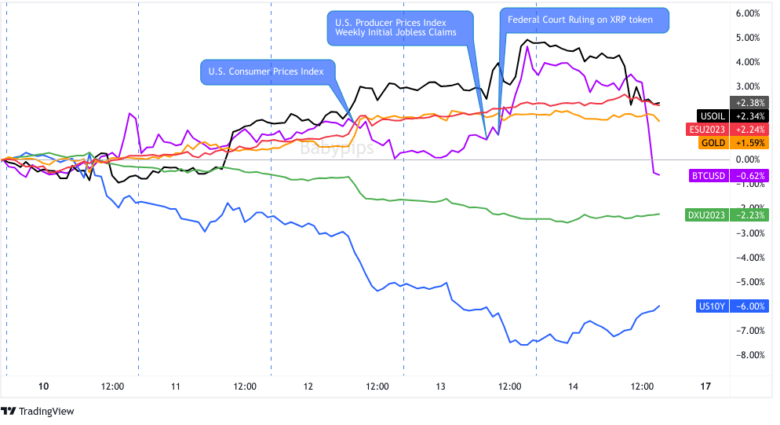

The market spotlight was mostly on the U.S. inflation updates this week as interest rate expectations continue to strongly affect overall risk sentiment.

Confirmation that U.S. inflation rates continue to slow from high inflation levels, plus downbeat Chinese data spurring stimulus hopes, lifted risk assets towards the latter part of the week.

Not sure what I’m talking about? I can explain, but lemme show you the biggest headlines first:

Notable News & Economic Updates:

? Broad Market Risk-on Arguments

China announced a loan relief plan for developers aimed at ensuring the delivery of homes that are under construction

U.S. Treasury Secretary Yellen met with Chinese officials in “direct and productive” discussions of economic and political issues

U.S. headline CPI showed a 0.2% m/m gain in June vs. estimated 0.3% uptick, bringing year-over-year rate down from 4.0% to 3.0% vs. the projected 3.1% reading. Core CPI up by 0.2% m/m vs. 0.3% consensus

U.S. headline and core PPI posted meager 0.1% m/m upticks in June vs. projected 0.2% gains, May readings downgraded to show 0.4% decline in headline figure and 0.1% increase in core reading

China’s headline CPI slowed from 0.2% to 0.0% y/y in June vs. estimated 0.2% figure, Chinese PPI fell by 5.4% y/y vs. 5.0% forecast and earlier 4.6% slump

Chinese trade surplus widened from $65.8B to $70.6B vs. $90.0B forecast, exports declined by -12.4% y/y in June (-6.1% y/y forecast; -7.5% y/y previous); the largest decline in over three years

University of Michigan Consumer Sentiment Index for July: 72.6 (64.5 forecast; 64.4 previous)

? Broad Market Risk-off Arguments

RBNZ kept interest rates on hold at 5.50% as expected, citing that “level of interest rates are constraining spending and inflation pressure as anticipated and required”

BOC hiked interest rates by 0.25% from 4.75% to 5.00% as expected, keeping the door open for future rate hikes on stubborn inflationary pressures and upgraded economic forecasts

Global Market Weekly Recap

Consolidation was the name of the game for most asset classes very early in the week, as traders assessed the potential implications of the U.S. CPI release on global borrowing costs and overall economic activity.

Risk-on vibes soon started picking up, as more market analysts weighed in on the possibility of a downside inflation surprise that could either dash hopes for a July hike or make it the last Fed tightening move for the year.

Crude oil bulls also took advantage of Tuesday’s headlines pointing to a drop in Russia’s output, as shipments through the country’s western port reportedly tumbled below their February levels.

As expected, the U.S. June CPI reflected subdued inflationary pressures on Wednesday, with the annual reading dropping like a rock from 4.0% to 3.0% and coming close to the Fed’s target range. On Thursday, U.S. PPI figures also fell short of estimates, adding to the cooling inflation narrative and lower odds of interest rates rising much further.

This piled on the post-NFP bearish USD bets and spurred another wave higher for riskier holdings. In particular, commodities and higher-yielding comdolls extended their gains in reaction to mostly downbeat Chinese data printed earlier on.

Market players likely figured that slower inflation and trade activity could encourage the PBOC to dole out additional stimulus, which would then benefit export-driven economies. As a result, the commodity-related Kiwi was able to quickly recoup losses, even after the RBNZ announced a somewhat dovish pause that same day.

Although their decision to keep rates on hold signaled a likely end to their aggressive tightening cycle, businesses and consumers were probably relieved to find out that borrowing costs wouldn’t be spiking too high in the near-term.

Meanwhile, the Bank of Canada hiked interest rates by 0.25% as expected and signaled scope for more tightening, but would likely be based on incoming data. It wasn’t the hawkish sentiment Loonie bulls were looking for and likely a contributor to Loonie weakness on the sessin.

From there, it was a steady climb for most risk assets and stock indices like the Nasdaq and S&P 500 for the remainder of the week. Of note was Amazon’s strong rally thanks to record sales during its Prime Day Sale, as well as the 4% surge in Alphabet shares and uptick among banking sector stocks ahead of earnings releases.

Crude oil jumped once more on Thursday, despite the surprise build in EIA stockpiles, as investors focused on unplanned disruptions in Libya and Nigeria, along with ongoing OPEC production cuts.

On the other hand, Treasury yields carried on with their slide, as markets started pricing a Fed funds rate of 3.71% by December 2024, down from the 4.10% forecast earlier in the week.

On Friday, the news cycle was pretty light and broad market price action was pretty stable throughout the session. After a relatively large risk-on move prompted by major catalysts this week, it looks like some profit taking was likely taken, most noticeably in oil and bitcoin prices. This behavior was possibly kicked off by a surprisingly strong preliminary U.S. consumer sentiment read.

The University of Michigan’s preliminary read for July came in at 72.6 (well above the 64.5 forecast), which may have supported the idea that the Fed does have more wiggle room to keep interest rates high for now. Unfortunately, this wasn’t a big enough event to bring the U.S. dollar back from a major beating this week, or take risk assets down from a solid run higher that held into the weekend.