Financial markets had a mixed run in the past trading sessions, as there were plenty of factors in play even before the highly-anticipated FOMC decision was announced.

Read on to find out how it all went down!

Headlines:

- Japan’s S&P Global final manufacturing PMI for April downgraded from 49.9 to 49.6

- RBNZ Governor Orr highlighted how the financial system is already adjusted to high interest rate environment, but spending and job security may be at risk

- U.K. Nationwide HPI for April: -0.4% m/m (+0.1% expected, -0.2% previous)

- Australia’s commodity prices for April: -11.6% y/y (-14.9% previous)

- U.S. ADP non-farm employment change for April: 192K (179K expected, 208K previous)

- U.S. ISM manufacturing PMI for April: 49.2 (50.0 expected, 50.3 previous), prices component up from 55.8 to 60.9 and jobs component up from 47.4 to 48.6

- U.S. JOLTS job openings for March: 8.49M (8.68M expected, 8.81M previous)

- U.S. EIA crude oil inventories: +7.3M (-2.3M expected, -6.4M previous)

- FOMC kept interest rates on hold at 5.25-5.50% as expected, slowed down pace of reducing bond holdings from its balance sheet by $35B

- During the presser, Fed head Powell reiterated that “Further progress in bringing [inflation] down is not assured and the path forward is uncertain.”

- BOC Governor Macklem mentioned that “We’ve come a long way in the fight against inflation, and recent progress is encouraging,” downplaying expectations for a June cut

- BOJ reportedly intervened in the forex market after U.S. markets closed, but MoF’s Kanda refused to comment

Broad Market Price Action:

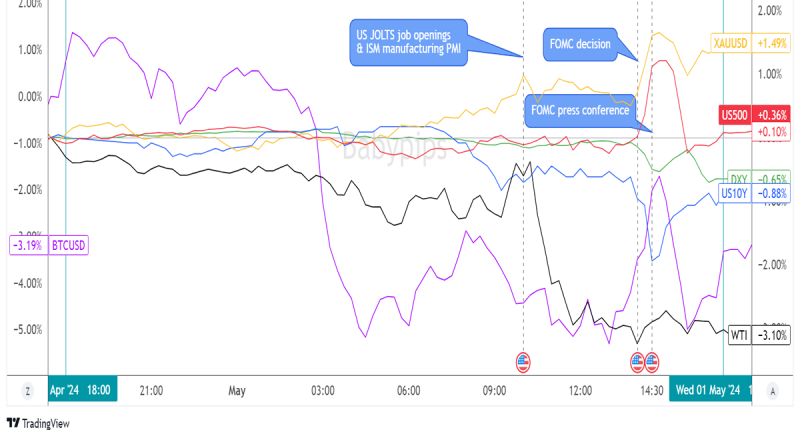

Dollar Index, Gold, S&P 500, Oil, U.S. 10-yr Yield, Bitcoin Overlay Chart by TradingView

While the rest of the asset classes were chillin’ in their ranges while waiting for the FOMC decision, bitcoin was already in selloff mode and dropping below the $60K handle early in the day.

Crude oil was also on shaky footing before it staged a steeper drop upon seeing a surprise build in EIA inventories, suggesting a significant dip in demand.

Meanwhile, Treasury yields also started turning lower despite a somewhat upbeat ADP jobs figure, before leveling off upon seeing downside surprises in the ISM manufacturing PMI and JOLTS job openings data.

On the flip side, gold pulled higher at the start of the NY session then joined U.S. equity indices on another leg up after the FOMC announced its policy decision. The Fed kept rates on hold as expected but gradually slowed the pace of reducing bond holdings from its balance sheet, which many interpreted to be a form of policy easing.

The dollar and U.S. yields took hits after the announcement, as the central bank dashed hopes of tightening anytime soon and emphasized that its next move is still likely to be a cut, despite the lack of progress in bringing inflation to target.

FX Market Behavior: U.S. Dollar vs. Majors

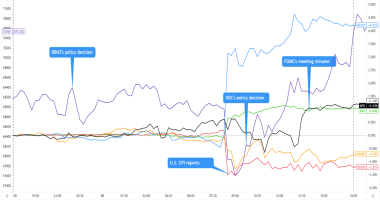

Overlay of USD vs. Major Currencies Chart by TradingView

Consolidation was the name of the game for the majors, as dollar traders were likely biting their nails ahead of leading U.S. jobs indicators and the much-anticipated FOMC decision.

A bit of a bearish tilt came in play even after an upbeat ADP employment report, and more sellers piled on after the mostly downbeat ISM manufacturing PMI and JOLTS job openings data. A steep selloff ensued during the Fed announcement, despite the central bank’s decision to keep interest rates unchanged.

The lack of any hawkish hints in the statement likely spurred profit-taking among previous long USD positions, and it didn’t help the dollar’s cause that Powell reiterated that their next move is still very much likely to be a rate cut.

To top it off, the Fed’s decision to slow down the pace of their reduction of bond holdings from their balance sheet was also viewed as a form of policy easing.

As soon as the closing bell rang for the U.S. markets, the Bank of Japan (BOJ) was said to have staged a stealth intervention in the forex market, dragging USD/JPY down by more than 400 pips to the 153.00 handle before it pulled up.

Upcoming Potential Catalysts on the Economic Calendar:

- Australia’s building approvals at 1:30 am GMT

- Japanese consumer confidence index at 5:00 am GMT

- Swiss CPI and retail sales at 6:30 am GMT

- U.S. Challenger job cuts at 11:30 am GMT

- U.S. initial jobless claims at 12:30 pm GMT

- BOC Governor Macklem’s speech at 12:45 pm GMT

- U.S. factory orders at 2:30 pm GMT

It’s shaping up to be a relatively quiet day in the currency market, as the economic calendar is taking a breather from top-tier data releases and traders may be holding out for Friday’s NFP.

Still, the upcoming Swiss CPI report might spur some intraday moves, given how the Swiss National Bank (SNB) recently surprised the markets with a rate cut. After that, the spotlight could turn to the U.S. initial jobless claims report that also tends to spur short-term price action from dollar pairs.

Looking for your own spot to record your market observations & trading statistics? If so, then check out TRADEZELLA! It’s an easy-to-use

journaling tool that can lead to valuable performance & strategy insights! You can easily add your thoughts, charts & track your psychology with each and every trade. Click here to see if it’s right for you!Disclaimer: Babypips.com earns a commission from any signups through our affiliate link. When you subscribe to a service using our affiliate links, this helps us to maintain and improve our content, a lot of which is free and accessible to everyone–including the School of Pipsology! We appreciate your support and hope that you find our content and services helpful. Thank you!