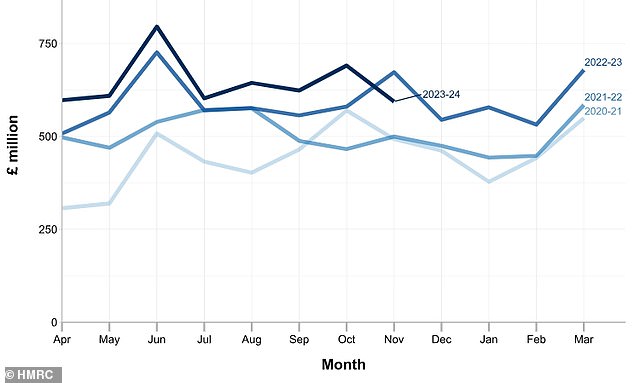

Inheritance tax receipts increased to £5.2billion in the eight months from April to November, data from HM Revenue & Customs reveals.

This marks a £400million increase from the same period a year ago, and continues the upward trend over the last decade.

Last month, the Chancellor shied away from slashing inheritance tax in the Autumn Statement, as it emerged the levy is on track to raise nearly £10billion a year by the end of the decade.

The Institute for Fiscal Studies thinks inheritance tax receipts could be closer to £15billion a year in a decade.

Last month, the Office for Budget Responsibility said it expects inheritance tax receipts to reach £7.6billion this year, an increase of 7.5 per cent on last year.

Rising: Inheritance tax receipts increased to £5.2bn in the eight months from April to November,

Taking into account all taxes, HMRC receipts for the period increased by £24billion from 2022 to 2023, as total receipts reached £515.9billion.

Around 4 per cent, or 1 in every 25, estates pay inheritance tax. According to the IFS, the rapid growth in wealth among older people means this number is set to rise to over 7 per cent by 2032–33.

However, the freeze on inheritance tax thresholds, decades of house price increases and high inflation are bringing more estates above the threshold.

Inheritance tax is typically paid at a rate of 40 per cent over certain thresholds, but you can pass on money inheritance tax free to your spouse or civil partner, who will then also inherit your allowance for when they pass away.

The primary threshold is the nil-rate band and applies to the majority of people in the UK, enabling up to £325,000 of an estate to be passed on without having to pay any inheritance tax.

The main nil-rate band has been unchanged since 2009. However, there is also a residence nil rate band worth £175,000 which allows most people to pass on a family home more tax efficiently to direct descendants, although this tapers for estates over £2million and is not available at all for estates over £2.35million.

Not budging: Chancellor Jeremy Hunt made no changes to inheritance tax in the Autumn Statement

In June, official data showed the amount of inheritance tax raised in April and May this year climbed by 9.1 per cent year-on-year to £1.2billion.

Nicholas Hyett, investment manager at Wealth Club, said: ‘The Treasury raked in an extra £5.2million from inheritance tax from April to November 2023 and this number is increasing steadily, month after month, and year after year.

‘Last year it raised more than £7billion for HMRC but could hit £9.5billion before the end of the decade.

‘While just 4 per cent of estates pay inheritance tax at the moment, freezing the nil-rate and residence nil-rate bands for years means people who would not have been considered wealthy in the past will end up getting caught out by this most hated of taxes.’

Shaun Moore, tax and financial planning expert at Quilter, said: ‘It had been widely rumoured that the government was looking to make changes to its IHT rules, but at least for now more families will be topping up government coffers as they are caught by the IHT net.

‘IHT is a highly emotive tax that can split voters, so we can expect it to continue being a battleground policy for both the Conservatives and Labour as we near the general election.

‘Though Jeremy Hunt opted not to make changes during his latest statement, we are expecting a budget to take place in March during which it could resurface if the Tories view it as a vote winner. Either way, some form of simplification of the tax is overdue.’

Julia Peake, Canada Life’s tax and estate planning specialist, said: ‘People think they will not be caught but with the standard and resident nil rate bands remaining frozen until at least 2028, and compounded by house price inflation, more people are finding that when their house becomes unencumbered by a mortgage, it takes up most if not all of their nil rate band.’

She added: ‘This results in other assets in an estate being hit.’

While the Treasury’s coffers from inheritance are rising, many households have been left battling with dire delays from the government’s Probate Service.