The Kiwi may see some volatility in the upcoming Asia session with the quarterly employment update from New Zealand on the way. Will the numbers help the bears with the recent move lower, or bring back the bulls to play the longer-term uptrend in NZD/USD?

Before moving on, ICYMI, today’s Daily U.S. Session Watchlist looked at a potential setup on NZD/CHF as its short-term down move corrects, so be sure to check that out to see if there is still a potential play!

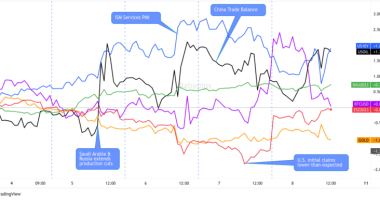

Intermarket Update:

| Equity Markets | Bond Yields | Commodities & Crypto |

|

DAX: 14856.48 -2.49% FTSE: 6923.17 -0.67% S&P 500: 4164.72 -0.67% NASDAQ: 13633.50 -1.88% |

US 10-YR: 1.589% -0.017 Bund 10-YR: -0.236% +0.001 UK 10-YR: 0.795% -0.002 JPN 10-YR: 0.094% +0.005 |

Oil: 65.71 +1.89% Gold: 1,777.70 -0.78% Bitcoin: $54,580.75 -5.27% Ethereum: $3,420.79 +3.67% |

Fresh Market Headlines & Economic Data:

Upcoming Potential Catalysts on the Economic Calendar

API Crude Oil Inventory Change at 8:30 pm GMT

New Zealand Employment Change q/q at 10:45 pm GMT

Australia Services PMI at 11:00 pm GMT

Australia Building Permits at 1:30 am GMT (May 5)

Spain Unemployment Change at 7:00 am GMT (May 5)

Germany Services PMI at 7:55 am GMT (May 5)

Euro area Services PMI at 8:00 am GMT (May 5)

Euro area PPI at 9:00 am GMT (May 5)

Bundesbank Wuermeling speech at 10:45 am GMT (May 5)

What to Watch: NZD/USD

On the one hour chart above, we can see a pretty clear downtrend in the works on NZD/USD, falling from a swing high around 0.7300 last week to nearly retest the 0.7100 handle in today’s session.

That pattern may quickly change for the pair with the latest employment update from New Zealand coming soon in the upcoming Asia session. Expectations are for a slowdown in job growth for the first quarter of 2021, and if that scenario plays out or wirse, the downtrend in NZD/USD may continue it’s run to the downside.

If that’s the case and RBNZ spikes lower, watch for a break of the previous swing lows before considering a short position. If the market trades higher prior to the event, then watch out for bearish reversal patterns up to the falling “highs” trendline before considering your short position.

If we get a positive surprise, then that could ignite traders to price in a potential scenario where the RBNZ can reduce the pandemic stimulus measures, prompting a rally in the Kiwi across the board. In that scenario, a break above the falling “highs” pattern is the simple technical signal to watch out for, and if the market is consolidating tightly prior to the event, the consider a small long position a market levels if we see an upside break.