MARTIN Lewis has issued an urgent warning to households who have just weeks left to claim up to £1,000 in free cash.

In the latest MoneySavingExpert newsletter and most recent episode of his ITV Money Show, the consumer champion said people can claim back a number of tax allowances by up to four tax years.

This includes the Marriage Tax Allowance, PPI and the Uniform Tax Rebate.

But the current financial year ends on April 5 meaning you have to claim on or before this date if you want to claw back any tax for the 2019/20 tax year.

He said: “With a number of tax allowances you can claim back four tax years before the current one.

“So that means when the new tax year starts on 6 April we say bye-bye to the 2019/20 tax year.”

Read more in Martin Lewis

Here’s how to claim the four tax rebates now and ensure you get up to £1,000 in free cash.

Marriage Tax Allowance

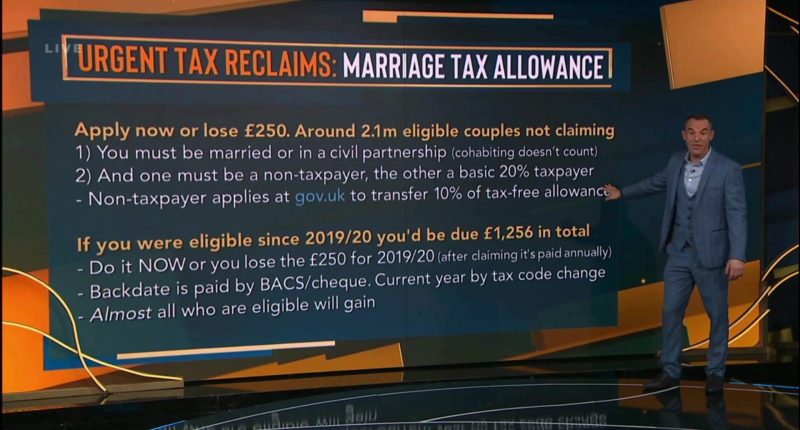

More than 2million couples are eligible for the Marriage Tax Allowance but don’t claim it.

Couples who are married or in a civil partnership where one person earns less than the personal allowance threshold of £12,570 qualify.

You can transfer £1,260 of the personal allowance to your partner, reducing their tax bill by up to £252.

Most read in Money

Bear in mind, the maximum amount you can get for the 2019/20 tax year is £250.

In addition to 2019/20, you can also get it for 2020/21, 2021/22, 2022/23 and 2023/24 tax years.

The tax break was worth £250, £252, £252 and £252 during those years respectively, meaning you could get up to £1,256.

You can apply for Marriage Allowance for free online on the Gov.uk website.

PPI

The deadline to claim back missold PPI, which stands for payment protection insurance, was August 29, 2019.

That means you can’t get a tax refund if you haven’t already received a payout.

But if you have received a payment in the last four years, you could be eligible for money back on overpaid tax.

You can claim any tax back by filling out a R40 form from the Gov.uk website.

There’s an online service you can use, or you can fill in an on-form screen, print it off and post it to HMRC.

Check your tax code

Your tax code is a series of letters and numbers which relate to how much income tax is taken from your pay or pension.

But you should check if you’re on the right one as if not you could end up paying more tax than you should.

HMRC should update your tax code when your income changes, say for example if you get a pay rise.

But sometimes HMRC might not have the correct information and you’ll need to get in touch with them to correct it.

You can find your tax code in several different ways, including:

- on a “Tax Code Notice” letter from HMRC if you get one

- on your payslip (this might be online or in paper form)

- on the HMRC app

- by checking your tax code for the current year online on your personal tax account

You can find your personal tax account via the Gov.uk website, where you can also update your employment details and tell HMRC about any change in income that might have affected your tax code.

Uniform Tax Rebate

If you wash or repair your own work uniform you qualify for an allowance to cover the cost, even if it’s just a branded T-shirt.

The minimum allowance is £60 a year, which is worth £12 a year for those on the basic rate of tax, or £24 on the higher rate.

It’s another tax rebate you can claim for the previous four years, meaning you’ve got to claim it by April 5 for 2019/20 if you were eligible at the time.

You might be able to get more depending on the industry you work in too.

Pilots and flight deck crew can claim up to £1,022 a year, joiners up to £140 and ambulance staff up to £185 a year.

READ MORE SUN STORIES

Meanwhile, firefighters and fire officers’ minimum allowance is £80 and dental nurses allowance is £125.

You can claim a Uniform Tax Rebate via post by filling in a P87 form found on the Gov.uk website.

Do you have a money problem that needs sorting? Get in touch by emailing [email protected].

Plus, you can join our Sun Money Chats and Tips Facebook group to share your tips and stories.