Risk currencies were strutting their stuff like they just won a Super Bowl thanks to positive economic updates from the U.S. and from China pulling out fresh ways to stimulate their economy. We guess that traders are all in for that “soft landing” touchdown!

Unfortunately for European currencies, traders were unloading as data from the region continues to disappoint like the NY Giants.

Missed the major forex headlines? Here’s what you need to know from last week’s FX action:

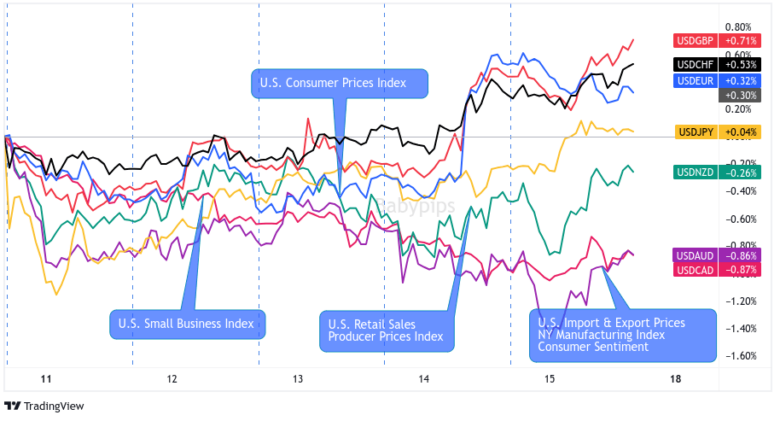

USD Pairs

Overlay of USD vs. Major Currencies Chart by TV

Risk-taking weighed on the U.S. dollar early in the week and a bit of profit-taking kept it in tight ranges ahead of the U.S. CPI release.

Uncle Sam’s consumer inflation numbers came in as expected and, together with Thursday’s strong U.S. retail sales and PPI reports, supported “soft landing” bets for the economy.

USD traded as a safe haven in the second half of the week as it lost pips against the comdolls but closed higher against European currencies like EUR, GBP, and CHF.

🟢 Bullish Headline Arguments

CPI for August: 0.6% m/m (0.5% m/m forecast; 0.2% m/m previous); Core CPI: 0.3% m/m (0.2% m/m forecast/previous)

MBA Mortgage Applications: -0.8% w/w vs. -2.9% w/w previous

Retail Sales in August: 0.6% m/m (0.4% m/m forecast; 0.5% m/m previous)

Weekly Jobless Claims: 220K (221K forecast; 217K previous)

Producer Prices Index for August: 0.7% m/m (0.4% m/m forecast/previous); core PPI at 0.2% m/m as expected (0.4% m/m previous)

🔴 Bearish Headline Arguments

NFIB Business Optimism Index: 91.3 (91.7 forecast; 91.9 previous); “Inflation remains top business problem”

EUR Pairs

Overlay of EUR vs. Major Currencies Chart by TV

The euro was trading as a counter currency early in the week as traders limited big bets ahead of the European Central Bank’s (ECB) monetary policy decision.

The central bank did raise its interest rates as discussed in our Event Guide, but also gave “peak rates” and “higher for longer” vibes that got traders taking a second look at the region’s growth markers.

A high-interest rate environment didn’t suit EUR traders, who sold the common currency across the board on Thursday, but was able to claw back some of those on Friday.

🟢 Bullish Headline Arguments

Germany’s wholesale prices were up by 0.2% (vs. -0.1% expected, -0.2% previous) in August; selling prices down by 2.7% y/y

Germany ZEW Economic Sentiment: -11.4 (-14.0 forecast; -12.3 previous)

🔴 Bearish Headline Arguments

Italy’s industrial output fell by 0.7% m/m in July (vs. -0.2% expected, 0.5% previous)

Germany Current Account in July: €18.7B (€22.3B forecast; €28.4B previous)

Euro Area Industrial Production for July: -1.1% m/m (-0.3% m/m; 0.4% m/m previous)

European Central Bank raised the deposit rate from 3.75% to 4.00% on Thursday; Lagarde does not signal that this may be the peak but the announcement came off as a “dovish hike.”

GBP Pairs

Overlay of GBP vs. Major Currencies Chart by TV

The pound traders’ reaction to an arguably weak U.K. jobs report and a dovish monthly GDP update is telling us that British pound traders are not comfortable with the country’s growth trajectory given its current high interest rate environment.

GBP was dragged lower at the start of Tuesday and Wednesday’s London session trading and saw limited pullbacks.

Then, GBP was pulled even lower when traders worried about growth in the European region following the ECB’s “dovish hike.”

🟢 Bullish Headline Arguments

BOE policymaker Catherine Mann said on Monday she’d likely support further rate hikes to fight inflation

The unemployment rate was higher from 4.2% to 4.3% in August; Jobless claimants are lower from 29K to 0.9K; Average wage growth is still at 8.5% record high in July; net jobs change was -207K, far below -80K forecast

🔴 Bearish Headline Arguments

Monthly GDP surprisingly contracted by 0.5% m/m in July (vs. -0.2% expected, 0.5% previous) after strikes in hospitals and schools as well as unusually rainy weather weighed on output

The total trade in goods and services deficit widened by £1.2B to £18.8B in the three months to July, as exports saw a larger fall than imports.

Industrial production fell by 0.7% m/m in July (vs. 1.8% m/m in June); with declines recorded in 3 out of 4 production sectors

RICS: U.K. house price gauge hits 14-year low of -68 in August (vs. -56 in July) thanks to elevated mortgage costs and economic uncertainty

CHF Pairs

Overlay of CHF vs. Major Currencies Chart by TV

A lack of economic releases from Switzerland meant that the Swiss franc traded mainly as some combination of counter currency and safe haven for most of the week.

CHF sold off on Monday when risk appetite gained ground and fellow safe haven JPY was pushed higher.

The franc started selling off on Wednesday, though, as more traders priced in a “soft landing” in the U.S. but also their growth concerns in the European region.

CHF looks set to end the week lower against all its major counterparts except EUR and GBP.

🔴 Bearish Headline Arguments

Switzerland Producer price index slipped by -0.2% m/m in August (-0.3% m/m expected, -0.1% m/m previous)

AUD Pairs

Overlay of AUD vs. Major Currencies Chart by TV

China’s stimulus efforts and the defense of its local currency supported AUD even through relatively weak mid-tier Australian data releases.

AUD traded in loose ranges for most of the week before “soft landing” bets in the U.S. pushed the commodity-related currency higher against most of its counterparts.

The Australian dollar ended the week mostly in the green across the board, the only exception being against the oil rally boosted Canadian dollar.

🟢 Bullish Headline Arguments

NAB: Business confidence in Australia improved from 1 to 2 in August but was still weighed by “deep negatives in the retail sector”

Chinese property developer giant Country Garden secured approval from its creditors to extend repayments on six onshore bonds by three years

Chinese industrial production accelerated from 3.7% y/y to 4.5% in August vs. estimated increase to 3.9%

Chinese retail sales rose from 2.5% y/y to 4.6% in Aug vs. projected improvement to 3.0%

🔴 Bearish Headline Arguments

A Westpac report showed Australian consumer confidence slipping by 1.5% to 79.7 in September while business conditions were up 2 points to 13 in August.

Melbourne Institute inflation expectations fell from 4.9% y/y to 4.6% y/y in September

Australia’s unemployment rate remained at 3.7% in August; Participation rate edged up from 66.9% to 67.0%; Employment gains higher at 64.9K (vs. 25.4K expected, -1.4K previous) but part-time gains (+62.1K) outpaced full-time job increases (+2.8K)

CAD Pairs

Overlay of CAD vs. Major Currencies Chart by TV

Higher crude oil prices and a bit of risk-taking gave the oil-related CAD a boost for most of the week.

The Loonie traded in ranges on Wednesday and early Thursday before growth concerns in Europe and “soft landing” bets in the U.S. lifted CAD and made it on track to close the week higher against most of its major counterparts.

🟢 Bullish Headline Arguments

On Tuesday, OPEC oil data showed a potential 3 million-barrel per day shortfall on the Saudi Arabia supply squeeze

Canada Manufacturing Sales: 1.6% m/m (0.7% m/m forecast; -2.0% m/m previous)

🔴 Bearish Headline Arguments

Canada Wholesale Sales for July: 0.2% m/m to C$81.3B (1.4% m/m previous; -2.1% m/m)

NZD Pairs

Overlay of NZD vs. Major Currencies Chart by TV

With not a lot of data releases from New Zealand, NZD traded as a risk currency for most of the week.

That is, it found support from the PBOC warning against yuan selling on Monday and then traded lower ahead of the U.S. CPI release.

NZD started recovering from its weekly lows on Wednesday and has maintained its upswings against most of its counterparts (except AUD and CAD).

🟢 Bullish Headline Arguments

Overseas visitor arrivals into New Zealand continued to rebound a year on from fully opening the border, with short-term visitors up from 11.3% to 19.8% in July

The food price index rose by 8.9% y/y in August (vs. 9.6% y/y in July) led by grocery food prices

🔴 Bearish Headline Arguments

New Zealand Manufacturing Index in August: 46.1 vs. 46.6

JPY Pairs

Overlay of JPY vs. Major Currencies Chart by TV

Speculations of the BOJ possibly exiting its negative interest rate era as early as January next year bumped up JPY at the start of the week.

JPY peaked on Monday, though, because the safe haven also resumed its losses against its major counterparts.

In fact, the safe haven has hit new intraweek lows against commodity-related currencies and has barely gained pips against troubled European currencies like EUR, GBP, and CHF.

🟢 Bullish Headline Arguments

Over the weekend, BOJ Gov. Ueda gave an interview with Yomiuri and implied that the central bank may have enough information about wage hikes by the end of 2023 to possibly reevaluate its monetary policies.

Japanese large manufacturers’ sentiment strengthened from -0.4 to 5.4 in Q3 2023, large non-manufacturers index climbed from 4.1 to 6.0

🔴 Bearish Headline Arguments

Machine tool orders dipped by 6.3% m/m in July (-19.7% y/y) and marked its first monthly decline in two months.

Producer price inflation slowed down from 3.4% y/y to 3.2% y/y in August as the cost of utilities fell

Core machinery orders dropped by 1.1% m/m (vs. -0.9% expected, 2.7% previous) in July as manufacturers balked at new investments

Final industrial production revised from -2.0% to -1.8% in July