The ECB is about to announce its policy decision in a bit!

If you’re gutsy enough to trade a euro pair during this top-tier event, better check out this break-and-retest setup on EUR/NZD.

Before moving on, ICYMI, yesterday’s watchlist checked out an ascending triangle pattern on AUD/JPY ahead of Australia’s jobs report. Be sure to check out if it’s still a valid play!

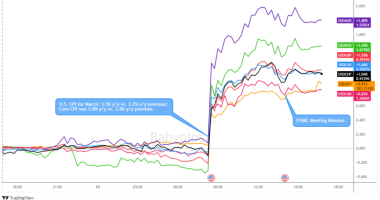

And now for the headlines that rocked the markets in the last trading sessions:

Fresh Market Headlines & Economic Data:

BOC hiked interest rates by 0.50% to 1.00% as expected

U.S. EIA crude oil inventories rose by 9.4 million barrels

New Zealand BusinessNZ manufacturing index up from 53.6 to 53.8

ECB monetary policy statement at 11:45 am GMT

ECB press conference at 12:30 pm GMT

U.S. headline and core retail sales at 12:30 pm GMT

U.S. initial jobless claims at 12:30 pm GMT

U.S. preliminary UoM consumer sentiment index at 2:00 pm GMT

FOMC member Mester’s speech at 7:50 pm GMT

Use our new Currency Heat Map to quickly see a visual overview of the forex market’s price action! ? ?️

What to Watch: EUR/NZD

Missed the bullish breakout on this pair’s longer-term descending triangle?

Don’t fret because there might still be a chance to catch the retest!

The pair is hesitating to extend the rally past the 1.6050 minor psychological mark, which means that a pullback might be needed to draw more buyers out.

The Fibonacci retracement tool shows that the 38.2% level is near the former triangle resistance around the 1.5900 handle while the 50% Fib coincides with the 100 SMA dynamic support.

This faster-moving SMA is above the 200 SMA to confirm that support levels are more likely to hold than to break. However, Stochastic has plenty of room to move lower before reflecting oversold conditions or exhaustion among sellers.

This suggests that the pullback might keep going until the 61.8% Fib at 1.5835, which is in line with the 200 SMA dynamic support.

If any of the Fibs are able to keep losses in check, EUR/NZD could bounce back up to the swing high and beyond!

Just make sure you keep tabs on the ECB decision and press conference to see if the shared currency could go for more gains.

Keep in mind that their earlier announcement turned out less dovish than expected, but this happened before geopolitical tensions between Russia and Ukraine wreaked havoc on inflation.

This post first appeared on babypips.com