A COUPLE has revealed how a handy Martin Lewis tip helped them get £17,000 they were owed.

During the latest episode of the Martin Lewis Money Show, a viewer got in touch to explain how his wife was returned the cash following an error that affects 100,000s.

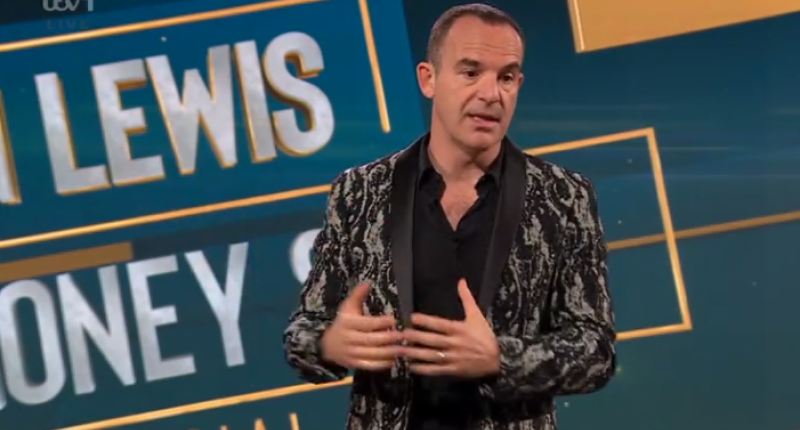

The consumer champion returned to our screens on Tuesday night for his hit ITV show.

He kicked off the programme with successes viewers had written in with after watching his shows.

Trevor sent an email regarding the recent episode about a historic state pension error which saw hundreds of thousands of Brits, mainly women, underpaid.

He wrote in and said: “Following your show about Home Responsibilities, my wife claimed from 2007.

READ MORE IN MONEY

“Took some time but letter just received informing her that she will receive just under £17,000 plus an increased monthly payment.”

Trevor then thanked Martin and the team for raising awareness of the issue.

Speaking live Martin reminded other women aged over 66 in particular to take a look at if they too can claim.

What is Home Responsibilities Protection (HRP)?

FROM 1978 to 2010, protection was provided for parents to avoid gaps in their “qualifying years

This system was then replaced in 2010 by the one we have now, called National Insurance Credits.

Most people got HRP automatically if they were getting child benefit in their name for a child under the age of 16 and they had given the child benefit office their National Insurance (NI) number.

If someone claimed child benefit before May 2000 and did not provide their NI number on the form, it’s possible that their credits may not have been transferred to their NI account from the child benefit computer.

This may affect their pension entitlement and women who are now in their 60s and 70s are most likely to be affected.

If you think you may be entitled, but you have questions, the Pension Service can be reached using the gov.uk website or by calling 0800 731 0469.

The pension error, which was first revealed in 2022, has seen 210,000 people miss out on retirement money they’re entitled to.

Most read in Money

It’s understood that 150,000 of those affected by the historic error are still alive and around 60,000 are now deceased.

The DWP estimates that a total of £1.3billion is owed to those affected – that equates to an average amount of £5,000 owed to each individual.

When the mistake was uncovered the DWP described it as the “second largest” source of errors in state pensions.

Those affected are people who claimed child benefit, largely women who were stay-at-home mums, before May 2000 as they could have gaps in their National Insurance (NI) record which in turn affects the amount of state pension they get.

The amount of state pension someone gets is based on their NI contributions and the number of “qualifying years” they have.

From 1978 to 2010, protection was provided for parents to avoid these gaps by a system known as Home Responsibilities Protection (HRP) credits.

This system was then replaced in 2010 by the one we have now, called National Insurance Credits.

If someone claimed child benefit before May 2000 and did not provide their NI number on the form, it’s possible that their credits may not have been transferred to their NI account from the child benefit computer.

This may affect their pension entitlement and women who are now in their 60s and 70s are most likely to be affected.

The DWP has already started sending letters to thousands of people who might have been entitled to HRP between 1978 and 2010 but have no HRP on their NI record.

It expects to send several hundred thousand letters to those affected over the next 18 months.

Where errors are found, NI records will be corrected and the DWP will then recalculate state pensions and pay arrears.

This could result in increased pension payments as well as a lump sum payment.

Last year, The Sun spoke to Susan Burton, 66, who almost missed out on £50,000 for her retirement because of this error.

Another lady, 74, has received a £17,000 windfall after falling victim to the error.

It means that finding out if you have been missing out, could mean a big pay day.

What do I need to do now?

The DWP says it has begun the process by writing to those already over pension age, but so far has not given any update yet on how many letters they’ve sent or what response they have received.

For the tens of thousands of those affected who have died, it will be a matter of tracking down the families of the deceased.

Sir Steve Webb, a former pensions minister who is now a partner at consultants LCP, told The Sun: “The scale of this problem is such that it is going to take 18 months to try to track down all those who may have missed out.

“But HMRC’s records give them only very limited information about who to contact, so anyone who thinks they were eligible for Home Responsibilities Protection which may be missing from their state pension should check if they were entitled and put in an application.”

Anyone who has received child benefit since 1978 should check their NI record.

If the payment is missing, there is a form that can be filled in to get the information added to your record.

It is called a CF411 form and it can be found on the government’s website.

You can also contact the HMRC National Insurance helpline for an application form.

Your state pension will then be automatically recalculated and the arrears will be paid.

You can still apply for HRP if, for the full tax years (April to April) between 1978 and 2010, if you were either:

- Sharing the care of a child under 16 with a partner you lived with and they claimed Child Benefit instead of you

- Caring for a sick or disabled person

Any HRP you had before April 6, 2010, have converted to National Insurance credits.

You must have reached state pension age on or after April 6 for these credits to go towards your pension.

READ MORE SUN STORIES

Elsewhere, a Martin Lewis fan has revealed how the expert’s handy tip helped him track down £2,300 in free cash.

Plus, another has revealed how a little-known trick helped them to boost their state pension by £7,000.

Do you have a money problem that needs sorting? Get in touch by emailing [email protected].

Plus, you can join our Sun Money Chats and Tips Facebook group to share your tips and stories.