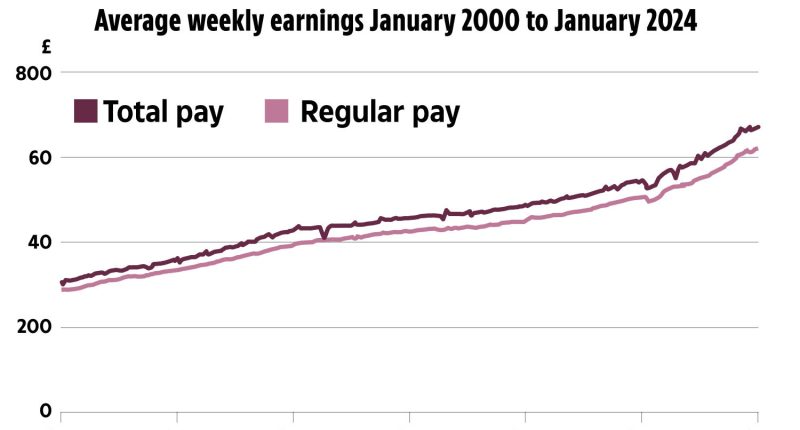

WAGES are rising for millions of workers but at a slower pace than in previous months.

Growth in regular pay, excluding bonuses, was 6.1% in the three months to January this year.

That’s according to official figures released today by the Office for National Statistics (ONS).

That was down from 6.2% for the three months to December last year.

the slowest rate rise since October 2022.

Taking into account inflation, which measures how much prices are rising, annual total pay increased by 1.4% in a boost for workers.

Read more in Money

The ONS also said average weekly earnings were estimated at £672 for total earnings and £627 for regular earnings in January.

Liz McKeown, director of economic statistics at the ONS, said: “Recent trends in the jobs market are continuing with earnings, in cash terms, growing more slowly than recently but, thanks to lower inflation, real terms pay continues to increase.”

Meanwhile, the rate of unemployment rose to 3.9% in the three months to January from 3.8% the previous three months, the ONS said.

However, between December 2023 to February this year, the estimated number of vacancies in the UK fell by 43,000 to 908,000.

Most read in Money

A growth in wages is good news for millions of workers who have been battling against high inflation since 2022.

The most recent figures show the annual rate at which prices rise was 4% in the year to January, the same as the month before.

This was lower than the 4.2% that economists had forecast in a boost for Prime Minister Rishi Sunak.

Inflation figures for February are set to be released next week on March 20.

If pay rises by less than inflation it squeezes incomes, as it means people’s pay in real terms is worse off.

Inflation is a measure of how much goods and services are worth in a given period.

Last year, rising wages were blamed for keeping inflation stubbornly high, which led the Bank of England to push up borrowing costs for households by raising its base rate.

However, the base rate has now been held at 5.25% four consecutive times and wage growth is slowing, albeit while still rising.

Responding to ONS’ most recent data, Chancellor Jeremy Hunt said: “Our plan is working. Even with inflation falling, real wages have risen for the seventh month in a row.

“Take-home pay is set for another boost thanks to our cuts to national insurance which in total are putting over £900 a year back into the average earner’s pocket.”

What it means for your money

Growth in wages is good news, particularly if it’s higher than the rate of inflation.

It means households have more purchasing power and more money to pump into the economy.

However, wage growth can also risk fuelling inflation, which businesses pass on to customers by increasing the price of goods and services.

In turn, the BoE can decide to hike its base rate which has a knock-on effect in the cost of borrowing.

This makes loans, credit cards and mortgage repayments become more expensive.

Alice Haines, personal finance analyst at Best Invest, said despite slowing wage figures, the BoE would likely want to see it slow more before it went ahead with cutting interest rates.

READ MORE SUN STORIES

She commented: “The general sense is that interest rates will remain higher for longer as the central bank waits for more concrete evidence that inflationary pressures are easing so for now Britain’s workers must continue to grapple with the cost-of-living squeeze.

She added: “Salary rises are likely to be more muted this year as employers look to keep costs down and protect profits and some might find themselves without a job at all if businesses decide to go down the redundancy route to slash staffing costs.”

Do you have a money problem that needs sorting? Get in touch by emailing [email protected].

Plus, you can join our Sun Money Chats and Tips Facebook group to share your tips and stories.