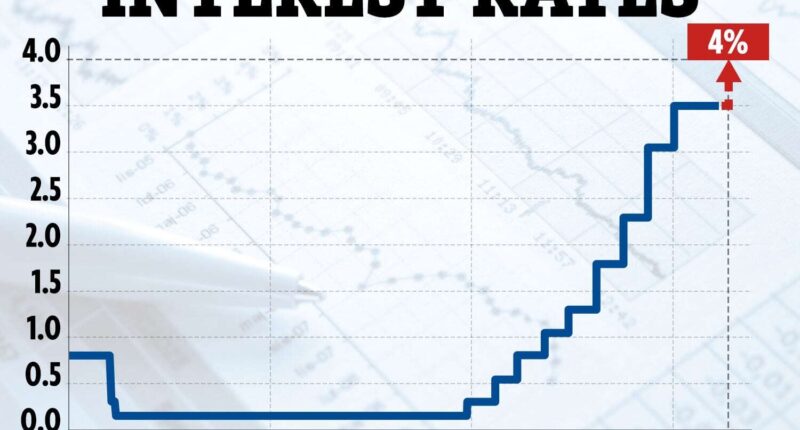

THE Bank of England has raised its base rate in a blow for millions of households.

The rate was hiked from 3.5% to 4% today in a bid to tackle high inflation.

It is the 10th time in a row that the BoE has raised its base rate.

The last time was in December, when it went up from 3% to 3.5%. This followed the single biggest hike from 2.25% to 3% in November.

It is the highest the base rate has been since October 2008, when it dropped from 5% to 4.5%.

When the BoE increases its base rate, banks usually increase how much they charge on loans and mortgage repayments.

But any hikes are usually good news for people with savings stashed away.

One of the BoE’s main jobs is to keep inflation at 2%. Hiking its base rate is one way of doing this.

Hiking interest rates is meant to encourage households to save rather than spend, which forces inflation down.

Inflation in December fell to 10.5% from 10.7% in November. It peaked at a 40-year-high of 11.1% in October.

Most read in Money

In December, the BoE said it expects inflation to continue to fall gradually over the first few months of 2023.

In a letter to Chancellor Jeremy Hunt, BoE governor Andrew Bailey said the Bank thinks inflation peaked last year.

But, it also suggested it would remain high until the end of 2023.

Inflation is a measure of the price of everyday goods, so if it’s high it means everything from fuel to food is costing more.

It comes after the International Monetary Fund (IMF) predicted the UK will be the only major economy in the G7 to shrink this year.

In a blow to millions of households, it forecasted the UK economy will contract by 0.6% in 2023.

We explain what today’s BoE hike means for you.

Mortgage rates rising

Your mortgage rates could go up following today’s hike – but how much it will rise depends on the type of loan you have.

Those on a fixed-rate mortgage won’t be impacted until they come to the end of their fixed period and have to sign another deal.

Other mortgages, such as tracker or standard variable rate (SVR) mortgages, could be impacted straight away.

Tracker mortgages are directly linked to the BoE base rate – which means you will see an immediate impact.

Homeowners on standard variable rate mortgages won’t see their repayments go up straight away, but they will likely increase shortly after today’s hike.

Your bank should tell you about any change to your SVR before it goes up.

The exact amount yours will go up depends on how much you’re borrowing and your loan-to-value.

Loan-to-value is the ratio of what you have borrowed for your mortgage against how much you paid as a deposit.

According to TotallyMoney, the 0.5% hike today will add £52 a month to mortgage bills for those not on a fixed deal.

That’s based on the average UK property costing £270,708 with a 75% loan-to-value and a mortgage with a 25-year term.

In December, the Bank of England warned millions of households could face £3,000 a year hike on their mortgage repayments by the end of 2023 with a 3.5% interest rate rise.

With the base rate climbing to 4% today, this figure may rise higher.

It comes as new analysis by The Labour Party suggests homeowners coming off fixed-rate deals could face mortgage hikes of up to £14,000 a year.

Alastair Douglas, chief executive officer of TotallyMoney, said 750,000 homeowners are at risk of defaulting on their mortgage in the next two years due to increased monthly repayments too.

For those in this situation, he said to contact their lender as soon as possible to reach an agreement.

“The Financial Conduct Authority recently instructed firms to support borrowers with measures which included allowing customers to make lower repayments, switch to interest-only, or moving to a different rate,” he said.

Credit card and loan rates could rise

The cost of borrowing through loans, credit cards and overdrafts could go up too, as banks are likely to pass on the increased rate.

After consecutive rate rises by the BoE, interest rates on credit cards and personal loans already hit a record high in December, according to Moneyfacts.

Many big banks – like Lloyds, MBNA, Halifax and Barclaycard – link their credit card rates directly to the Bank of England base rate.

That means their credit card rates will hike automatically in line with any changes to interest rates – but you’ll be given notice before this happens.

You can check the terms and conditions of your credit card to see if the rate can go up when the base rate does.

Certain loans you already have like a personal loan or car financing will usually stay the same, as you’ve already agreed on the rate.

But rates for any future loan could be higher, and lenders could increase the rate on credit cards and overdrafts – although they must let you know beforehand.

You can cancel a credit card if you want and will have 60 days to pay off any outstanding balance.

Savers might get better rates

The hike is likely to be good news for savers as banks battle it out to offer market-leading interest rates.

A rate rise is generally good news for savers, especially after a long stretch of getting very low rates on their money.

But, bear in mind high inflation can erode away the value of any savings you have.

So if you have £100 in the bank this year and inflation is 10.5%, the real spending power of that money is reduced to £89.50.

The base rate rise could see banks pass on higher rates to savers – though they are usually much slower to act than with passing on higher rates for borrowing.

This means savings rates are more likely to edge up slowly rather than change immediately.

Anyone currently getting a low rate on easy-access savings might want to look around for a better rate.

Do you have a money problem that needs sorting? Get in touch by emailing [email protected]