Revived Fed rate hike bets stemming from an upbeat May NFP lifted U.S. bond yields and risk appetite early on, before sentiment shifted this way and that throughout the choppy week.

Ready to hear what happened this week? Better check these market-moving headlines first!

Notable News & Economic Updates:

? Broad Market Risk-on Arguments

Saudi Arabia announced a voluntary addition of 1 million-barrel-per-day production cut after weekend OPEC+ meeting, while other voluntary cuts expiring in 2023 will be extended until the end of 2024

China’s Caixin services PMI improved from 56.4 to 57.1 in May (vs. 55.2 expected) and suggested continued post-lockdown recovery

World Bank raised global growth forecast from 1.7% to 2.1% for the year but downgraded 2024 forecast from 2.7% to 2.4%

China’s biggest state banks cut their deposit rates, which would help set the stage for PBoC reducing its other interest rates

? Broad Market Risk-off Arguments

U.S. ISM services PMI for May fell short of estimates at 50.3 vs. 51.9 in April, with prices component chalking up a 3.4-point drop to 56.2; HCOB Eurozone Services PMI for May: 55.1 vs. 56.2 in April

SEC charged Binance, the biggest digital asset exchange in the world, with mishandling funds and lying to regulators; SEC sued crypto exchange Coinbase for operating as an unregistered broker, a day after filing a lawsuit against Binance

ECB President Lagarde said on Monday“there is no clear evidence that underlying inflation has peaked,” hints at further tightening

RBA surprised markets with a 25bps rate hike to 4.10%, says “further tightening of monetary policy may be required”

ECB President Lagarde says “there is no clear evidence that underlying inflation has peaked,” hints at further tightening

BOC also surprised with a 25bps rate hike and kept door open for more tightening since inflation remains stubborn

Chinese trade surplus shrank from $90.2 billion to $65.8 billion in May, as exports slumped 7.5% while imports fell 4.5% year-over-year

Global Market Weekly Recap

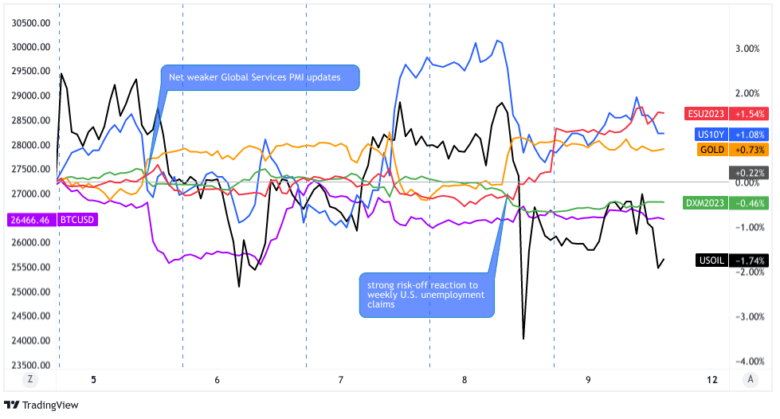

Dollar, Gold, S&P 500, Bitcoin, Oil, U.S. 10-yr Yield Overlay Chart by TV

Traders started the week off bullish on the Greenback and oil, thanks to another NFP beat, a resolution to the debt ceiling drama, and the OPEC+ surprise announcement of voluntary cuts.

To top it off, rumors that Chinese regulators are looking into providing support for the country’s shaky housing sector also lifted the market mood, particularly in Asia.

Not only did these developments influence global equities in positive territory, but it also boosted Treasury yields on stronger Fed rate hike bets. WTI crude oil even gapped higher to test the $74 per barrel resistance on Monday.

However, U.S. bond yields were quick to return the gains the following day, when the ISM services PMI fell short of estimates and even highlighted a sharp dip in price levels.

Equities ticked slightly higher midweek, as the focus shifted to a more upbeat RBA interest rate decision. This was followed by a similarly hawkish BOC announcement, which also featured a surprise 0.25% interest rate hike.

Outside of the commodity currencies, risk assets struggled to stay afloat when China printed a downbeat trade report. As it turns out, exports slumped 7.5% year-over-year while imports fell 1.5% in May, reminding market watchers of the short-lived economic rebound.

Even bitcoin and other cryptocurrencies lost their footing, but this was mostly due to U.S. regulators suing top exchanges like Binance and Coinbase for allegedly misleading investors. Not even Apple’s unveiling of Vision Pro seemed enough to shore up risk appetite then.

Although crude oil was able to squeeze out some gains thanks to API and EIA data reflecting stronger than expected demand conditions, equities resumed their slide on Thursday. The slide away from risk-on vibes accelerated during the Thursday U.S. session, correlating with a weaker-than-expected U.S. weekly initial jobless claims print.

The print came in at 261K new claims, much higher than the 235K forecast, likely prompting traders to up their recession bets (as well as lower odds of Fed rate hikes), characterized by a big fall in bond yields, and U.S. dollar vs. a rise in bond prices and gold.

Volatility calmed down a bit on Friday with the lack of major catalysts released, but risk sentiment appears to have broadly leaned positive, mainly for U.S. equities thanks to Tesla / GM news lifting the U.S. tech sector, but also correlating with confirmation headlines from China that big banks there will cut their deposit rates to help spur economic activity.

Friday performance was mixed as we saw equities hold their Asia session gains, bond yields stayed in the green despite a U.S. session rally in bond prices, and the U.S. Dollar Index steadily rallied on the session, likely putting pressure on commodities and crypto into the weekend.