On Wednesday (June 15) at 6:00 pm GMT the Fed will publish its monetary policy decisions for the month of June.

What exactly are markets expecting and how can you trade the event?

Here are points you need to know:

What happened last time?

- FOMC raises rates by 50 bps from 0.50% to 1.00% as expected

- Fed to begin reducing its balance sheet on June 1

- Powell: Fed not actively considering a 75bps rate hike

- Powell: It will not be easy to achieve a “soft landing”

After months of speculations, the Federal Open Market Committee (FOMC) raised the target range of its federal funds rate by 50 basis points to a max of 1.00%.

The Fed also announced that it would begin trimming its Treasury securities and agency debt and

agency mortgage-backed securities holdings starting June 1.

In his presser, Chairman Powell hinted that his team would raise interest rates by another 50 basis points in the next two meetings but that they didn’t think a 75 bps increase was on the table.

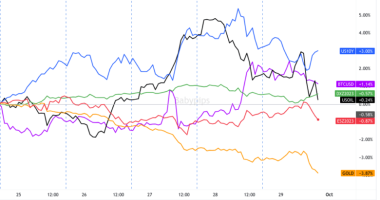

The hawkish plans initially sent the dollar higher, but traders eventually focused on a bit of profit-taking and pricing in the rejection of the 75 bps hike.

USD traded tightly for most of the day, spiked higher during the statement release, and eventually traded at new intraday lows at the end of the day.

What are traders expecting this time?

- Another 50 basis point rate hike to 1.50%

- New growth and inflation projections since March

- FOMC presser may give clues to plans beyond July rate hike

We already know that the Fed will raise its rates by another 50 bps this month. We also know that the team will follow it up with a third 50-bps rate hike in July.

But what happens after July?

Many believed that members would pause to reassess the impact of their sharp increases until September when they might resume raising rates.

Thanks to Fridays’ hotter-than-expected inflation, though, some are now pricing in continuous rate hikes through September.

We might get more clues when we see the Fed’s revised growth and inflation projections.

We know that at least some Fed members want interest rates “above neutral” to help bring down inflation, and March’s forecasts saw rates peaking to 3.00% in 2023.

If June’s inflation figures come in waaay higher than March’s estimates, then we can guesstimate how far June’s 1.50% interest rate is to a “neutral” interest rate.