Japan is printing a bunch of lower-tier reports this week, but the yen will likely take its cues from other key market themes.

Which events should you look out for?

I’ve got a list!

Japan’s economic releases

- Bank of Japan’s (BOJ) meeting minutes (Nov 3, 11:50 pm GMT) will explain the central bankers’ decision to trim its growth forecasts for 2020

- Average cash earnings (Nov 5, 11:30 pm GMT) could see a 0.2% uptick (from -1.3%) in September

- Household spending (Nov 5, 11:30 pm GMT) seen growing by 2.5% after a 1.7% increase in August

Safe-haven demand

- As a low-yielding (and supposedly low risk) currency, traders will flock to the safe-haven yen in times of uncertainty

- All eyes will be on the U.S. election results, which could lead to contested results and prolonged counting in case we don’t see a clear winner on November 3

- Policy decisions from the Reserve Bank of Australia (RBA), Bank of England (BOE), and the Fed can also inspire intraday volatility among the majors

- Rising coronavirus cases around the world and the impact of imposed lockdowns can also boost the demand for the yen

Technical snapshot

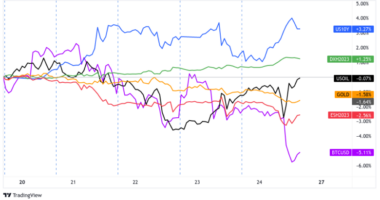

- The yen has strengthened against ALL of its major counterparts in the last 30 days

- It saw the most gains against the Aussie, followed by the euro and Kiwi

- Stochastic considers the yen “overbought” against AUD, CAD, EUR, and CHF on the daily time frame

- The rest of the yen’s counterparts are also heading to overbought territory

- JPY saw the most volatility against the comdolls and the pound in the last seven days