The U.S. dollar and surging bond yields stole the show this week, staying in positive territory throughout, supported by hawkish central bank rhetoric. Unfortunately this was the worst environment for gold bulls.

Not caught up on the major headlines? Check’em out before moving on to the full review!

Notable News & Economic Updates:

🟢 Broad Market Risk-on Arguments

U.S. weekly initial jobless claims: 204K (205K forecast; 202K previous)

ANZ: New Zealand’s business confidence index turned positive, up from -3.7 to 1.5 in September; Jury remains out on whether prices are falling “fast enough to bring core inflation pressures down in a timely fashion”

The BOJ announced an unscheduled bond-purchase operation. The central bank bought 300B JPY ($2B) worth of 5 to 10-year bonds in a bid to slow rising bond yields

China’s industrial profits fell by 11.7% ytd/y in August, a bit better than the 15.5% ytd/y decline in July, as government support measures helped stabilise parts of the economy

Tokyo’s core CPI rose 2.5% y/y in September (vs. 2.6% expected, 2.8% previous) amidst some cooling in consumer spending

Euro Area Flash CPI for September: 4.3% y/y (4.7% y/y forecast; 5.2% y/y previous)

U.S. Core PCE Price Index for August: 0.1% m/m (0.2% m/m forecast / previous); 3.9% y/y (3.8% y/y forecast; 4.3% y/y)

🔴 Broad Market Risk-off Arguments

On Monday, China Evergrande Group postponed a scheduled debt restructuring meeting and also revealed its inability to issue new notes under its current debt restructuring plan

European Central Bank President Lagarde restated on Monday that the level of interest rates will stay restrictive for as long as needed to slowdown high inflation

FOMC member Neel Kashkari shared that there’s a 40% chance the Fed would “push the federal funds rate higher, potentially meaningfully higher”

Germany’s GfK consumer sentiment deteriorated from -25.6 to 26.5 in September; “Private consumption will not be able to positively contribute to overall economic development this year.”

China Evergrande Group Chairman Hui Ka Yan placed under police surveillance on Wednesday, raising concerns of the developer’s future as liquidation fears grow; On Thursday, Evergrande Group filed for bankruptcy in New York.

The Biden Administration presented a new plan to sell offshore drilling rights in the Gulf of Mexico at the slowest rate in history

On Friday, New York Fed President John Williams said that interest rates may be at or near peak, and unlikely to come down as inflation may not get back to 2.00% target until 2025

Global Market Weekly Recap

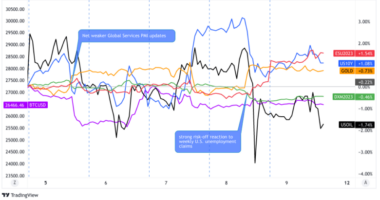

Dollar, Gold, S&P 500, Oil, U.S. 10-yr Yield, Bitcoin Overlay Chart by TradingView

The U.S. dollar and rising bond yields appears to have been the main theme this week, as seen in the chart above as both never really saw a negative print all week long. It’s like they’re playing a game of “Who Can Stay Up the Longest.”

This was a signal that the broad markets continued focus on the “higher for longer” interest rate narrative that was set by last week’s central bank events, and supported this week with more commentary from central bank officials.

Arguably, the most notable commentators were FOMC member Neel Kashkari arguing a 40% chance of the Fed pushing interest rates higher, and European Central Bank President Christine Largarde who signaled on Monday that interest rates will stay high for how ever long it is need to push inflation rates down.

A bit of risk-off vibes may have supported the Greenback this week, likely coming from the Evergrande debt saga in China as the major property developer prompted negative headlines, including news that its founder was reportedly placed under police surveillance and that it filed for bankruptcy in New York on Thursday.

With the Dollar and U.S. bond yields shooting for the stars early on, it’s no surprise that other assets were taking a hit, most notably equities, oil and bitcoin. But oil was able to recovering quickly starting on Tuesday, with arguments there being increased speculation that the upcoming Golden Week holiday in China may increase demand, as well as another anticipated drop in oil inventory data from the U.S.

On Wednesday, we did get the official government report showing another -2.17M barrel drop in crude oil inventory, supporting Tuesday’s speculation and prompting oil to rally further into Thursday, with WTI breaking above the $95/barrel handle before running out of steam.

Gold had a rough one this week. It completely broke down as rising bond yields continue to draw capital from the precious metal. Every shallow bounce was met quickly with sellers, taking the market down over -3% on the week to around $1,855 at the time of this writing.

Thursday saw a slight shift from the strong U.S. dollar and bond yield narrative, arguably without a major catalyst. This behavioral shift seems to correlate with the U.S. data releases, most notably another better-than-expected U.S. weekly jobless claims read. It’s also possible that the sticky inflation updates from the Eurozone play a factor in U.S. dollar weakness as the euro was able to draw in buyers on the session.

Broad risk sentiment may have shifted to a little less averse as well on Thursday, potentially on slightly better-than-expected industrial profits data from China signaling stabilization, a welcomed sight given China’s recent moves to support the economy.

Oil made an interesting move lower on the session without an apparent direct catalyst, potentially a signal of profit taking after an unreal August – September rally of over 15%.

Again, weird moves all around with no significant catalysts, which brings up the argument of month and quarter end profit taking / repositioning may be in play as the weekend approached.

On Friday, the U.S. dollar and bond yields continued to trend lower from intraweek highs, while gold and equities continued their bounce through the London session. During the U.S. session, we got the highly anticipated U.S. Core PCE Price Index data. It gave the markets a mixed result with the monthly change coming in below expectations, but the year-over-year read coming above expectations.

The U.S. dollar moved higher after the event to solidify its dominant performance and signal that the focus will remain on sticky annualized rates. It also prompted one last push lower across the major assets, most notably in gold, the biggest loser this week.