economy, it’s not surprising that equities and oil prices have taken a big dip on the rising possibility of recession. Bond yields collapsed as well as this likely puts pressure on central banks to reconsider their recent hawkish monetary policy / interest rate outlooks. The 10-year U.S. Treasury yield fell from a session high of 3.70% to 3.388% at its lows.

The drop in risk sentiment seems to have found a session bottom, correlating with an announcement from the Swiss National Bank that Credit Suisse Group AG meets liquidity and capital requirements, and that the SNB will provide liquidity if necessary.

This post first appeared on babypips.com