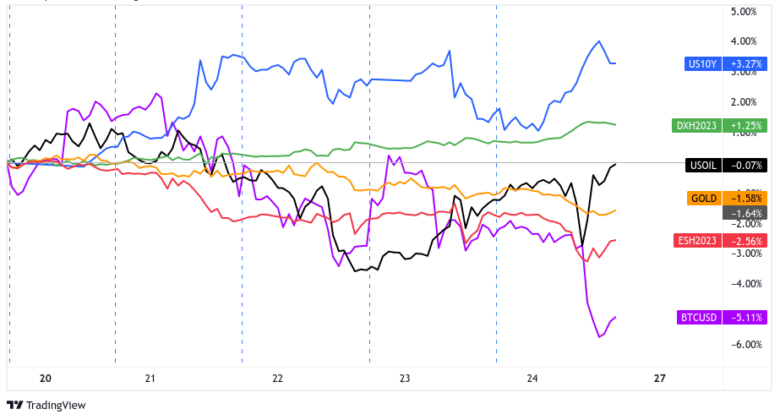

Sticky inflation and green shoots from PMI surveys had bond yields pumping higher and risk assets moving into the red this week. It was no surprise that the U.S. dollar dominated the FX majors, solidified on Friday by another hot inflation read in the U.S.

Notable News & Economic Updates:

Spotlight back on Ukraine-Russia war after Biden’s surprise visit to Kyiv, talks of China’s President visiting Russia in April or May

Global bond yields surge, most notably in Europe, thanks to upside PMI surprises

U.S. economy grew by 2.7% in Q4 2022, less than the previous forecast of 2.9% expansion. Quarterly price index upgraded from 3.5% to 3.7%

Central bank developments:

- Reserve Bank of Australia meeting minutes confirmed scope for more interest rate hikes, as core inflation strength reflected strong domestic demand

- Reserve Bank of New Zealand hiked interest rates by 50bps to 4.75% as expected, citing upside risks to previously upgraded economic estimates and increasing its OCR forecast from 5.25% to 5.50% this year

- FOMC meeting minutes confirmed more tightening moves on the horizon, as “some measures of financial conditions eased over the past few months”

- Bank of Japan Governor Designate Ueda: Current low rates are appropriate as inflation needs to sustainably and steadily meet 2% target

- The Bank of Korea kept its policy interest rate at 3.50%, and upgraded its outlook on GDP while downgrading inflation forecasts

U.S. Core PCE Price Index came in above +0.4% m/m expectations for January at +0.6% m/m, supporting the idea that the Fed will have to maintain aggressive stance on monetary policy

Intermarket Weekly Recap

The week was off to a quiet start, as U.S. and Canadian traders were in holiday mode. News of Biden’s surprise visit to Ukraine kept investors on edge, though, as the U.S. President pledged “unwavering support” for the country.

It didn’t help that North Korea launched a couple of missiles into the Pacific early in the week, keeping geopolitical jitters present.

The focus shifted to global PMI reports on Tuesday, as Australia got the ball rolling by printing decent improvements in both manufacturing and services sectors for February. Services PMIs in Germany and France also reported a faster pace of expansion, but manufacturing remained in contraction.

It was the U.K. PMI readings that turned out to be quite a surprise, as stronger than expected results dampened recession fears and boosted gilt yields.

Meanwhile, equity markets continued to weigh the impact of these strong business surveys on monetary policy, as the VIX jumped nearly a couple of points to 22.8.

On Wednesday, the RBNZ delivered on its tightening pledge by announcing a 0.50% rate hike as expected and it upgraded its OCR forecast for the year.

Later in the day, the FOMC minutes also followed through on its hawkish outlook, as the transcript noted that “a number of participants observed that a policy stance that proved to be insufficiently restrictive could halt recent progress.”

Investors also seemed well-aware of the lack of mention of “disinflation” in the minutes and the fact that the meeting occurred before consecutive upside surprises in jobs and inflation data were printed.

Even so, global yields retreated in the following sessions while U.S. equities pulled slightly higher on a few earnings surprises. The preliminary version of the U.S. Q4 2022 GDP revealed a slight downgrade from 2.9% to 2.7% growth due to downward revisions in consumption.

On Friday, we saw a big spike in short-term volatility across the financial markets after the U.S. printed its latest read on the Core PCE Price Index (the Fed’s preferred inflation metric). It came in hot, above the 0.4% m/m forecast at 0.6% m/m, throwing water on beliefs the Fed will be able to slow down, pause, or even reverse rate hikes this year.

In fact, the market seems to think the Fed may get more aggressive with hikes, based on what we saw with the CME Fed Watch Tool. The probability of the Fed hiking 50 bps to the 5.00% – 5.25% range rose to 29.9% from 27.0% just a day ago, while the probability on the 4.75% – 5.00% range ticked lower from 73.0% to 70.1% after the Core PCE read.

Risk assets quickly shifted towards a negative lean on this event as equities and crypto initially fell on the announcement, while the U.S. dollar and bond yields made intra-week highs before the Friday close.

Most Notable FX Moves

USD Pairs

Overlay of USD Pairs: 1-Hour Forex Chart

Safe-haven flows on resurfacing geopolitical tensions and the possibility of higher borrowing costs lifted the dollar, especially on Friday after the highly anticipated core PCE price index number came in above expectations on Friday.

FOMC minutes highlighted the need to maintain a restrictive policy stance, with some members citing concerns about halting the recent progress on inflation if they slow down tightening

U.S. flash services PMI jumped from 46.8 to 50.5 vs. 47.3 forecast

U.S. flash manufacturing PMI up from 46.9 to 47.8 vs. 47.4 consensus

U.S. Q4 2022 GDP downgraded from 2.9% to 2.7%, price index upgraded from 3.5% to 3.9%

U.S. Core PCE Price Index came in hot in January 2023: +0.6% m/m vs. +0.4% m/m expected/previous; Personal income grew by +0.6% m/m vs. +0.3% m/m previous

University of Michigan U.S. consumer sentiment survey was revised higher for February to 67 vs. 64.9 in January

EUR Pairs

Overlay of EUR Pairs: 1-Hour Forex Chart

Feb Services sector PMIs from Germany and France surprise to the upside

Manufacturing sector PMIs disappoint and reflect deeper industry contraction in Feb

German ZEW economic sentiment index up from 16.9 to 28.1 vs. 22.8, indicating stronger optimism

German Ifo business climate index improved from 90.2 to 91.1 as expected in Feb

Germany Final GDP read for Q4 2022 was -0.4% q/q vs. -0.2% q/q previous

GBP Pairs

Overlay of GBP Pairs: 1-Hour Forex Chart

Strong upside surprise in Feb manufacturing PMI from 47.0 to 49.2 vs. 47.5 forecast, reflecting slower contraction

Feb services PMI also jumped from 48.7 to 53.3 to signal surprise expansion vs. 49.2 forecast

U.K. GfK consumer climate index improved from -45 to -38 vs. -43 forecast in Feb

JPY Pairs

Overlay of Inverted JPY Pairs: 1-Hour Forex Chart

It was a choppy start to the week for yen pairs, as traders looked ahead to BOJ Governor-Designate Ueda’s speech amid rumors of ending the yield curve control policy. However, Ueda affirmed that current low rates are appropriate and failed to deliver on the “hawkish twist” that many anticipated.

AUD Pairs

Overlay of AUD Pairs: 1-Hour Forex Chart

The RBA meeting minutes underscored the possibility of more interest rate hikes on the horizon, as policymakers pointed to strong domestic activity lifting core inflation. However, the weaker than expected wage price index brought some doubts.

Feb manufacturing PMI ticked higher from 50.0 to 50.1, indicating slightly stronger growth

Feb services PMI improved from 48.6 to 49.2 to reflect slower contraction

Q4 2022 wage price index rose by only 0.8% q/q vs. projected 1.0% gain, previous 1.1% increase

Construction work done slipped 0.4% q/q vs. estimated 1.6% increase, earlier 3.7% jump

Q4 private capital expenditure advanced 2.2% q/q, twice as much as the estimated 1.1% gain

NZD Pairs

Overlay of NZD Pairs: 1-Hour Forex Chart

The RBNZ hiked interest rates by 0.50% as expected, which was slower than the previous 0.75% hikes. Still, the official statement was mostly upbeat since policymakers upgraded their OCR forecast for the year and noted that the near-term impact of Cyclone Gabrielle would probably not alter their course.

CAD Pairs

Data from Canada came in mostly weaker than expected, highlighting the BOC’s plans to pause from tightening as noted in the previous week.

Headline CPI came in at 0.5% m/m vs. estimated 0.7% uptick for Jan

Trimmed mean CPI slowed from 5.3% to 5.1% y/y vs. 5.2% forecast

Headline retail sales rose by 0.5% m/m as expected in Dec vs. previous flat reading

Core retail sales printed surprise 0.6% drop m/m vs. estimated 0.1% dip