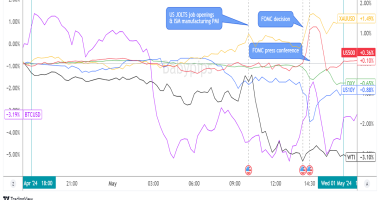

A parade of top-tier reports from the major economies contributed to a choppy trading environment throughout the week. The U.S. dollar was front and center as traders repriced their Fed interest rate expectations, ultimately taking the top spot thanks to a blockbuster employment update on Friday. The Australian dollar lost tons of pips on weak Chinese PMI, shaky Chinese equities prospects, and Australia’s Q4 CPI supporting a potential RBA rate cut. The euro and the British pound are net lower than their non-USD counterparts as more ECB members supported “sooner than later” rate cuts while the BOE dropped hints of tightening in its February statement.

This Article Is For Premium Members Only

Become a Premium member for full website access, plus get:

- Ad-free experience

- Daily actionable short-term strategies

- High-impact economic event trading guides

- Access to exclusive MarketMilk™ sections

- Plus More!