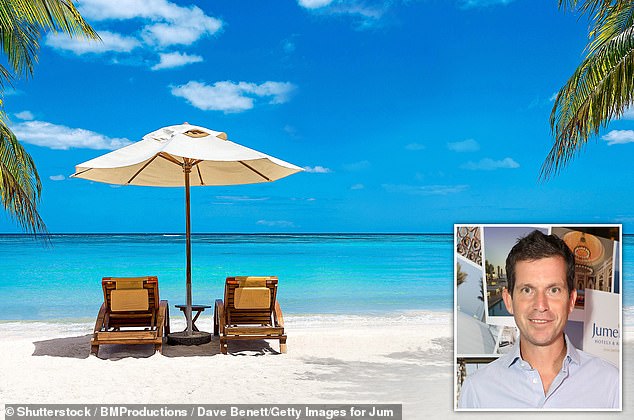

The Hideaways Club offers its clients the dream of a jet-setting lifestyle with access to exclusive Swiss ski chalets and luxury Greek villas.

The company’s original backers included tennis stars Tim Henman and Tomas Berdych, Formula 1 driver Nick Heidfeld and billionaire Mike Balfour, founder of the Fitness First gym chain.

But the Gibraltar-based group is facing a lawsuit from incensed investors who claim they have been trapped into paying tens of thousands of pounds in annual fees despite some being unable to stay in a Hideaways property of their choice for years.

One investor told The Mail on Sunday: ‘This is the Hotel California. You can check out any time you like, but you can never leave.’

The club says in response there is a service which enables some members to leave – but shareholders respond that they would have to accept a hefty discount. The company is taking legal action through the Gibraltar courts against some members over fees.

Ambassador: The company’s original backers included tennis star Tim Henman (pictured)

But a group of about 70 self-described ‘rebels’ are filing a class action lawsuit in Gibraltar against the club, the first time such a motion has been attempted in the territory. They are being represented by two law firms there, Peter Caruana & Co and CruzLaw LLP. Investors have also approached the UK’s financial watchdog, the Financial Conduct Authority (FCA), and asked it to investigate, claiming they have been ‘fobbed off’ by the Gibraltar Financial Services Commission.

The Hideaways Club, founded in 2007, markets itself as an alternative to second homes and timeshares and claims it is open only to ‘high net worth individuals and sophisticated investors’.

Investors pay an annual membership fee and purchase a share of a property portfolio comprised of villas, chalets and high-end apartments. Members are told they can take holidays in the various homes and informed that they will benefit if the value of the properties increases.

The situation began to sour in 2013 when complaints emerged of the properties being poorly maintained – though the club says it now has high satisfaction rates. Club members claim they also began to struggle to book holiday slots of their choice – sometimes even a year in advance.

One investor said things noticeably worsened in 2020 after a group of 20 shareholders bought out the original owners of the management company. The new owners include John Ott, a former partner at US consulting giant Bain & Company, and Anders Granstrom, head of Swedish investment company Kraften Invest.

Henman, pictured, is still listed on the Hideaways website as an owner and ambassador.

Balfour, one of the original co-founders, is thought to have sold out of the business. The management company holds a ‘golden share’ in the property portfolio, giving it control over any decisions. The rebels allege they are selling properties. But the company says it has also made purchases.

The annual membership fees have also increased, which the company said was in line with inflation. Some investors who have stopped paying their membership fees are being pursued by the company in the Gibraltar courts.

Investors claim they are trapped by a ‘two-in-one-out’ policy which stipulates that two new members must join for each one that leaves. The company says members agreed to this upon signing up.

The investor said that if no new members sign up, none of them can leave. They claimed: ‘Some people have been trying to leave for over ten years but can’t.’

A spokesman for the company said: ‘A small group of high-net worth experienced investor fundholders who claim they want to depart the club are disputing the commercial contracts they signed with the club and the funds.

‘Their misguided attempts to avoid personal debts are the subject of active litigation in Gibraltar, the results of which may be announced soon by the court.

‘It is our understanding that publishing an article in an attempt to influence the outcome of an active legal case is potentially prejudicial and fraught with legal liabilities.’