On Thursday, the European Central Bank is likely to raise its interest rates by another 25 basis points.

How can the decision affect EUR’s prices?

Here are the important points you need to know before working on your trading plan:

Event in Focus:

European Central Bank (ECB) Monetary Policy Statement

When Will it Be Released:

June 15, Thursday: 6:00 pm GMT

ECB President Lagarde will conduct a presser 30 minutes later.

Use our Forex Market Hours tool to convert GMT to your local time zone.

Expectations:

- ECB to raise its refinancing rates by 25 basis points to 4.00%

- ECB President Lagarde will likely project that the battle against high inflation isn’t over, and signal room for more rate hikes before considering any pause.

Relevant Eurozone Data Since Last ECB Statement:

? Arguments for Tighter Monetary Policy / Bullish EUR

On June 7, ECB Executive Board member Isabel Schnabel signaled more interest rate increases ahead as high inflation rates persists

On June 6, ECB Governing Council member Knot said that due to high energy costs, it will be harder to bring down consumer inflation rates

On June 5, Lagarde said “There is no clear evidence that underlying inflation has peaked”

HCOB Germany Services PMI for May: 57.2 vs. 56.0 previous; “rising costs and resilient demand lead to sticky services price inflation”

Euro area unemployment rate for April 2023: 6.5% as expected vs. 6.6% previous

Germany Producer Prices Index in April: +0.3% m/m vs. -1.4% m/m previous

Bundesbank May 2023 Report: “Inflation rate fell significantly in March due to base effect“; sees underlying price pressures to remain high in next few months

On May 19, Lagarde said that the central bank is at a critical moment where inflation is slowing, but there is a need to have “high & sustainably high interest rates.”

Final CPI read for April: inline with +7.0% y/y forecast and above +6.9% y/y previous read; core CPI inline with 5.6% forecast and below 5.7% previous

On May 12, ECB Vice President de Guindos said he has doubts about whether or not underlying inflation will ease; says there could be more interest rate hikes ahead

? Arguments for Looser Monetary Policy / Bearish EUR

Euro Area GDP for Q1 2023 (third est.): -0.1% q/q (0.1% q/q forecast; -0.1% q/q previous); employment was up by +0.6% q/q (final est.) vs. +0.6% q/q forecast & +0.3% q/q previous

German industrial production rose 0.3% m/m versus projected 0.7% uptick in April, earlier reading revised from 3.4% drop to 2.1% decline

Germany’s factory orders fell by 0.4% m/m in April, less than March’s upwardly revised 10.9% decline and the expected 2.2% decrease

HCOB Eurozone Services PMI for May: 55.1 vs. 56.2 in April; input price inflation slowed to a 28-month low rate

Euro area annual inflation (flash estimate for May): 6.1% y/y ( 6.5% y/y forecast) vs. 6.7% y/y previous

HCOB Germany Manufacturing PMI for May: 43.2 (lowest read in three years) vs. 44.5

HCOB Eurozone Manufacturing PMI for May: 44.8 vs. 45.8 in April; surveys showed sharp drop in new orders and factory production; still hiring but at a decelerating pace

France’s inflation unexpectedly lower at -0.1% m/m in May vs. 0.3% expected, 0.6% uptick in April

Germany’s Q1 2023 GDP revised from 0.0% to -0.3%, putting the economy in a technical recession after Q4’s 0.5% decline

Flash Germany Manufacturing PMI in May: 42.9 vs. 44.5 previous; Services PMI at 57.8 vs. 56.0

Previous Releases and Risk Environment Influence on EUR

May 4, 2023

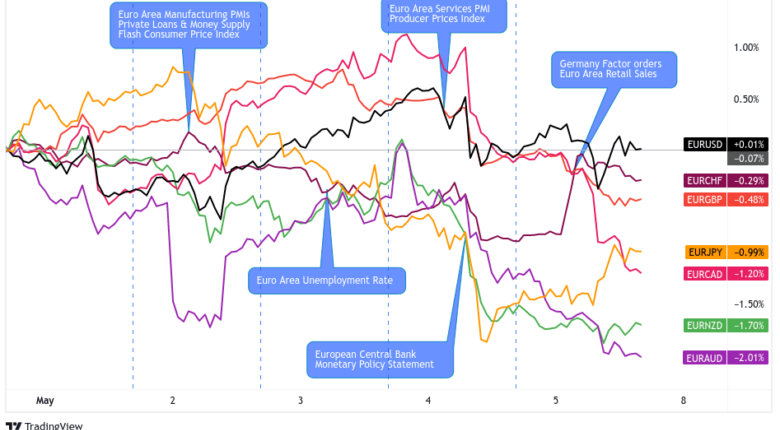

Overlay of EUR vs. Major Currencies Charts by TV

Action/Results: The ECB raised its main refinancing rate by 25bps to 3.75%, disappointing those who priced in a 50bps rate hike.

In her presser, Lagarde noted that some members did vote for a 50bps hike and that there’s room for further rate hikes.

She also shared that the central bank will stop its Asset Purchase Programme (APP) reinvestments in July, a move that would reduce ECB’s portfolio by an average of 25B EUR per month.

Choosing to raise rates by 25bps instead of the “usual” 50bps shortly after reports of slower inflation and bank lending were released smelled a lot like “almost end of tightening cycle” to a lot of traders.

Despite Lagarde’s hawkish remarks, EUR fell across the board and stayed near its intraday lows until the end of the day.

The ECB’s decision came a day after what markets considered a “dovish hike” for the Fed, which made it easier for traders to price in another “dovish hike” that week.

EUR had also been rising in the days before the decision, so a buy-the-rumor, sell-the-news scenario was on the table.

Risk environment and Intermarket behaviors:

Broad risk sentiment leaned negative, likely due to fresh signals of possible peak global growth, most notably Chinese PMI moving into contractionary territory, falling German retail sales, and a spike in job cuts in the U.S. This may have influenced euro traders to focus more on weakening economic conditions in the Euro area rather than hawkish rhetoric from the ECB that week.

Mar. 16, 2023

Overlay of EUR Pairs: 1-Hour Forex Charts by TV

Action/Results: As expected, the ECB raised its main refinancing rates by another 50 basis points to 3.50% in March.

The ECB staff also released its latest projections (made before the banking sector tensions peaked) showing headline and core inflation averaging 5.3% (from 6.3%) and 4.6% in 2023 respectively. Meanwhile, 2023 growth was revised higher from 0.5% in December to 1.0% on better-than-expected energy and “international environment” developments.

In her presser, ECB President Lagarde said that the central bank will now be “data dependent.” She also assured that the euro area banking sector is “resilient,” and that ECB has the tools and facilities and is ready to respond “as necessary” if needed.

Risk environment and Intermarket behaviors: Concerns over Credit Suisse peaked days before the ECB’s decision, so assurances that the euro area’s banking sector is “resilient” and that the ECB has the tools ready to deploy helped calm banking jitters.

Higher euro area interest rates, combined with increased confidence in the Eurozone’s banking sector, helped pull EUR from its intraday lows. The common currency ended the day only slightly lower than its major counterparts.

Price action probabilities

Risk sentiment probabilities: “Risky” assets like equities, commodities, and commodity-related currencies have been benefiting from a risk-friendly trading environment, likely due to better-than-expected earnings reports and expectations of the end of tightening cycles from major central banks.

Unless today’s U.S. CPI reports and tomorrow’s FOMC decision point to a lot more central bank rate hikes in the foreseeable future than markets had priced in, global assets may continue to reflect optimism for the end of rising interest rates.

Euro scenarios

Base case: As several ECB officials have hinted, the central bank is likely to raise its interest rates by 25 basis points to 4.00%.

ECB members may also underscore the need to do more to battle high inflation, probably through their new staff projections or outright telling us about having room for more rate hikes.

But weaker-than-expected economic indicators are making it hard for the ECB to justify further hawkishness and EUR traders know it.

Like in last month’s decision, EUR could spike at the actual rate hike before profit-taking and “dovish hike” pricing drag the common currency lower against its major counterparts, especially those who stayed hawkish / surprised with rate hikes like CAD.

Reaction to the ECB event is also likely to be short-lived as the markets eventually turn their focus back to U.S. themes and data releases.

Alternative Scenario: To emphasize the need for further tightening, ECB could possibly raise its rates by 50bps instead of 25bps, a very low conviction scenario at the moment.

The higher-than-expected rate hike may boost EUR across the board. EUR’s strength will depend on how hawkish the new economic projections and Lagarde’s presser are, however.