Shares in Marks & Spencer were in fashion once again as the City declared that the High Street stalwart has regained its sparkle.

In a major vote of confidence following a bullish update this week, analysts at Deutsche Bank Research, Barclays, Credit Suisse and Goldman Sachs all raised their target prices on the stock.

That came a day after M&S reported an 11 per cent rise in food sales and more than 6 per cent growth at its clothing and homeware division.

The FTSE 250 firm said annual profits should be higher than last year, having previously warned there might be a slight decline.

The shares rose 8.3 per cent after Tuesday’s unscheduled update. And they rose another 4.5 per cent, or 10p, to 231.6p yesterday, taking gains for the year so far to nearly 90 per cent.

Bouncing back: In a big vote of confidence analysts at Deutsche Bank, Barclays, Credit Suisse and Goldman Sachs all raised their target prices on Marks & Spencer stock

The rally came as analysts at Deutsche said it ‘has shown further evidence of its journey along the road to redemption’.

They added: ‘We have been supportive of the turnaround and view this as further evidence that investors should look at M&S again with a fresh pair of eyes, as the business has fundamentally changed.’

Now valued at more than £4.5billion, M&S is on track to rejoin the FTSE 100 next month having dropped out of the index for the first time four years ago.

The FTSE 100 fell 0.4 per cent, or 32.76 points, to 7356.88 and the FTSE 250 was down 0.4 per cent, or 78.97 points, to 18,580.78.

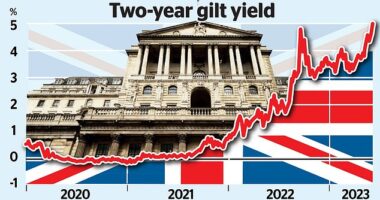

Official figures in the UK showed inflation fell from 7.9 per cent in June to 6.8 per cent in July but that was not enough to allay fears that the Bank of England will press ahead with further interest rate hikes.

Russ Mould, investment director at AJ Bell, said: ‘The Bank may be glad of the breathing space provided by the scheduling of its next meeting which does not come until late September.

‘This will allow it to look at a few more data points before deciding its next move on rates. One thing is absolutely certain – the battle against inflation is far from over.’

Mining giant Antofagasta sank 2.2 per cent, or 32.5p, to 1420p after City broker RBC downgraded its rating on the stock to ‘underperform’ from ‘sector perform’.

Construction group Balfour Beatty, which is working on the HS2 high-speed railway and the Hinkley Point C nuclear power station in the UK, tumbled as it flagged up challenges in its US office projects.

The firm blamed a tech downturn in the north-west and rising interest rates as customers downsize and delay investments. Shares plunged 10.6 per cent, or 36.8p, to 310p.

It was a mixed set of results for Essentra. The components group swung back into a profit of £10.3million in the six months to the end of June, having made a £10.7million loss a year earlier. But revenue fell 5.5 per cent to £166.3million.

It also warned that distributors were choosing to hold on to less inventory. Shares slid 3.1 per cent, or 4.8p, to 150.4p.

Software specialist Wandisco signed a licence agreement with General Motors to transfer the automotive giant’s data to Microsoft Azure Cloud.

The first phase of contract is valued at £314,000, and the news lifted shares in the troubled company 13.6 per cent, or 11p, to 92p.

Biopesticide developer Eden Research has landed its first order for a seed treatment product which aims to stop birds damaging crops. Shares flew up 6.5 per cent, or 0.38p, to 6.13p.

Oxford-genetics company Genincode, which focuses on preventing cardiovascular disease, has filed a request to US regulators to approve its lead diagnostic product which can examine whether a person is at risk of suffering heart attacks and strokes.

It surged 15.2 per cent, or 1.75p, higher to 13.25p.