What’s up, dollar traders?

If you’re planning on trading the NFP release, here’s what you should know about the previous report, how the dollar reacted, and what’s expected this time.

What happened last time?

- U.S. added 315K jobs vs. estimated 295K gain in August

- Jobless rate ticked higher from 3.5% to 3.7%

- Labor force participation rate improved by 0.3%

- Average hourly earnings up by 0.3% vs. 0.4% consensus

Uncle Sam printed another upside NFP surprise for August, chalking up the FIFTH consecutive month in better-than-expected jobs data.

The economy added 315K jobs, surpassing the consensus of a 295K increase but coming in lower than the earlier 526K gain. Previous revisions also amounted to 115K in downgrades.

Even though the headline jobless rate popped higher from 3.5% to 3.7%, a closer look at its components reveals that the uptick was mostly due to an increase in labor force participation.

This means that more people rejoined the workforce to look for job opportunities then—a sign of improved confidence in the labor market.

Meanwhile, wage growth wasn’t as impressive. Average hourly earnings showed a meager 0.3% gain, slower compared to the 0.4% consensus and the previous 0.5% increase.

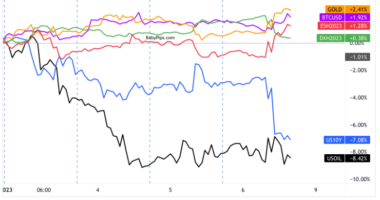

The Greenback had a bearish initial reaction to the report, as market watchers seemed unsure if the upside surprise would be strong enough to warrant another big rate hike from the Fed.

The U.S. currency carried on with its selloff for the first few hours after the release, as the downgrades to previous data and slower wage growth likely weighed on monetary policy outlook.

Later on, the dollar managed to pull up from its post-NFP losses, as traders likely booked profits ahead of the Labor Day holiday.

What’s expected this time?

- September hiring to come in at 265K

- Jobless rate to hold steady at 3.7%

- Average hourly earnings likely increased another 0.3%

Another slowdown in U.S. hiring is expected for September, as number crunchers estimate a 265K increase and no change in the unemployment rate.

Wage growth might be steady with another 0.3% uptick for the month, easing inflation fears somewhat.

Leading indicators are giving mixed signals, though.

JOLTS job openings dropped from a downgraded 11.17 million figure to 10.05 million in August, hinting at fewer job vacancies available in the past month. This also marked the report’s steepest monthly fall since April 2020.

The September ISM manufacturing PMI slipped from 52.8 to 50.9, with the jobs component tumbling from 54.2 to 48.7 to reflect contraction.

The ISM services PMI posted a smaller than expected dip, with the employment index climbing from 50.2 to 53.0 to signal faster growth.

The ADP non-farm employment change figure also turned out slightly stronger than expected, as the reading came in at 208K versus the estimated 200K increase.

Weaker than expected NFP results could dampen hopes of yet another 0.75% interest rate hike from the Fed, as this could challenge their assessment that the labor market remains tight.

On the other hand, another upside surprise could keep dollar traders looking forward to more aggressive tightening moves from the U.S. central bank.

Don’t forget to keep an eye out for revisions to previous reports, too!

Planning on trading the dollar but not sure which USD pair to trade? Check out the major USD pairs’ performance and take a look at USD pairs’ average volatility see if you can spot trading opportunities!