On Friday at 12:30 pm GMT we’ll see Uncle Sam’s latest labor market numbers.

Planning on trading July’s non-farm payrolls (NFP) event?

Here are points you need to know first:

What happened last time?

- U.S. adds 372K payrolls in June vs. 268K expected, 384K in May

- Unemployment rate unchanged at 3.6% as expected

- Participation rate edged lower from 62.3% to 62.2%

- Average hourly earnings down from 0.4% to 0.3%

- Last two months of payrolls revised net 74K lower

The economy added a net of 372K jobs in June, which is lower than May’s 384K increase but higher than the 268K figure than markets had expected.

The rest of the numbers didn’t look as rosy. The unemployment rate stayed at 3.6% but both participation and average hourly earnings inched lower. Last but not least, April and May’s NFP figures were revised by a net of 74K jobs lower.

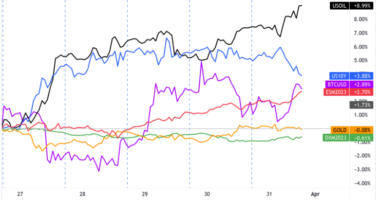

The mixed figures probably contributed to the dollar’s mixed reactions.

USD jumped across the board at the report’s release but also lost most of its gains, especially against the comdolls. The dollar ended the day lower against most of its counterparts except against safe-havens like JPY and CHF.

What’s expected this time?

- July NFP to come in at 250K vs. 372K gain in June

- Unemployment rate seen steadying at 3.6%

- Average hourly earnings to grow by another 0.3%

- Participation rate to maintain at 62.2%

The headline NFP figure is expected to maintain its downtrend, printing at 250K after June’s 372K gain.

Other major figures are expected to keep their June readings, however. The unemployment rate is seen at 3.6%, participation rate could still be at 62.2%, and average hourly earnings might continue to grow by 0.3%.

A stronger-than-expected NFP and steady-ish to strong wage growth numbers would support the Fed members’ hints that the FOMC gang is “nowhere near done” raising interest rates.

The prospect of more aggressive rate hikes could rain on the equities parade and possibly boost USD against its major counterparts.

If this week’s figures reflect labor market weakness, however, then the Fed will be more motivated to tread lightly with its next rate hikes.

Weak NFP figures and low wage growth can actually extend this month’s equities upswing and encourage risk-taking in the forex markets.

This post first appeared on babypips.com