Major financial assets started the week on a chill note as a lack of market movers gave traders room to prep for this week’s potential catalysts.

How did your favorite assets fare yesterday?

Headlines:

- Caixin China General Services PMI for April: 52.5 vs. 52.7 previous; Price indices edged higher; Composite PMI improved from 52.7 to 52.8 (highest since May 2023)

- Australia’s MI inflation gauge for April: 0.5% m/m (0.5% previous)

- HCOB France’s final services PMI for April revised higher from 50.5 to 51.3; “Jobs growth accelerated to a nine-month high,” Input cost inflation cooled to its weakest since August 2021

- HCOB Germany’s final services PMI for April revised lower from 53.3 to 53.2; “Employment increased at a solid and accelerated rate,” Service firms raised their prices on higher costs and demand

- HCOB Eurozone final services PMI for April revised higher from 52.9 to 53.3; “New business supported higher activity and the quickest pace of job creation for ten months,” “Inflationary pressures intensified”

- Eurozone Sentix investor confidence for May: -3.6 (-4.8 expected, -5.9 previous); “The economy appears to have somewhat digested the various burdens of the last two years since the beginning of the Ukraine crisis“

- Euro Area industrial producer prices for March: -0.4% m/m as expected (vs. -1.1% previous)

- Richmond Fed President and FOMC voting member Thomas Barkin believes that today’s interest rates can “take the edge off demand” and “bring inflation back to our target“

- In a speech, New York Fed President John Williams said “Eventually we’ll have rate cuts” but for now monetary policy is in a “very good place“

- Fed’s Senior Loan Officer Survey showed more U.S. banks reporting stricter lending standards in Q1 2024

- BRC-KPMG retail sales monitor fell 4.4% y/y in April as wet spring weather, early Easter spending, and inflationary pressures limited shopping activities

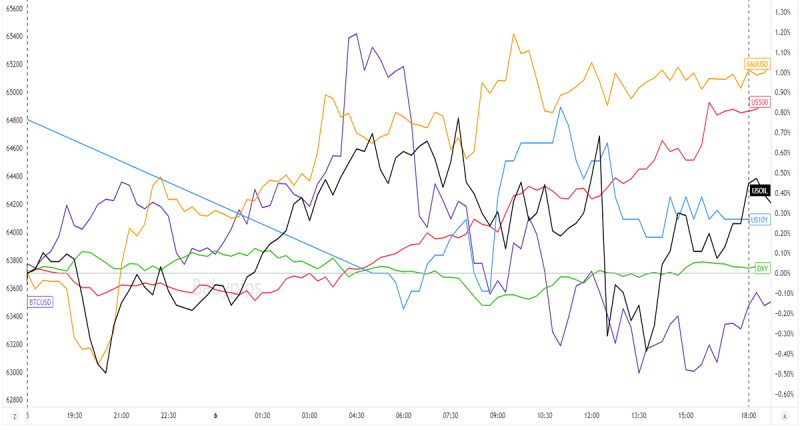

Broad Market Price Action:

Dollar Index, Gold, S&P 500, Oil, U.S. 10-yr Yield, Bitcoin Overlay Chart by TradingView

After a brief trip lower in the early Asian session, gold and oil prices traded higher. The safe-haven gold gained ground on increased Fed interest rate bets and talks of Israel pressing on with its attack on Rafah despite the ongoing ceasefire talks. Crude oil prices also took advantage of these headlines along with speculations of OPEC+ extending its output cuts.

Fed rate cut bets dominated the U.S. session, which pulled U.S. stock indices higher and extended spot gold’s gains. The U.S. dollar juuust capped the day in the green while U.S. 10-year yields dipped back below 4.50%. Bitcoin (BTC/USD) danced to its own tune, hitting highs near $65,500 before plummeting to the $63,000 area.

FX Market Behavior: U.S. Dollar vs. Majors

Overlay of USD vs. Major Currencies Chart by TradingView

USD/JPY started the day with a huge jump while Japan’s markets were out on holiday and despite the weak U.S. labor market readings we saw on Friday.

The Greenback’s strength waned closer to the European session open and remained weak until the start of the U.S. session when demand for U.S. stocks likely improved the demand for USD. Speeches by FOMC members Barkin and Williams likely limited USD’s gains as they hinted that further rate hikes are off the table for now.

Despite an intraday recovery, the U.S. dollar still ended the day mixed with gains against JPY, CHF, and NZD while registering losses against EUR, CAD, GBP, and AUD.

Upcoming Potential Catalysts on the Economic Calendar:

- Switzerland’s unemployment rate at 5:45 am GMT

- Germany’s factory orders at 6:00 am GMT

- Germany’s trade balance at 6:00 am GMT

- U.K.’s Halifax house price index at 6:00 am GMT

- France’s preliminary private payrolls at 6:45 am GMT

- France’s trade balance at 6:45 am GMT

- U.K.’s construction PMI at 8:30 am GMT

- Euro Area’s retail sales at 9:00 am GMT

- Canada’s IVEY PMI at 2:00 pm GMT

- German Bundesbank President Nagel to give a speech at 5:00 pm GMT

We’re in for another non-U.S.-focused data calendar so keep close tabs on potential currency-specific price action. ECB rate cut bets and further info on Canada’s economy just might move EUR and CAD today!

Looking for your own spot to record your market observations & trading statistics? If so, then check out TRADEZELLA! It’s an easy-to-use

journaling tool that can lead to valuable performance & strategy insights! You can easily add your thoughts, charts & track your psychology with each and every trade. Click here to see if it’s right for you!Disclaimer: Babypips.com earns a commission from any signups through our affiliate link. When you subscribe to a service using our affiliate links, this helps us to maintain and improve our content, a lot of which is free and accessible to everyone–including the School of Pipsology! We appreciate your support and hope that you find our content and services helpful. Thank you!