A strong U.S. economic release brought back “higher for longer” bets for the Fed!

What would that mean for the major financial assets?

We’re taking a closer look at their reactions:

Headlines:

- Australia’s inflation slowed but is still faster than expected in Q1 2024

- Germany Ifo Business Climate for April: 89.4 (88.9 forecast; 87.9 previous)

- API: U.S. crude stockpiles unexpectedly fell by 3.2M barrels for the week ending April 19 vs. 1.8M increase expected and 4.09M previous

- CBI U.K. Industrial Trends Survey for April. Business Sentiment rose to +9% from -3% in January. Domestic selling prices rose to +10% from +2% in Januar

- EIA U.S. commercial crude oil inventory fell by -6.4M vs. 2.74M previous

- Canada Retail Sales for February: -0.1% m/m (0.1% m/m forecast: -0.3% m/m previous); Core Retail Sales was -0.3% m/m (0.2% m/m forecast; 0.4% m/m previous)

- U.S. Durable Goods Orders for March: 2.6% m/m (2.2% m/m forecast; 0.7% m/m previous); Core read came in at 0.2% m/m (0.3% m/m forecast; 0.1% m/m previous)

- Japan’s ruling party LDP executive Takao Ochi, there’s no “broad consensus” on yen intervention right now, but a slide “160 or 170 to the dollar” may prompt “some action”

- ECB Governing Council member Joachim Nagel favors a June rate cut but believes it would “not necessarily be followed by a series of rate cuts.“

- China’s CB leading economic index slightly improved from -0.3% to -0.2% in March; “Depressed consumer expectations continue to push the LEI down.”

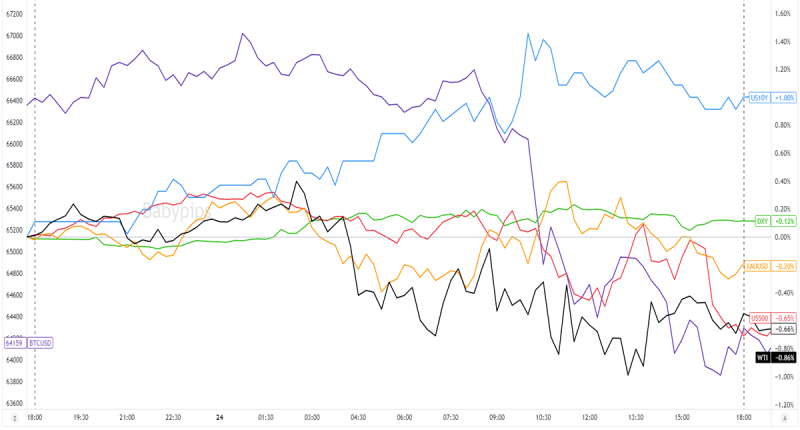

Broad Market Price Action:

An extension of relatively risk-friendly trading conditions from the previous day sustained the demand for many of the major financial assets early yesterday.

The tides turned during the London and U.S. sessions, however, as positive economic reports from the U.S. brought back concerns over a “higher for longer” interest rate environment.

U.S. 10-year bond yields inched higher on not-so-dovish Fed bets, spot gold capped the day in the red, and the S&P 500 fell despite positive corporate earnings results.

Meanwhile, bitcoin (BTC/USD) declined sharply following a bearish technical breakout, and U.S. crude oil prices weakened on easing geopolitical and supply concerns (API and EIA’s reports still showed enough supply despite their declines).

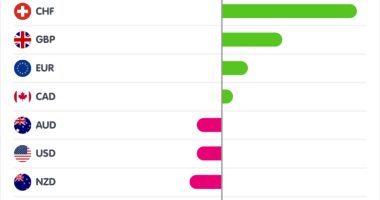

FX Market Behavior: U.S. Dollar vs. Majors

Overlay of USD vs. Major Currencies Chart by TradingView

The U.S. dollar started the day in tight ranges except against AUD and NZD which were supported by a hotter-than-expected Australian inflation and stronger export activity in New Zealand.

USD then slowly edged higher in the late Asian and early European sessions possibly due to traders taking profits ahead of the U.S. GDP and core PCE releases. The Greenback also struggled to gain traction against EUR following a strong German confidence report and GBP on strong U.K. data releases.

A stronger-than-expected U.S. core durable goods orders provided USD with fresh upswings in the U.S. session but a bit of profit-taking near the end of the session dragged the dollar back closer to its U.S. session open levels.

USD remains strong against fellow safe havens like CHF and JPY (USD/JPY is now above 155.00!) but is struggling against comdolls like AUD and NZD and European currencies like EUR and GBP.

Upcoming Potential Catalysts on the Economic Calendar:

- Australia and New Zealand’s markets out on bank holiday

- German GfK consumer climate at 6:00 am GMT

- ECB’s economic bulletin at 8:00 am GMT

- U.S. advance GDP and GDP price index at 12:30 pm GMT

- U.S. initial jobless claims at 12:30 pm GMT

- U.S. preliminary wholesale inventories at 12:30 pm GMT

- U.S. pending home sales at 2:00 pm GMT

- ECB Governing Council member Joachim Nagel to give a speech at 3:15 pm GMT

- U.K.’s GfK consumer confidence at 11:01 pm GMT

- Tokyo’s core CPI at 11:30 pm GMT

- Australia’s quarterly PPI at 1:30 am GMT (Apr 26)

- BOJ’s policy decision out during the Asian session (Apr 26)

We’re getting the first estimates of Uncle Sam’s growth for the first quarter of 2024!

And then there’s the Bank of Japan (BOJ), which could say a thing or two (or twenty) about the yen’s fresh weakness.

Will the U.S. GDP report prompt a re-pricing of Fed interest rate bets? Will the BOJ decide to intervene in the currency markets? Stay tuned!

Looking for your own spot to record your market observations & trading statistics? If so, then check out TRADEZELLA! It’s an easy-to-use

journaling tool that can lead to valuable performance & strategy insights! You can easily add your thoughts, charts & track your psychology with each and every trade. Click here to see if it’s right for you!Disclaimer: Babypips.com earns a commission from any signups through our affiliate link. When you subscribe to a service using our affiliate links, this helps us to maintain and improve our content, a lot of which is free and accessible to everyone–including the School of Pipsology! We appreciate your support and hope that you find our content and services helpful. Thank you!