Risk-off assets took the lead this week as the top market focus continued to be on the recent run of negative pandemic developments and its potentially negative global economic impact.

For the major currencies, this driving theme was mostly beneficial to the Japanese yen, which managed to hold on to the top spot among the major currencies despite a risk-on rally on Friday.

Notable News & Economic Updates:

Intermarket Weekly Recap

There was very little in the way of major economic or geopolitical catalysts to spark any notable moves in the financial markets this week. And based on the price action across the different major asset classes, it looks like the main driving theme continued to be developments with the Delta variant of the COVID-19 virus.

This week’s COVID-19 updates pointed to an accelerated rate of new cases, especially in Asia. This prompted Japan to declare a state of emergency and ban spectators from the upcoming Olympic event, and we heard from the World Health Organization, which urged extreme caution against completely lifting public health measures.

This was likely the driver behind the outperformance in gold and the Japanese yen as traders de-risked on expectations that we may have passed peak recovery momentum and the potential for a slow down ahead. Treasury bonds also benefited from this theme, pushing yields lower through the Thursday session where we saw 10-yr yields hit an intra-week low of 1.251%.

Risk-on bulls were able to rebound on Friday, but there doesn’t appear to be a direct catalyst for the u-turn in market sentiment. Arguably, this was likely a technical rebound of a short-term oversold market and/or a profit taking move by traders ahead of the weekend.

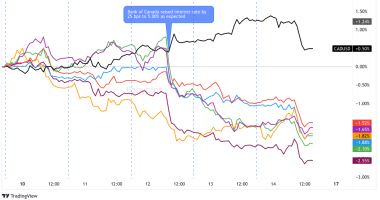

In the FX space, again the Japanese yen was the best performer followed by the Swiss franc and U.S. dollar, a typical outcome when risk-off sentiment is the dominant market driver.

The comdolls were the biggest net losers among the majors with the Canadian dollar falling the most, likely with the help of falling oil prices earlier in the week (likely on the breakdown of output talks between OPEC and its partners) before its Friday bounce on falling U.S. oil inventories.

USD Pairs

GBP Pairs

EUR Pairs

CHF Pairs

CAD Pairs

NZD Pairs

AUD Pairs

JPY Pairs