Heads up, dollar traders! The Fed is scheduled to announce their policy decision this week, and rate increase is eyed.

Will it be a 0.25% or 0.50% hike? And how will the dollar react?

Let’s review what happened in the previous rate statement and what market watchers are expecting.

What happened last time?

- FOMC kept rates on hold at <0.25% as expected

- Fed head Powell highlighted surging inflation

- Powell: “Quite a bit of room to raise rates without threatening labor market”

The January FOMC decision turned out more hawkish than expected, as Fed officials pointed to “slightly worse” inflation as a reason to start their tightening cycle soon.

In particular, Fed head Powell noted that there is room to hike interest rates without derailing the pickup in employment.

“The best thing we can do to support continued labor market gains,” Powell said, “is to promote a long expansion, and that will require price stability.”

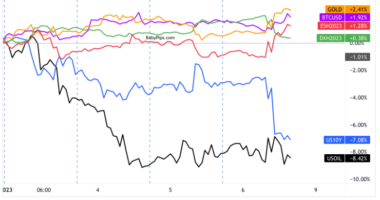

Not surprisingly, the dollar rallied across the board during the announcement, as bulls started pricing in an increase of at least 0.25% for March.

Meanwhile, global equities took hits, as the possibility of higher borrowing costs brought jitters for business investment and consumer spending.

What’s expected this time?

- Markets pricing in 0.25% interest rate hike to <0.50%

- Fed to start reducing balance sheet

- Dot plot forecasts to hint at fewer hikes than previously expected?

Everyone and his momma are expecting a 0.25% hike from the Fed this time, although some are still keeping their fingers crossed for a 0.50% increase.

To add to these bullish vibes, the Fed would likely announce a balance sheet reduction with specifics on caps for the unwinding of their holdings of Treasuries and agency securities.

Recall that main man Powell himself mentioned in his semi-annual testimony that he will be voting for a 0.25% hike this March and that he expects his fellow policymakers to set the pace of a balance sheet runoff.

Also, Uncle Sam printed the January CPI bombshell a couple of weeks after the latest FOMC decision, basically hitting the nail in the coffin for a hike this month. ICYMI, the report indicated that U.S. inflation is running at its highest level in 40 years!

While all these suggest that a 0.25% Fed rate increase has been priced in for quite some time, there’s a slight chance that policymakers might drop a hint of caution due to the war in Ukraine.

This might be reflected in the updated dot plot forecasts, which previously projected three interest rate hikes for 2022 as of December last year. Significant adjustments to inflation and growth estimates might also impact the dollar’s reaction to the event.

Keep in mind that upgraded forecasts could convince the Fed to accelerate its tightening plans for the rest of the year, which might translate to stronger upside for the Greenback.