The dollar is in for a busy week as traders price in start-of-year flows, U.S. politics updates, and FOMC and NFP releases.

Who’s up for trading the scrilla?

If you are, then read all about the potential catalysts in the next few days!

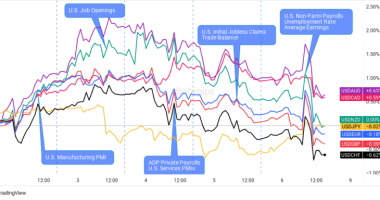

Manufacturing-related numbers

- Final Markit PMI (Jan 4, 2:45 pm GMT) to be adjusted lower from 56.7 to 56.5

- ISM manufacturing PMI (Jan 5, 3:00 pm GMT) seen dipping from 57.5 to 56.4 in December

- Factory orders (Jan 6, 3:00 pm GMT) could slow down from 1.0% to 0.6%

FOMC meeting minutes (Jan 6, 7:00 pm GMT)

- As expected, the U.S. Federal Open Market Committee (FOMC) kept its monetary policies steady in December

- Governor Powell and his team also upped their growth estimates and cleared a few points around their purchases

- Watch out for members’ conditions for easing/tightening especially as voting members become more dovish in 2021

NFP-related updates

- Fed members have hinted that low unemployment will not be a “sufficient trigger for policy action.”

- The ADP report (Jan 6, 1:15 pm GMT) could plummet from 307K to 170K

- Weekly initial jobless claims (Jan 7, 1:30 pm GMT) to extend above-700K streak

- ISM’s services PMI (Jan 7, 3:00 pm GMT) to slow down from 55.9 to 54.5

- Non-farm payrolls (NFP) (Jan 8, 1:30 pm GMT) seen dropping from 245K to 112K

- The unemployment rate could remain at 6.7%

- Average hourly earnings to print at 0.1% (from 0.3%)

Overall dollar demand

- Risk appetite at the start of the year could mean more losses for the safe-haven dollar

- Uncertainty over Georgia’s Senate runoffs and Biden’s confirmation can mean limited gains for the dollar compared to the other safe-havens

Technical snapshot

- Keltner Channels are showing the dollar’s “oversold” conditions against the Aussie and Kiwi

- It’s also approaching oversold levels against the rest of its major counterparts

- Daily EMAs AND SMAs are reflecting the dollar’s short and long-term bearish trends across the board

- The dollar was most volatile against the Aussie, Kiwi, pound, and euro in the last seven days

This post first appeared on babypips.com