Heads up, franc traders!

The Swiss National Bank will be announcing their interest rate decision this week, and word through the grapevine is that another hike is due.

Will they announce a smaller increase this time, though?

Here are the important points you need to know if you’re planning on trading the news:

Event in Focus:

Swiss National Bank (SNB) Monetary Policy Statement

When Will it Be Released:

June 22, Thursday: 7:30 am GMT

SNB Chairperson Thomas Jordan will hold a press conference after the announcement.

Use our Forex Market Hours tool to convert GMT to your local time zone.

Expectations:

Relevant Swiss Data Since Last SNB Statement:

? Arguments for Hawkish Monetary Policy / Bullish CHF

- SNB head Jordan mentioned that risks from inflation are higher than that of deflation in the future due to deglobalization, adding that higher interest rates are beneficial for the banking system

- Swiss GDP rose 0.3% quarter-over-quarter in Q1 vs. projected 0.1% growth figure and earlier flat reading

? Arguments for Dovish Monetary Policy / Bearish CHF

- Headline CPI slowed from 0.2% m/m in March to a flat reading in April, before picking up again by 0.3% in May

- Jobless rate ticked higher from 1.9% to 2.0% in May vs. 1.9% forecast

- Manufacturing PMI (Procure) dipped from 45.3 to 43.2 in May to reflect slower pace of expansion, following earlier decline from 47.0

- Retail sales slumped from -1.9% year-over-year to -3.7% in April vs. estimated 1.4% decline

- KOF economic barometer fell from 96.1 to 90.2 in May, chalking up fourth consecutive monthly drop

Previous Releases and Risk Environment Influence on CHF

March 23, 2023

Action/Results: SNB hiked interest rates from 1.00% to 1.50% as expected, with Chairperson Jordan citing that they could not rule out additional increases in rates to ensure price stability.

The central bank also did not rule out future currency interventions, leading to a slight pop higher for the Swiss currency after the announcement and onto the next trading sessions.

Risk environment and Intermarket behaviors: Risk-off flows were still very much in play during this trading week, as investors stayed wary of banking sector risks.

In addition, U.S. Treasury Secretary Yellen’s clarification that the government is not considering “blanket insurance” for uninsured deposits sparked worries that smaller bank runs could follow.

On top of the feeble coordinated attempt by major central banks to shore up the sector, this sparked a flight to safety and rally in gold, which benefited the correlated franc early on.

Dec. 15, 2022

Action/Results: The Swiss central bank hiked interest rates by 50 basis points to 1.00% to counter a “further spread of inflation.”

This sparked a sharp rally for the franc across the board, especially since the decision ran contrary to prevailing expectations for central banks to tone down their hawkish rhetoric during the month.

In addition, the SNB upgraded their inflation forecasts, likely keeping franc bulls hopeful for yet another tightening move in their next announcement.

Risk environment and Intermarket behaviors: This was a particularly busy trading week marked by four major central bank announcements plus top-tier inflation updates, leading to a bit of consolidation before the big events rolled in.

Risk-off flows came into play when the FOMC stuck to its hawkish bias, followed by still-aggressive tightening moves by the BOE and ECB. It didn’t help risk assets that downbeat COVID-19 updates and economic figures from China kept coming in.

Price action probabilities

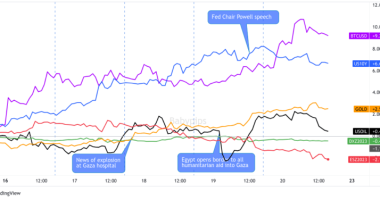

Risk sentiment probabilities: Major central banks have been shifting their policy stances these days, with some pausing their tightening cycles and others resuming their interest rate hikes to ward off stubborn inflation.

That focus on monetary policy outlooks will likely continue to dominate broad risk sentiment and volatility this week, especially since we’ll get more updates to the global monetary policy picture with the Swiss National Bank’s decision, the Bank of England’s monetary policy decision, and Fed Chair Powell’s testimony to Congress.

Volatility and risk sentiment vibes may stay muted until those events start playing out on Wednesday. And since hawkish rhetoric from the Fed and ECB lately hasn’t dampened the risk mood as much as in the past, it’s possible traders will still lean risk-on this week, unless we get an ultra hawkish surprise (especially if it’s from Fed Chair Powell or the Bank of England) or a significant news/event surprise not currently scheduled on the calendar.

SNB scenarios

Base case: Another interest rate hike is widely expected from the SNB, but market participants seem to be torn between an aggressive 0.50% hike or a 0.25% increase.

Recent economic figures are mostly pointing to the need to slow down their pace of tightening as inflation is already down to their target range while the outlook has soured somewhat.

However, SNB head Jordan’s latest testimonies hint that the central bank could be looking to err on the side of hawkishness. Reiterating that they’d like to see inflation fall below 2% and that they’re open to potential currency intervention might mean more upside for the Swiss franc.

Overall, the event outcome doesn’t seem to have a strong probability lean for either 25 bps or 50 bps hike scenarios, so this is one of those events where it’s probably a good idea to wait for the event outcome and see how the market reacts.

And if we do get a 50 bps hike and/or strong signals of hikes within the next few meetings, then that could possibly draw in fundamental bulls to go long CHF against currencies with either dovish or not-so-hawkish central banks (BOJ, RBNZ).

And if broad risk sentiment leans positive as currently expected, CHF/JPY is a pair to watch closely for opportunities and do more work on before considering a risk management plan.

Alternative Scenario: Since tightening is pretty much priced in for the SNB decision, a 25 bps hike AND any rhetoric shift to a less optimistic stance may be treated by traders as a signal that the central bank is likely to sit on its hands during their next decisions, potentially sparking CHF long profit taking in the short-term.

In this scenario, watch out for both shorter and longer-term opportunities to short CHF against currencies with relatively hawkish central banks (ECB, RBA, BOC), with higher conviction if the broad risk mood is leaning positive around the event.