The major currencies started the week in tight ranges but with a slight “risk aversion” lean as debt ceiling and global growth concerns raised the demand for safe havens.

The tides turned mid-week, however, thanks to “June skip” talks from Fed members and optimism over the passing of the debt ceiling bill. AUD and CAD seems to have benefited the most from the risk-friendly turn, while the “safe havens” saw the broadest hits as expected when the environment shifts positively.

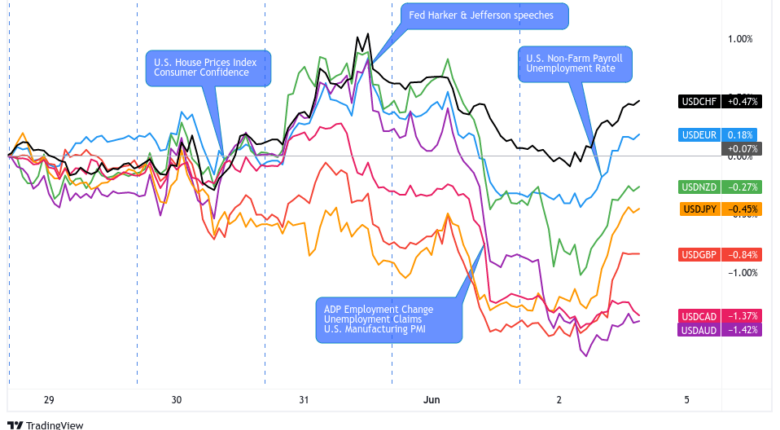

USD Pairs

Uncertainty around the U.S. debt ceiling bill encouraged USD weakness in the first half of the week. But the bulls found some relief as debt default fears began to ease and possibly on stronger-than-expected housing prices and consumer confidence data.

Then, Fed members Jefferson and Harker started hinting the possibility of “skipping” a rate hike in June, prompting a repricing of rate hike expectations (i.e., reduction of U.S. dollar longs, move towards risk assets).

Eased debt ceiling concerns, less hawkish Fed bets, and a few rounds of risk-taking dragged the safe haven dollar to new intraweek lows by Friday, which was quickly turned around with the May U.S. jobs report. The NFP number seems to have been the main focus, coming in well above expectations, arguably opening the idea that the Fed has lots of room to cut with low risk of crashing the economy.

? Bullish Headline Arguments

U.S. lawmakers reached a tentative debt ceiling deal over the weekend

JOLTS U.S. Job Openings in April: 10.1M vs. 9.75M in March; “the number and rate of layoffs and discharges decreased to 1.6M”

The debt-limit legislation brokered by President Joe Biden and Speaker Kevin McCarthy was passed by the House Wednesday evening with a 314-117 vote

ADP National Employment Report for May: +278K (+200K forecast) vs.291K previous

The U.S. Senate passed the debt ceiling and budget cuts package late Thursday evening, bringing the U.S. one step closer to avoiding a debt default scenario

U.S. Non-Farm paryolls for May: +339K (+180K forecast) vs. upwardly revised 294K in April; Unemployment Rate rose to 3.7% (3.5% forecast, 3.4% previous); Average hourly earnings: +0.3% (+0.4% forecast/previous)

? Bearish Headline Arguments

U.S. Consumer confidence in May: 102.3 vs. 103.7 in April

S&P Corelogic Case-Shiller Index for March: +1.5% m/m (+0.3% m/m forecast) vs. +0.3% m/m previous

U.S. Fed Beige Book revealed that some districts reported cooling labor market conditions, as employment still increased but at a slower pace in late April to early May

Federal Governor Jefferson signaled on Wednesday that the Fed may skip a rate hike in June while still keeping open the option of further rate hikes later

S&P Global US Manufacturing PMI read for May: 48.4 vs. 50.2 in April

ISM Manufacturing PMI for May: 46.9 vs. 47.1 in April; Prices Index fell 9 points to 44.2; Employment Index grew by 1.2 points to 51.4

EUR Pairs

Slower-than-expected growth, credit and inflation data from the Euro Area eased hawkish ECB expectations and dragged the euro lower against the majors this week.

? Bullish Headline Arguments

France’s GDP confirmed at 0.2% in Q1 2023

Germany’s unemployed rose by 9K in April, lower than 14K expected and March’s 23K unemployed

ECB review finds that the Eurozone’s financial stability remains fragile thanks to banking stress outside the Euro Area.

Germany Retail Sales for April: +0.8% m/m; -4.3% y/y

Euro area unemployment rate for April 2023: 6.5% as expected vs. 6.6% previous

? Bearish Headline Arguments

Spanish flash CPI slowed from 4.1% year-over-year to 3.2% in April versus 3.6% forecast

Euro Area Private Loans for April: 2.5% y/y vs. 2.9% y/y in March; M3 Money Supply grew by 1.9% y/y in April vs. 2.5% y/y in March

France’s consumer spending down by 1.0% m/m in April – its third consecutive decline – vs. 0.3% expected, -0.8% m/m in March

France’s inflation unexpectedly lower at -0.1% m/m in May vs. 0.3% expected, 0.6% uptick in April

HCOB Eurozone Manufacturing PMI for May: 44.8 vs. 45.8 in April; surveys showed sharp drop in new orders and factory production; still hiring but at decelerating pace

HCOB Germany Manufacturing PMI for May: 43.2 (lowest read in three years) vs. 44.5

Euro area annual inflation (flash estimate for May): 6.1% y/y ( 6.5% y/y forecast) vs. 6.7% y/y previous

GBP Pairs

After a sleepy start to the week, Sterling bulls grabbed the reins, likely sparked by stubborn goods inflation data on Tuesday, keeping expectations high that the Bank of England (BOE) will have to stay hawkish to fight inflation.

It may have also helped GBP bulls that traders were selling its fellow European counterparts EUR and CHF throughout the week on weak Euro area data and a shift away from risk aversion sentiment.

? Bullish Headline Arguments

U.K. BRC price shop index accelerated from 8.8% to record high of 9.0% year-over-year in May to reflect even stronger pace of inflation in retail stores

? Bearish Headline Arguments

S&P Global / CIPS UK Manufacturing PMI for May: 47.1 (a four-month low) vs. 47.8 previous

CHF Pairs

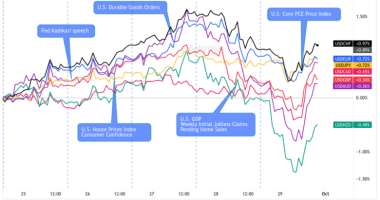

Overlay of CHF vs. Major Currencies Chart by TV

There may not be a lot of market-moving reports from Switzerland but that didn’t stop Swiss franc traders from making pips rain!

CHF traded in tight ranges in the first half of the week before net weak Swiss economic updates and rising broad risk-taking sentiment soon dragged the franc lower, landing at the bottom spot among the majors by the Friday close.

? Bullish Headline Arguments

Swiss Q1 GDP report showed that economy expanded 0.3% quarter-over-quarter versus projected 0.1% growth figure and earlier flat reading

Swiss retail trade turnover fell by -3.7% y/y in April vs. -1.4% expected, -1.9% y/y in March

? Bearish Headline Arguments

Switzerland’s KOF economic barometer fell from downgraded 96.1 figure to 90.2 in May to reflect worsening conditions versus 95.7 forecast

procure.ch Purchasing Managers’ Index (PMI) for May: 43.2 vs. 45.3

AUD Pairs

Overlay of AUD vs. Major Currencies Chart by TV

China’s PMI misses and U.S. debt ceiling concerns kept the pressure on AUD in the first half of the week.

But thanks to hawkish statements from RBA Governor Lowe, positive Caixin China PMI data, and a positive turn in global risk sentiment, AUD soon gained steady support to closely battle the Loonie for the top spot among the majors at the Friday close.

? Bullish Headline Arguments

Australia’s monthly CPI accelerated from 6.3% y/y in March to 6.8% y/y in April (vs. 6.4% expected)

Judo Bank Australia Manufacturing PMI for May: 48.4 vs. 48.0 in April; third straight read of contractionary conditions

Australia’s private capital expenditure rose 2.4% quarter-on-quarter in Q1 vs. projected 1.1% gain, following earlier period’s upgraded 3.0% reading

? Bearish Headline Arguments

Australian building approvals tumbled 8.1% month-over-month in April versus estimated 2.3% rebound, following earlier downgraded 1.0% slump

RBA Gov. Lowe: “We really want people to understand that we’re serious about this, that we will do what is necessary, and not to question our commitment to get inflation down. As painful as it is, we’ve got work to do there.”

Australia Retail Sales for April: 0.0% m/m (as forecasted) vs. 0.4% m/m previous

CAD Pairs

Overlay of CAD vs. Major Currencies Chart by TV

The Canadian dollar was kept in tight ranges early on Wednesday when traders went into risk-on mode sparked by rising U.S. debt deal optimism, a June Fed hike “skip” and possibly on positive Canadian GDP data showing the Bank of Canada still has room to hike.

? Bullish Headline Arguments

Canada current account for Q1 2023: -C$6.2B deficit vs. -C$8.1B deficit in Q4 2022

Canada GDP Q1 2023: +0.8% q/q vs. +0.0% q/q in Q4 2022

? Bearish Headline Arguments

S&P Global Canada Manufacturing PMI for May: 49.0 vs. 50.2 in April, largely driven by falling output and new orders, lower customer spending in efforts to reduce inventories

Canadian corporate profits tumbled 5.6% quarter-over-quarter in Q1, erasing part of earlier 7.3% increase

NZD Pairs

The comdoll traded lower with negative risk sentiment early on as traders worried about the U.S. debt ceiling bill progress and China’s data misses. There seems to be a correlation as well with the Kiwi’s accelerated fall on Wednesday, lining up with another negative NZ business confidence survey, but it’s more likely the drop was due to the falling Aussie when Australian CPI was release almost at the same time as NZ survey data.

Risk sentiment shifted back to positive in the late Wednesday / early Thursday sessions with Fed’s “June skip” talks and passing of the U.S. debt deal in both the House and Senate. This helped the Kiwi dig a bit out of the red, at least against the safe havens on Friday.

? Bullish Headline Arguments

ANZ: New Zealand business confidence lifted 13 points from -43.8 to -31.1, while expected own activity rose from -7.6 to -4.5 in May

? Bearish Headline Arguments

New Zealand Building Permits for April 2023:-2.6% m/m (2.0% m/m forecast) vs. 6.6% m/m previous

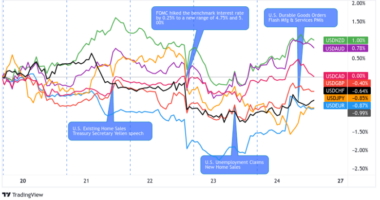

JPY Pairs

Overlay of JPY vs. Major Currencies Chart by TV

Risk aversion and safe haven demand kept the yen supported in the first half of the week.

But an unscheduled meeting between Japanese financial officials helped turn the tides in favor of JPY bears, as well as the broad risk sentiment shift back towards risk-on on Wednesday.

? Bullish Headline Arguments

Japan’s unemployment rate improved from 2.8% to 2.6% in April versus consensus at 2.7%

Japan’s consumer sentiment rose from 35.4 to 36 in May, the highest reading since January 2022

Japan Capital Expenditure for Q1 2023: +2.7% q/q; “Spending, excluding software, rose 10% from a year earlier, compared with a 3.7% rise forecast by economists”

au Jibun Bank Japan Manufacturing PMI for May: 50.6 vs. 49.5 in April; “Greater business and consumer confidence had helped to lift overall customer demand”

? Bearish Headline Arguments

BOJ Governor Ueda reiterates that they have not yet achieved sustainable 2% inflation, so central bank will maintain easy policy

Japan’s industrial production unexpectedly fell by 0.4% in April, its first decline in three months.

Japan’s retail sales up by 5.0% y/y in April, slower than March’s 6.9% growth and the expected 7.1% uptick.

Japan’s housing starts dropped by 11.9% y/y in April, faster than March’s 3.2% decline and the expected 0.9% dip