Improved risk sentiment and a bit of profit-taking started the U.S. dollar on weak footing, but a few U.S. data releases soon turned the tide for the Greenback.

Which market themes dominated in the previous trading sessions?

We have the deets!

Headlines:

- NAB quarterly business survey showed Australia’s business confidence picked up from -6 to -2; Business conditions steady at +10 in Q1 2024

- ECB Vice President Luis de Guindos signaled a June cut on Thursday but policymakers disagree on potential later moves

- French central bank chief Francois Villeroy de Galhau said there was “a very large consensus” for a cut in June

- Weekly Initial Jobless Claims: 212K vs. 212K forecast/previous)

- U.S. existing home sales down 4.3% m/m in March: 4.19M (4.20M forecast, 4.38M previous)

- Philly Fed Manufacturing Survey for April 2024: 15.5 (1.0 forecast; 3.2 previous); Prices paid rose to 23.0 vs. 3.7; Employment index ticked lower to -10.7 vs. -9.6

- New York Fed President John Williams said on Thursday that higher interest rates are a possibility if the data supports that move

- Atlanta Federal Reserve President Raphael Bostic sees inflation hitting the 2% target more slowly than expected

- SNB member Antoine Martin said on Thursday that they expect inflation to “remain within the price stability range over the next three years” and that “FX intervention has proved to be an effective additional instrument“

- Japan’s national core CPI slowed down from 2.8% y/y to 2.6% y/y in March; The “core core” index that BOJ usually watches dipped from 3.2% y/y to 2.9% y/y

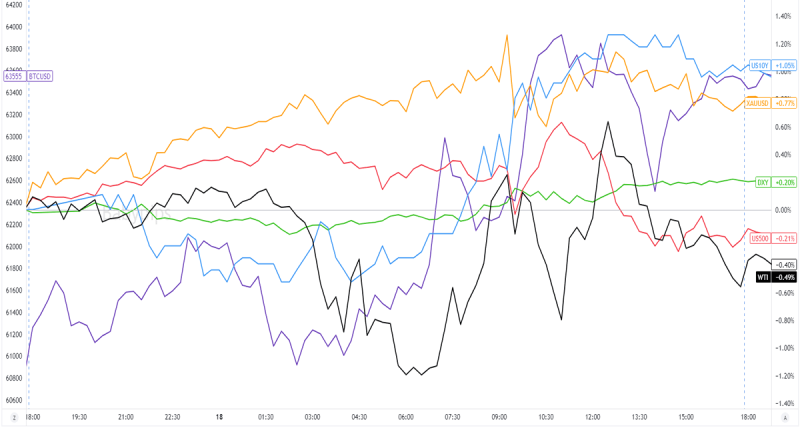

Broad Market Price Action:

With not a lot of fresh catalysts to price in, Asian session traders mostly extended market themes from the previous session.

Fortunately, risk sentiment improved hours later as concerns for a “higher for longer” interest rate environment were overshadowed by a more stable yuan, productive talks between currency officials of the U.S., South Korea, Japan, and other countries, and dovish sentiments from ECB officials.

The risk-friendly vibe lasted until the U.S. session when Uncle Sam’s data releases underscored the lack of pressure on the Fed to ease its monetary policies.

U.S. 10-year yields rose from 4.57% to 4.65%, the U.S. dollar pared some of its intraday losses, and the S&P 500 ended the day slightly in the red. Meanwhile, bitcoin (BTC/USD) maintained an uptrend that started in the previous U.S. session; WTI crude oil showed a bumpy intraday recovery, and gold prices steadied after hitting the $2,385 area.

FX Market Behavior: U.S. Dollar vs. Majors

Overlay of USD vs. Major Currencies Chart by TradingView

Improved risk sentiment, potential profit-taking, and a slightly stronger-than-expected Australian unemployment rate during the Asian session weighed on the U.S. dollar and kept it at intraday lows for most of the European session.

Luckily for USD bulls, U.S. data releases such as the initial jobless claims and Philadelphia Fed’s manufacturing survey underscored the economy’s strength and supported a “higher for longer” interest rate path for the Fed.

The U.S. dollar climbed across the board and capped the day near new intraday highs.

Upcoming Potential Catalysts on the Economic Calendar:

- Germany’s PPI report at 6:00 am GMT

- U.K.’s retail sales at 6:00 am GMT

- BOE MPC member Sarah Breeden to participate in a panel discussion at 2:15 pm GMT

- BOE MPC member David Ramsden to participate in a panel discussion at 2:15 pm GMT

- BOE MPC member Catherine Mann to participate in a panel discussion at 4:30 pm GMT

With no top-tier reports scheduled in the U.S. session, we may see a continuation of yesterday’s U.S. session themes as well as currency-specific price action following the release of Germany’s producer price and U.K.’s retail sales data.

Looking for your own spot to record your market observations & trading statistics? If so, then check out TRADEZELLA! It’s an easy-to-use journaling tool that can lead to valuable performance & strategy insights! You can easily add your thoughts, charts & track your psychology with each and every trade. Click here to see if it’s right for you!

Disclaimer: Babypips.com earns a commission from any signups through our affiliate link. When you subscribe to a service using our affiliate links, this helps us to maintain and improve our content, a lot of which is free and accessible to everyone–including the School of Pipsology! We appreciate your support and hope that you find our content and services helpful. Thank you!

This post first appeared on babypips.com