Middle East conflict developments, inflation updates and interest rate expectations continued to dominate the markets this week.

These themes and other drivers prompted no sight of the usual risk behaviors and correlations between the major asset classes.

Notable News & Economic Updates:

🟢 Broad Market Risk-on Arguments

China conducted MLF operations that put a net ¥289B yuan of fresh liquidity in the banking system, the biggest net injection in almost three years

China’s Q3 GDP slowed down from 6.3% to 4.9% but beat 4.5% growth estimates; the unemployment rate eased from 5.2% to 5.0% in September

U.S. eased Venezuela oil sanctions after election deal; Analysts project Venezuela may be able to produce 200K barrels of crude oil a day after U.S. suspended some restrictions.

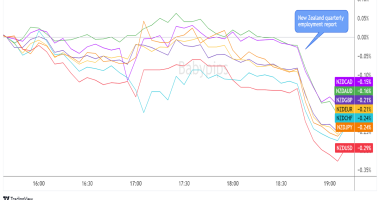

New Zealand’s annual inflation slowed down from 6.0% to a two-year low of 5.6% in Q2 (vs. 5.9% expected)

U.S. Retail Sales for September: 0.7% m/m (0.3% m/m forecast; 0.8% m/m previous); core retail sales at 0.6% m/m (0.2% m/m forecast; 0.9% m/m previous)

On Thursday, U.S President Biden said he spoke with Egypt President Abdel Fattah El-Sisi; leaders agree to allow 20 aid trucks into Gaza

Fed Chair Powell gives speech at the Economic Club of New York; comments that the committee will proceed carefully, hinting of another interest rate hold at the next meeting.

The People’s Bank of China injected a net ¥733B worth of cash via reverse repurchase contracts on Friday – the largest since April – to help ensure funding costs in its financial markets.

🔴 Broad Market Risk-off Arguments

U.S. crude oil inventory at Cushing fell by -4.5M barrels last week to 419.7M barrels, the lowest level since October 2014 – EIA

U.K.’s headline CPI remains at 6.7% y/y in September (vs. 6.6% expected); core CPI eased from 6.2% to 6.1% y/y (vs. 6.0% expected)

Fear and outrage erupted across the Middle East over a Gaza hospital blast just ahead of U.S. President Biden’s arrival in Israel

Canada CPI for September: -0.1% m/m (0.5% m/m forecast; 0.4% m/m previous); core CPI was -0.1% m/m (0.3% m/m forecast; 0.1% m/m previous)

Australia added a net of 6.7K jobs (vs. 20.6K expected, 63.3K previous) in September thanks to a 46.5K jump in part-time jobs offsetting the 39.9K decline in full-time employment

Global Market Weekly Recap

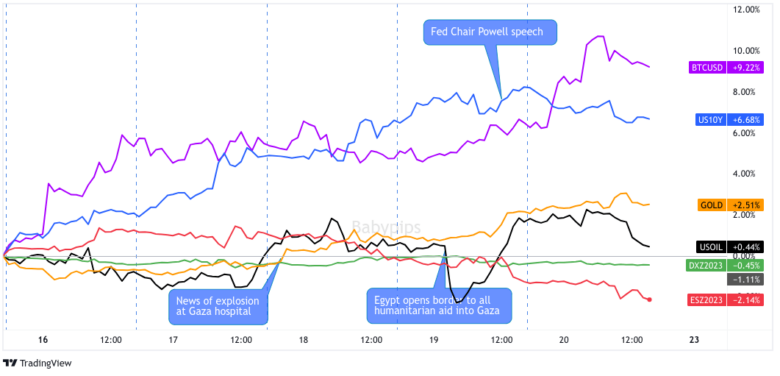

Dollar, Gold, S&P 500, Oil, U.S. 10-yr Yield, Bitcoin Overlay Chart by TradingView

As mentioned in the intro above, the usual price behaviors and correlations were thrown off this week. The major asset classes continue to behave a little bit differently relative to each other as traders need to weigh the major Middle East conflict against another week of global inflation updates, central bank speak and other market drivers.

The week started in low volatility mode as there were no major fresh catalysts to hit the wires during the Monday trading session. And with no fresh negative headlines on the geopolitical front plus news of Israel not initiating a ground move into Gaza on Sunday as originally thought, risk assets broadly moved higher on the session.

Bond yields and equities were up on the session, versus a dip in gold, the U.S. dollar. Oil was also moving lower, signaling fading geopolitical fears for the session.

But the most notable mover was bitcoin, which jumped and tested the $30K handle on Monday, on rumors that big time asset manager BlackRock’s bitcoin ETF was approved by U.S. regulators. This was promptly denied by BlackRock, sending the crypto king back to the $28K handle within the hour.

Tuesday was also a low volatility session for most of the major assets, with a slight risk-off and pro-Dollar lean through the Asia and London trade. The main driver for the day was likely the continued rise in bond yields, mainly during the U.S. session and correlating with the much better-than-expected U.S. retail sales update for September.

The positive read likely had traders pricing in the idea that as the economy continues to be resilient, the Fed continues to have room to keep monetary policy hawkish to fight the high inflation environment (i.e., the “higher for longer interest rates” theme).

The tone dramatically shifted during the Tuesday to Wednesday transition, sparked by news of an explosion at a hospital in Gaza, killing 500 people at the time of reporting. Traders quickly returned back to a geopolitical focus, pushing oil and gold higher, while taking capital from equities at the same time. This dampened optimism for the arrival of U.S. President Biden in Israel, who was there to try to help relieve tensions in the Middle East.

Traders also had to price in interest rate expectations mid-week, this time influenced by a slew of inflation updates from across the globe, including China last week, and New Zealand, Canada and the U.K. this week. While most updates signaled a slowing rate of price rises, the absolute rates of price growth are still well above most central bank target rates.

These updates and commentary from various Fed members of an openness to hike rates further if needed were the likely drivers of bond yields higher, most notably the 10-year U.S. Treasury yield which hit the 5.00% mark briefly going into the Friday Asia session.

Both the rising bond yields and geopolitical themes dominated through the Thursday session, with the latter really taking focus as traders began to price in the imminent start of a ground counter attack from Israel into Gaza (which has been staging for the past week).

Conditions have been dire this week Israel conducting airstrikes of Hamas targets in the densely populated Gaza Strip, and as well as slow to no movement of humanitarian aid. But we did get one sign of optimism on Thursday as Eqyptian President Abdel Fattah el-Sisi opened up a border crossing to allow some humanitarian aid into Gaza. This was taken as a very positive short-term sign, and correlates with the brief move lower in oil prices.

On Friday, broad market volatility was pretty light for most of the session as we saw a lack of fresh major catalysts from both the geopolitical and financial fronts. It’s likely that traders were waiting for further developments from the Middle East, but continued to price in likely negative developments ahead, characterized by a slight rise in gold and oil, while equities and bond yields mostly moved lower on the session.

Bitcoin was once again the most notable mover heading into the weekend, this time on news that the U.S. Securities and Exchange Commission dropped its charges against two executives from Ripple Labs. This was taken as another big win for the cryptocurrency space, and as support for speculation that spot bitcoin ETF approvals will soon materialize in the U.S. BTC briefly hit the $30K mark once again before pulling back slightly, and closing a solid +8% gain for the week on Friday.